Lihat juga

11.02.2026 01:48 PM

11.02.2026 01:48 PMMarkets are on edge, awaiting the release of key US employment data for January. The Federal Reserve is prioritizing the labor market over inflation and is counting on inflation cooling. Therefore, disappointing non?farm payrolls could hand EUR/USD bulls a decisive advantage that bears may not be able to counter.

Derivatives currently price a roughly 30% probability of three easing moves by the Federal Reserve in 2026, with two rate cuts already priced in by September — materially more than a week ago, when futures implied a roughly 50 bps cut in the federal funds rate. The shift in odds reflects a string of disappointing US economic data.

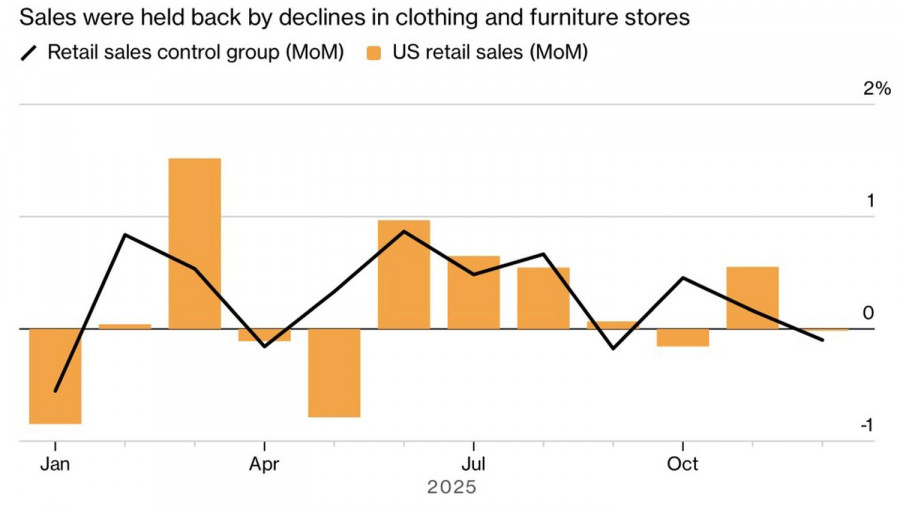

US retail sales dynamics

It began with a series of weak labor market signals from alternative sources and was followed by an unwelcome retail sales surprise. Retail sales were flat in December, while the Bloomberg consensus had expected a 0.4% m/m increase.

The Atlanta Fed's GDP

Now model immediately trimmed its Q4 GDP estimate from 4.2% to 3.7%. Treasury yields fell — and the dollar followed.

So far, the economy's strength, a stabilizing labor market and disinflation have given the central bank room to be comfortable with a 3.75% rate. But things change. Slowing GDP and renewed cooling in employment could push the central bank faster toward monetary easing. The fact that derivatives now forecast 2–3 rate cuts creates a bullish scenario for EUR/USD.

By contrast, the ECB has no plans to cut interest rates. Governing Council policymakers stress that the drop in eurozone inflation to 1.7% in January is temporary. Consumer price growth may continue to slow in the near term, but officials expect it to return toward the 2% target.

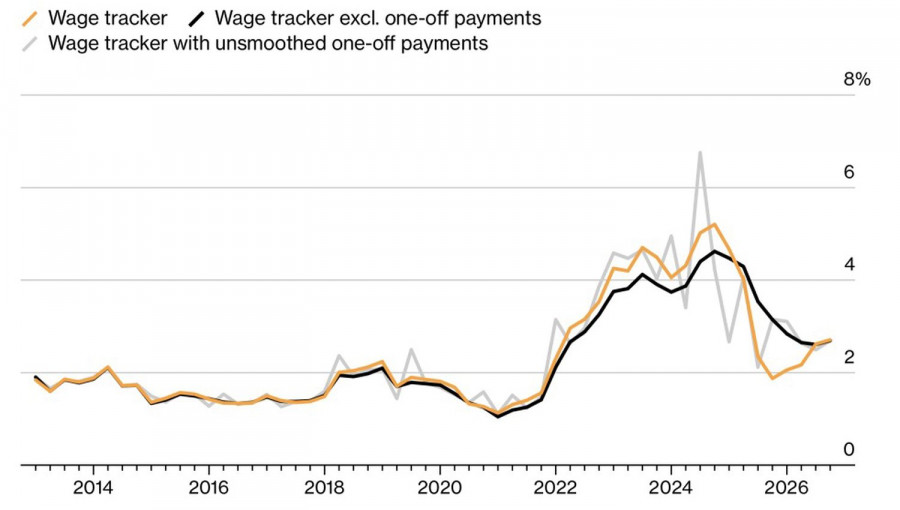

Wage dynamics in the euro zone

A key reason is relatively bullish wage forecasts in Europe. The ECB predicts that wages could rise by 2.6% in Q3 and 2.7% in Q4. Those forecasts are far below the 5%+ seen in 2024, but the environment has changed: such wage growth would be sufficient to push inflation back toward target.

So, in the absence of major political or geopolitical shocks, investors are returning to a familiar game: they are betting on a few easing moves by the Federal Reserve. More rate cuts = a weaker dollar; fewer rate cuts = a stronger dollar. In that sense, the US employment report is likely to put the issue to rest.

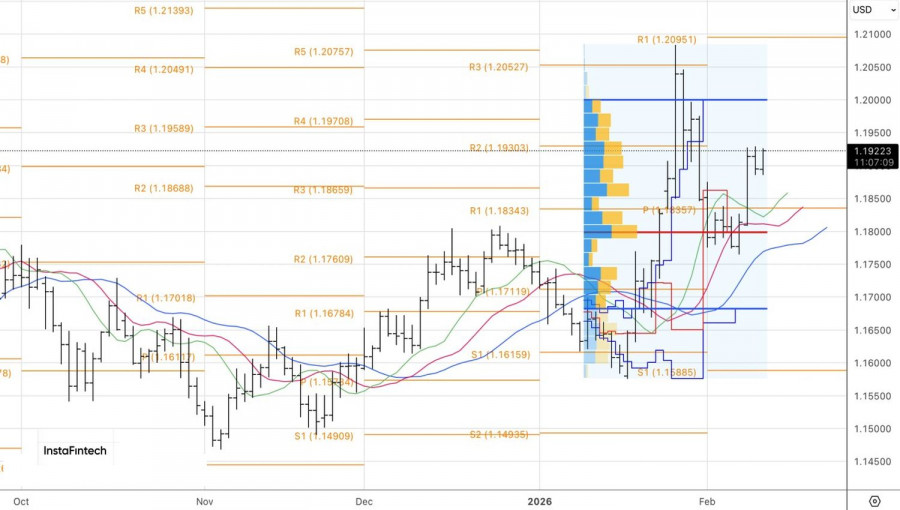

Technically, on the daily chart, EUR/USD bulls are trying to reclaim the initiative after yesterday's pullback. A break above 1.1930 would allow them to add to long positions opened from 1.1835. If they fail to hold above that level, it would be a signal to sell.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.