Vea también

11.02.2026 09:45 AM

11.02.2026 09:45 AMYesterday, equity indices closed mixed. The S&P 500 declined by 0.33%, while the Nasdaq 100 fell by 0.59%. The Dow Jones Industrial Average, however, rose by 0.10%.

Asian equity markets posted impressive gains, reaching record highs as the US dollar weakened. That momentum has emerged ahead of a key US employment report due Wednesday.

US retail sales data came in below forecasts, reinforcing investor bets on possible Federal Reserve rate cuts in mid-year. Weak consumer activity in the United States, reflected in stagnant retail sales, prompted a reassessment of Fed policy expectations. Investors interpret these prints as a sign of slowing US economic growth, which, in turn, raises the probability of monetary policy easing. Expectations of rate cuts are traditionally supportive for risk assets such as equities, since lower rates reduce borrowing costs and stimulate investment.

The MSCI Asia Pacific Index rose by 1.1% to hit a record, and the emerging markets index also reached record levels. It appears that this impulse will carry over to Wall Street: futures on the S&P 500 and Nasdaq 100 were already higher today. European equities are set for a flat to slightly positive open.

Treasuries continued to rally after the 10-year yield fell to its lowest level in about a month. Gold, which typically benefits from lower interest rates, added 0.5% as money markets now anticipate a slightly higher likelihood of three Fed rate cuts this year, two of which are already fully priced in.

Attention now shifts to the employment report and inflation data coming later this week for additional signals on policy, even as markets wobble over concerns about large AI spending by tech companies.

The jobs report will be critical. A weak print could push sentiment further toward risk-off if worries about US economic growth intensify. A solid report could ease some of those concerns. Economists forecast payrolls rising by 65,000 in January — the best monthly gain in four months — and expect the unemployment rate to stay at 4.4%.

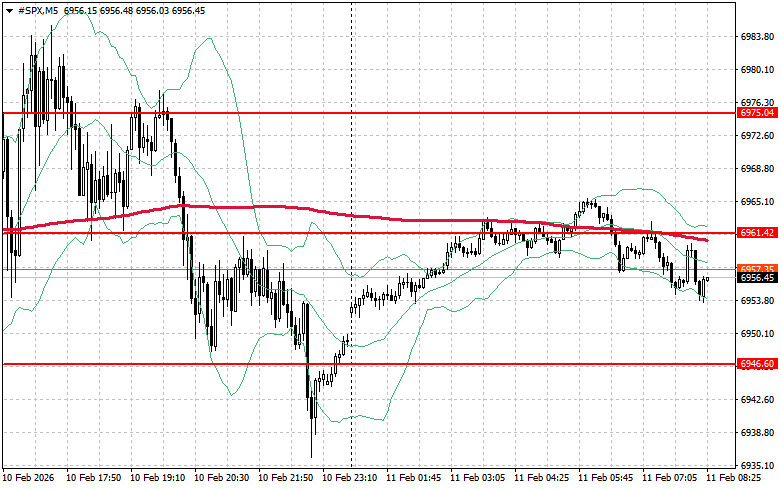

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,961. Breaking above that level would indicate upside and open the path to $6,975. An additional priority for bulls is to secure control above $6,989, which would strengthen buyers' positions. In case of a downside move amid falling risk appetite, buyers must assert themselves around $6,946. A break below that level could quickly push the instrument back to $6,930 and open the way to $6,914.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.