Vea también

28.01.2026 10:07 AM

28.01.2026 10:07 AMExpectations of a big payoff allowed the S&P 500 to record a new high for the first time in two weeks. The rally is now in its fifth consecutive day, which clearly underscores the importance of corporate earnings for investors. Bears on the broad index were not helped even by a sell?off in healthcare stocks after news that Medicare rates will remain unchanged. The market focused more on reports of rising cash flows and shareholder payouts at General Motors, which lifted the company's shares by nearly 9%.

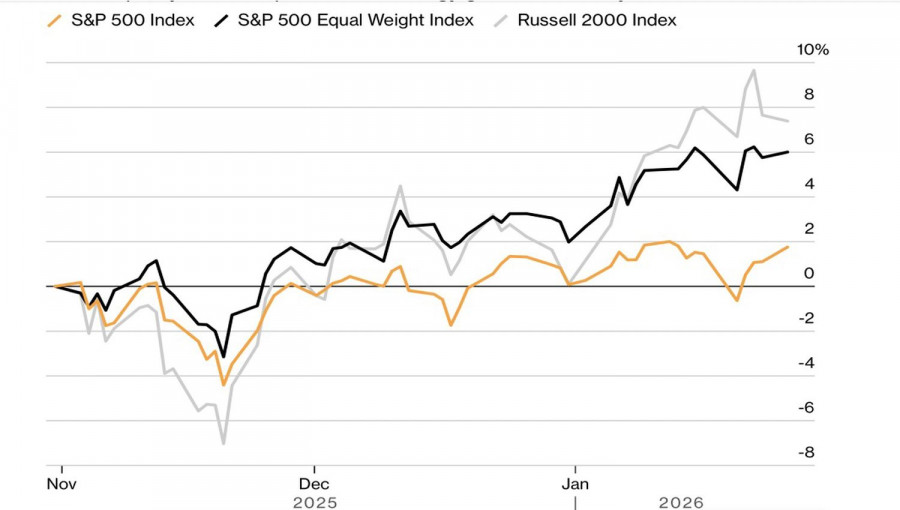

Around a hundred issuers will report Q4 results in the final week of January, including Microsoft, Meta Platforms, Tesla, and Apple. Wall Street analysts expect the Magnificent Seven to post earnings growth of about 20% in October-December, marking the slowest pace since 2023. Nevertheless, that is still a very high number, which fuels the rally in the tech giants' shares. While the S&P 500 clearly lagged the small?cap Russell 2000 at the start of the year, it is catching up to the leader by the end of the second month of winter.

Russell 2000 and S&P 500 Dynamics

Investors are asking one question: can Big Tech generate profits commensurate with the massive investments in artificial intelligence? If yes, the rotation that began more than a quarter ago may be put to rest. If not, money will flow back into small?cap stocks. Morgan Stanley believes cyclical stocks have taken the role of growth locomotive from tech — their fundamental valuations are more attractive, as is their ability to generate profits. The firm expects the Russell 2000 to rise 13.5% in 2026 versus +12.8% for the broad index.

The main supporting factor remains a favorable external backdrop. There is confidence in an acceleration of economic growth driven by fiscal stimulus and the continuation of the Fed's easing cycle.

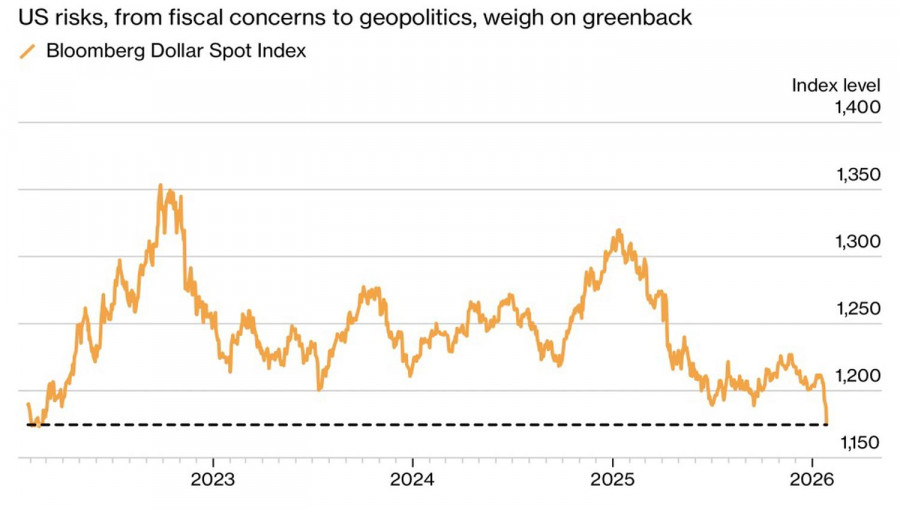

US Dollar Index Dynamics

Investors are not fazed by Donald Trump's remarks that a weaker US dollar is "great" because it improves business conditions. In fairness, depreciation does support export growth and increases foreign currency earnings for US multinationals.

Nevertheless, the White House's policy uncertainty leaves foreign investors sitting on packed suitcases. They are looking for a reason to pull money out of the United States. Capital outflows could play a nasty trick on the S&P 500. At the same time, a downtrend in the dollar for non?residents is like a red rag to a bull: the more it is waved in front of them, the stronger their urge to act.

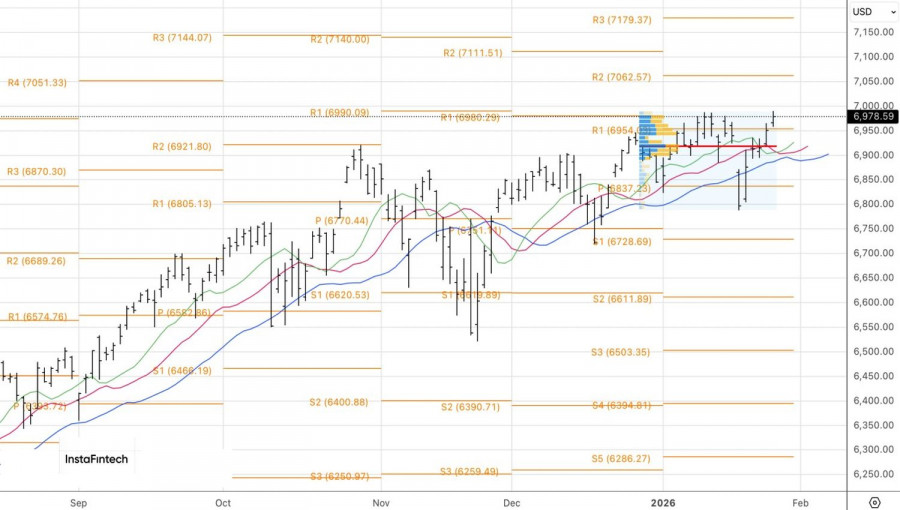

Technically, on the daily chart, the S&P 500 shows a recovery of the uptrend. Long positions opened at 6,935 and added at 6,985 can be increased further by buying breakouts above 6,990. The psychologically important 7,000 level is within reach. There is a high probability it will be hit in the near term.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.