Vea también

09.02.2026 01:19 PM

09.02.2026 01:19 PMTo predict the future, you must look to the past. In 2018, Bitcoin collapsed 80% from its peak after the crypto bubble burst. In 2022, it slumped amid the TerraUSD/Luna crashes and the FTX exchange failure. In 2025–2026, there were no single obvious causes. Ask five different experts, and you'll get five different drivers for BTC/USD's plunge — and each risks being wrong. So, is there any sensible explanation for where the digital asset is headed next?

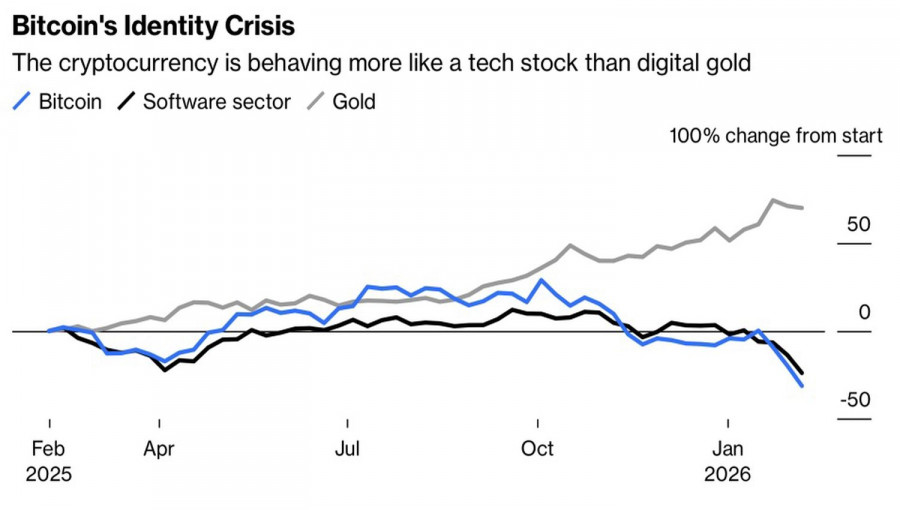

Over the years, investors have tried to liken Bitcoin to other assets in order to use fundamental analysis for forecasts. The crypto was often called "digital gold" for its supposed inflation?hedge properties, its capped supply and its utility as a dollar alternative. Yet, 2026's market shocks did not spare BTC/USD, which has dropped roughly 50% from its October record highs. Events in Venezuela, Iran, and Greenland didn't prevent the crypto market from losing about $2 trillion in market cap.

Bitcoin vs. tech stocks and gold

Gold, silver, and other precious metals outshone Bitcoin, prompting capital rotation out of BTC and weighing on its price. But the crash in rivals did not hand Bitcoin a lifeline. Its current price action looks more like that of software companies — the stocks hit hardest by fears that AI will displace their business models. A sharp rally in tech stocks on February 6, the fastest since May, reached out to the digital asset and helped it find some footing.

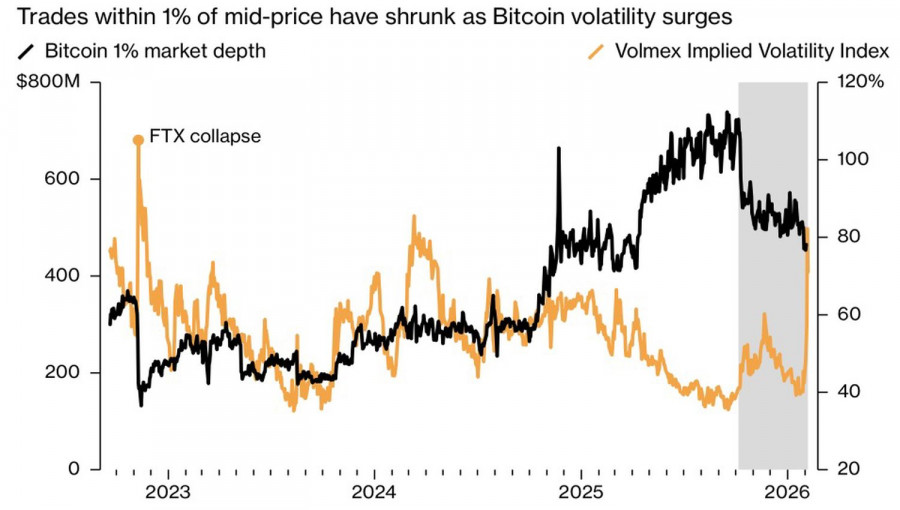

Pressure on Bitcoin from October through February reduced its relative volatility. Not long ago crypto was considered the riskiest of risky assets and was bought simply because it was rising. Its volatility was extreme, and a fall in price variability drew capital out of the market. In that sense, the sharp jump in the volatility measure from 57% to 97% in the first days of February is a positive sign for BTC/USD: it coincided with spot Bitcoin ETFs recording daily inflows of $221 million late in the week.

Volatility spike may be liquidity-driven

However, the volatility jump may have a prosaic cause: market depth on the crypto market has collapsed, reducing its ability to absorb large trades. That likely reflects a liquidity shortage. In this respect the intention of incoming Fed chair Kevin Warsh to shrink the Fed's balance sheet could deliver a serious blow to BTC/USD.

For now Bitcoin is trying to feel out a bottom and to make sense of what's happening.

Technically, the daily BTC/USD chart shows consolidation after a prolonged decline. Downward targets at $70,000 and $60,000 have been reached. It makes sense now to place pending sell orders at $67,200 and buy orders at $72,200.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.