Vea también

21.03.2025 12:45 AM

21.03.2025 12:45 AMMarkets shoot first and ask questions later. Upon hearing Jerome Powell's assurance that the Federal Reserve had everything under control and that there would be no recession, U.S. stock indices rose. Along with them, EUR/USD quotes climbed as well. As the currency of optimists, the euro gained an advantage due to an improvement in global risk appetite—an effect that, unfortunately, won't last long. Alongside the decline, another bad sign for the main currency pair is stagflation, precisely the scenario the Fed has outlined.

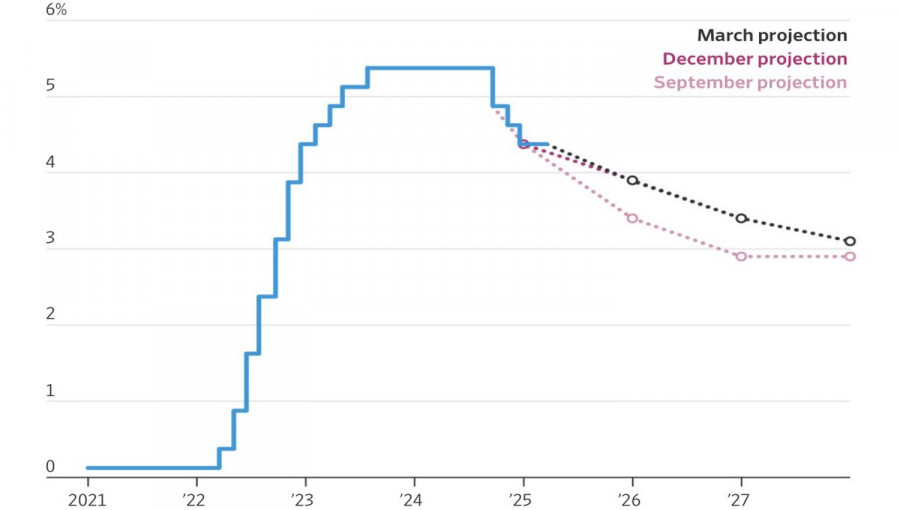

The long-term federal funds rate forecasts remained unchanged. The FOMC expects two rate cuts in 2025, another two in 2026, and one more in 2027. The total scale of monetary easing is estimated at 125 basis points. At the same time, Jerome Powell called the inflation triggered by tariffs temporary or transitory. The Fed can afford not to intervene in this process—prices will come down on their own over time.

Markets calmed down, but within a day, they recalled the events of 2021. Back then, the Fed also described high inflation in the U.S. as transitory. The argument was that the surge in economic activity following the COVID-19 pandemic would subside, leading to a drop in consumer prices. However, when CPI surged to nearly 10% in 2022, Powell and his colleagues swiftly changed their stance. They launched the most aggressive monetary tightening in four decades, which enabled the U.S. dollar to win the G10 currency race in 2024 and remain one of its leaders in 2023.

History is repeating itself. There is nothing more permanent than the temporary. Tariffs risk pushing consumer prices to new highs, forcing the Fed to abandon its forecasts. This could result in maintaining the federal funds rate at 4.5% until the end of 2025, as the OECD and Fitch Ratings urged. If that happens, after its sharp rally in the first two decades of March, EUR/USD risks plunging off a cliff.

Especially since the U.S. and the European Union stand on the brink of a trade war by imposing tariffs on steel and aluminum, the White House forced Brussels to respond. However, the retaliation did not sit well with Donald Trump. The Republican threatened to introduce a 200% tariff on European alcoholic imports. In response, the EU backed down, postponing tariffs on U.S. whiskey imports until mid-April—ostensibly to allow negotiations aimed at preventing economic pain for both sides.

I fear that Trump is not concerned with the EU's maneuvering. The U.S. president has declared April 2 as America's Liberation Day, hinting at sweeping reciprocal tariffs. Europe is unlikely to emerge unscathed.

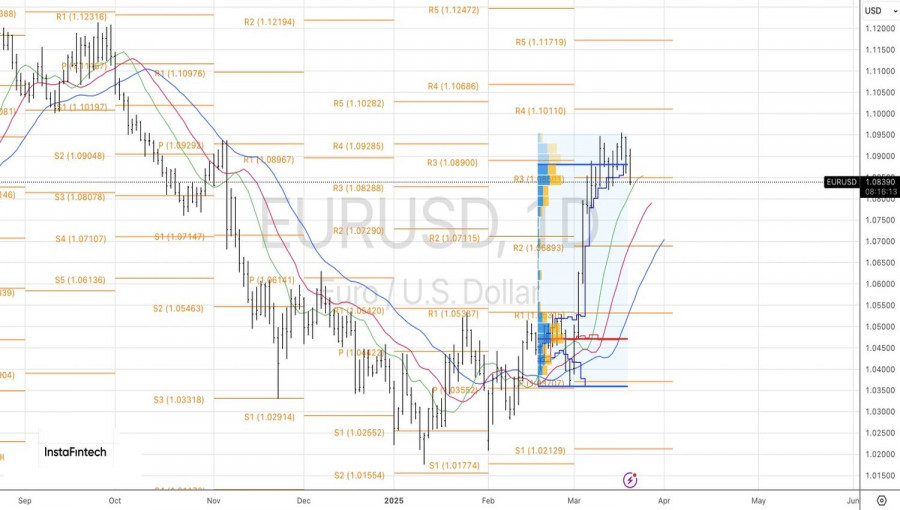

From a technical standpoint, a reversal pattern called Anti-Turtles has been activated on the EUR/USD daily chart. Short positions on the euro against the U.S. dollar, formed from the 1.089 level, should be maintained and periodically increased. Target levels are set at 1.0805 and 1.0720.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.