Vea también

10.02.2026 10:31 AM

10.02.2026 10:31 AMUntil the market can separate winners from losers, it will struggle to identify leaders and hit new record highs. Judging by the sharp rally after several days of declines, the S&P 500 drew the right conclusions and singled out new heroes. Candidates for that role are companies sensitive to the health of the US economy. As a result, the Dow Jones hit the 50,000 mark for the first time in history.

While Goldman Sachs is warning investors about aggressive selling of US equities by hedge funds for four consecutive weeks, Morgan Stanley points to an ideal time and place to buy. The bank argues that earnings expectations for tech companies have reached multi-year highs while fundamental valuations have fallen against a backdrop of volatility. At the same time, the sell-off in software stocks created prime buying opportunities. Morgan Stanley names Microsoft and Intuit among its top picks.

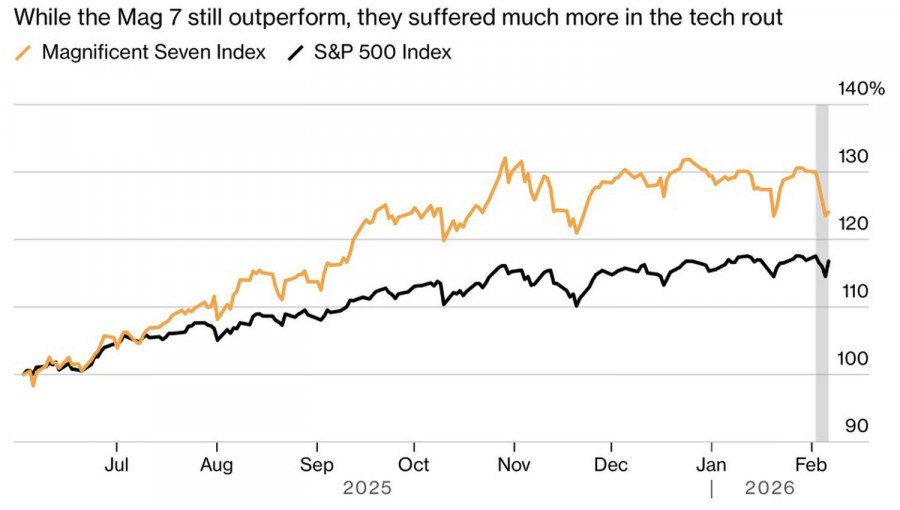

Magnificent Seven and S&P 500 Dynamics

Indeed, the price-to-forward-earnings ratio for the Magnificent Seven has fallen to 29, slightly below the five-year average. Moreover, those same software makers look well-positioned in a strong economy. Their businesses are unlikely to break overnight because of AI development — this is a long-term structural issue. For now, the panic in the market went too far. Those who acted on it managed to buy the dip.

According to Turnquist, when the S&P 500 exceeded its December high in the first quarter, the broad index gained on average 19.5% by year-end. Conversely, failure to retake the peak translated into an average market decline of 0.6%.

Year-to-date, the S&P 500 has not added even 2%, so it is too early to predict double-digit gains by year?end. Moreover, investors remain on edge — the VIX volatility index stands above its averages. Trading volume is 13% below the five-day average.

On the other hand, the S&P 500 was not deterred by rising US Treasury yields amid reports that Beijing advised Chinese banks to limit purchases of Treasuries. If they begin offloading Treasuries, yields could rise further, forcing the broad index to react to developments in the US debt market.

For now, the market is preparing for key US releases on employment, inflation, and retail sales. Will they help equities hit fresh record highs?

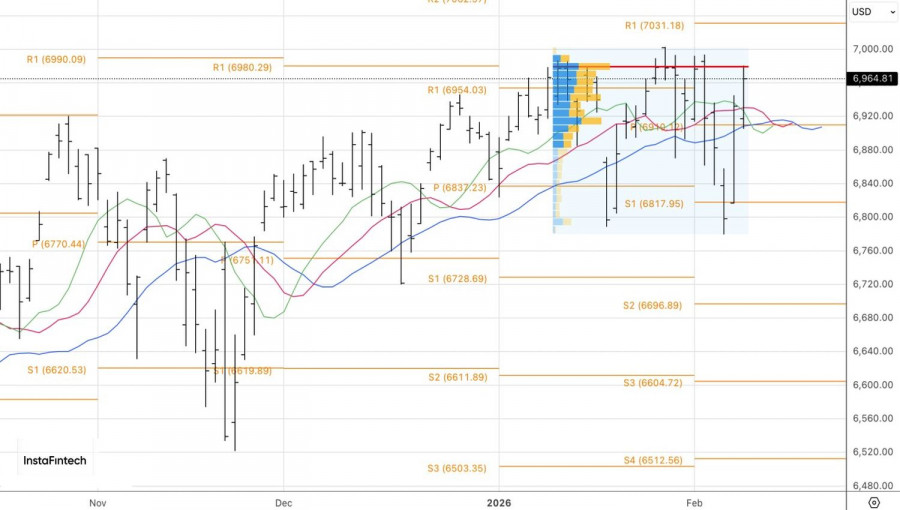

Technically, the daily S&P 500 chart shows a recovery in the bullish trend. New local highs at 6,992 and 7,002 would justify adding to long positions opened above the 6,910 mark. Upside targets for that move would be 7,100 and 7,250.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.