Lihat juga

20.02.2026 02:01 PM

20.02.2026 02:01 PMGermany is rising from its knees, and wage growth in the euro area is accelerating. Yet this is not helping the euro. On the contrary, EUR/USD plunged to a monthly low as demand for the US dollar as a safe-haven asset rose sharply. There is no need to look far for the reason. For the first time since 2003, the United States is prepared to intervene in a country in the Middle East. Twenty three years ago, the focus was Iraq. Markets are now focused on Iran.

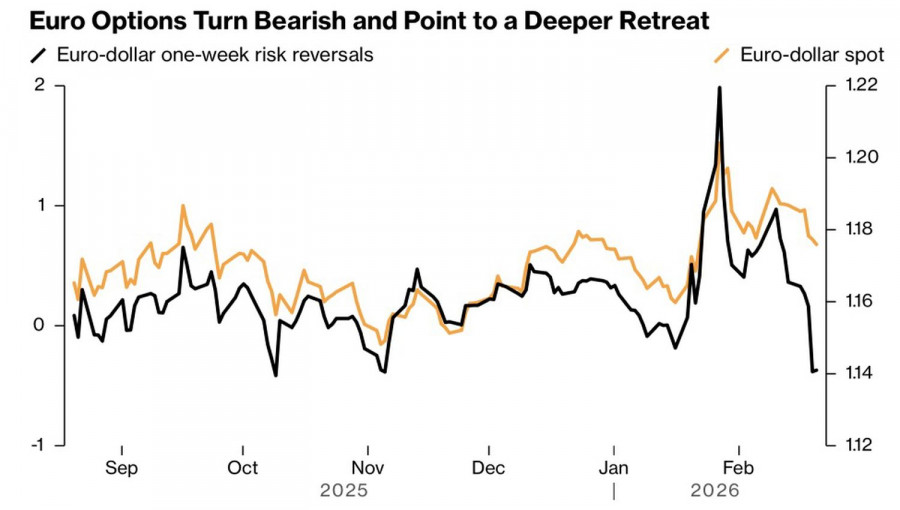

ING believes geopolitical risks are not yet fully priced into the main currency pair. The euro area is a net oil importer, and higher crude prices will weigh on its economy. In the event of a serious escalation in the Middle East, ING forecasts EUR/USD below 1.16. The derivatives market shares that view: demand for options with strikes at 1.17 and 1.15 is strong. At the same time, the euro's downside reversal risks versus the US dollar have fallen to their lowest since October.

EUR/USD dynamics and reversal risks

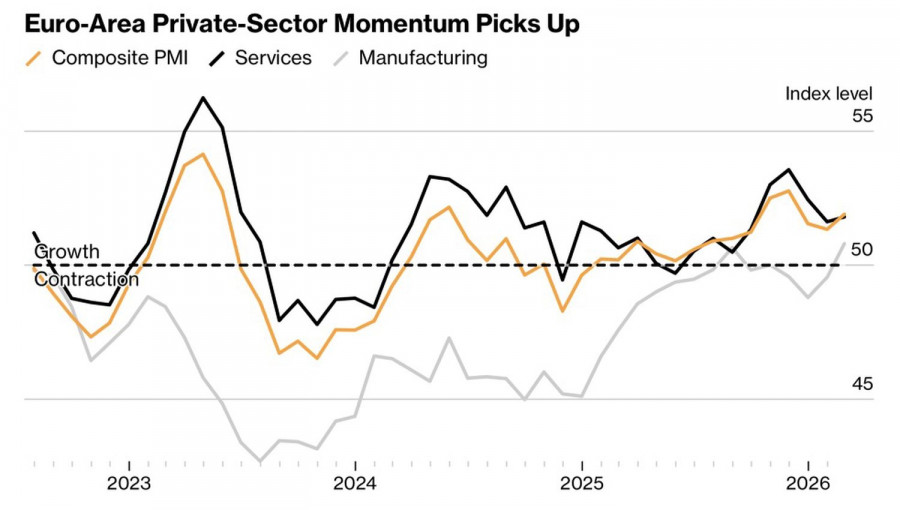

A string of positive euro area data did not help EUR/USD bulls. Negotiated wages in the currency bloc accelerated in the fourth quarter from 1.9% to 3.0% year-on-year. That is below the 5.4% peak recorded in 2024. Nevertheless, stronger wage dynamics raise the risk of higher inflation and reduce the chances of the ECB restarting monetary easing—a positive for the euro.

Another positive factor came from Germany, where fiscal stimulus from Friedrich Merz and increased defense spending pushed manufacturing business activity to a three-year high. The German engine is running at full tilt again and is pulling the rest of Europe along. The eurozone purchasing managers' indices beat Bloomberg consensus, which helped blunt the bears' attack on EUR/USD.

European business activity dynamics

Whether sellers can resume the offensive will depend on the US GDP release for the fourth quarter. However, the emergence of geopolitics at the forefront suggests that any dollar weakness driven by economic data may be temporary.

Donald Trump does not appear concerned with strengthening the greenback or with stoking US inflation via higher oil prices. He intends to end Iran's nuclear program and will stop at nothing. Stripped of attention, the US dollar is doing what it must do — it is rising.

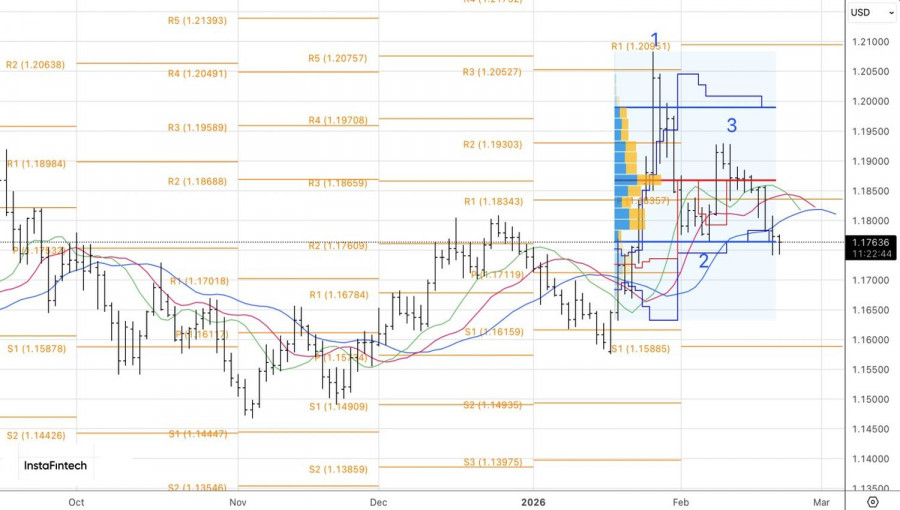

Technically, the EUR/USD daily chart shows a test of the lower bound of the range of 1.1765–1.1990. A decisive break of that band would allow further build-out of the short positions opened from 1.1835. A rebound would form the basis for a bull's counterattack, though one should not get carried away. Failed tests of moving averages and resistance near 1.1820 and 1.1835 would be fresh triggers for new selling. Short targets are 1.1680 and 1.1615.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.