Vea también

24.04.2025 12:59 AM

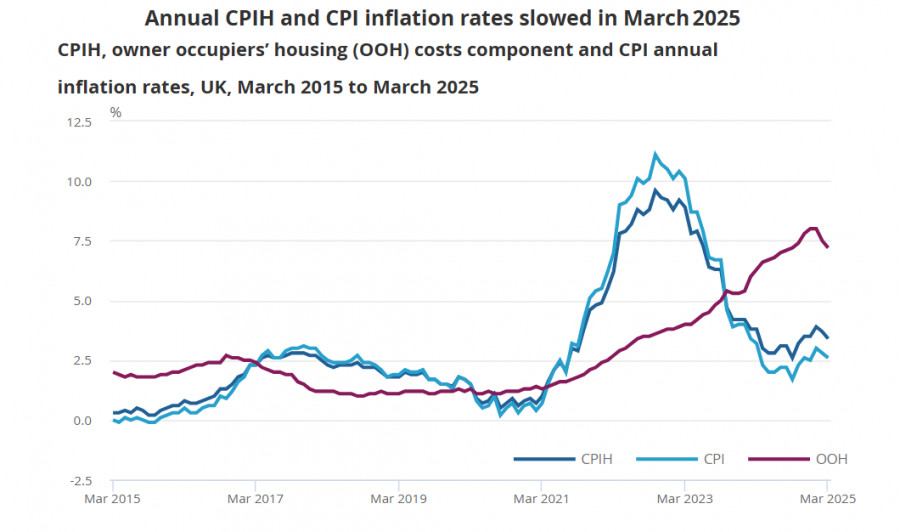

24.04.2025 12:59 AMInflationary pressure in the UK is gradually easing but remains elevated. In March, the core index fell from 3.5% to 3.4% year-over-year, while the headline CPI dropped from 2.8% to 2.6%. Meanwhile, the labor market remains tight, and average wage growth is not slowing.

The next Bank of England meeting is scheduled for May 8, and recent labor market and inflation data will play a key role in shaping the decision. At its previous meeting, the BoE kept the interest rate unchanged at 4.5%, citing a negative inflation outlook and heightened economic uncertainty. The latest data, however, can be considered positive—UK GDP grew by 0.5% in February, and the prospects of signing a trade agreement with the US without significant damage are now seen as fairly achievable.

Markets expect the BoE to cut rates by 25 basis points but not more than that. Moreover, the anticipated cut is not seen as the beginning of a complete normalization cycle. In February, the Bank projected inflation at 3.7% in Q3, as energy prices are expected to rise—so a swift rate-cutting path looks unlikely. This can be seen as a potentially bullish factor for the pound, but its weight remains fragile due to high uncertainty. The market is unlikely to price in such long-term expectations. Inflation may pick up again—or the opposite may happen, where a weakening economy eventually dampens price growth. Both scenarios are entirely plausible.

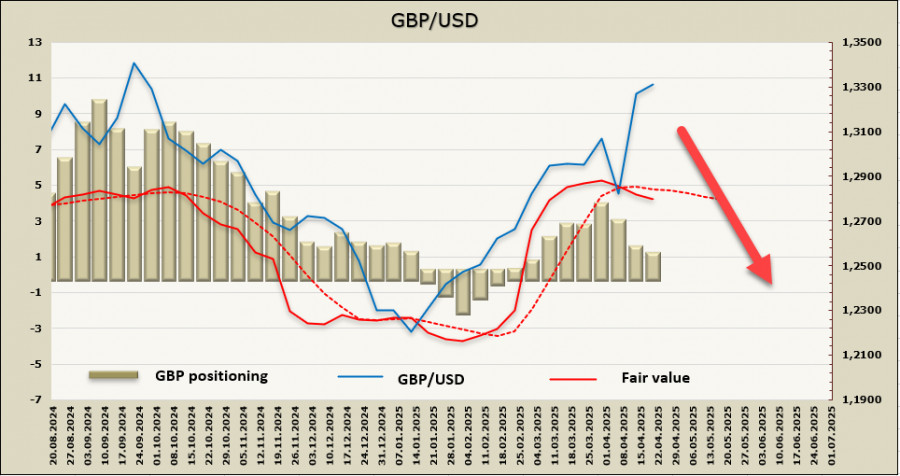

The net long speculative position on GBP decreased by $983 million over the reporting week to $538 million—essentially to a neutral level. The fair value is below the long-term average and shows a tendency for further decline.

Last week, we suggested that the pound's bullish impulse was nearing exhaustion. However, GBP still managed to reach the strong resistance level at 1.3433, driven by a broad sell-off in the dollar—so it pushed higher along with the market. At the same time, the fair value continues to decline, which makes the pound's rally look like a temporary reaction to another unexpected move from Trump rather than something grounded in fundamentals.

We expect a decline to begin from current levels, with the nearest target at the technical level of 1.3107, followed by a potential attempt to break below 1.3013.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.