Vea también

29.04.2025 09:10 AM

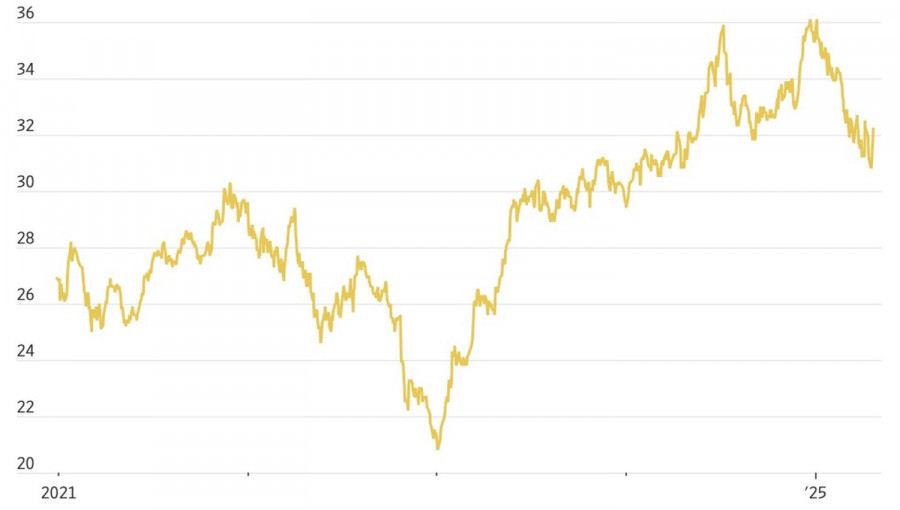

29.04.2025 09:10 AMThe market always keeps us engaged. Despite all the gloomy talk of recession, trade wars, supply shortages, inflation, and layoffs, the S&P 500 has declined by just a little over 3% from the levels seen when tariffs were announced on America's Liberation Day. For equities, what matters most is not the economy itself but how companies respond to its state. Can they remain profitable, and how strong will that profitability be? Between 2000 and 2015, excluding the recession, profit margins averaged 7.8%. In 2024, that figure rose to 10.7%. So, what should we expect in 2025?

Four members of the Magnificent Seven — Amazon, Apple, Meta Platforms, and Microsoft — report earnings between late April and early May. NVIDIA was hit by news that China's Huawei has developed a high-performance AI chip. However, overall, this group of companies has managed to recover after a wave of sell-offs. Although their share of the S&P 500's total market capitalization has significantly decreased, these former leaders have regained their footing.

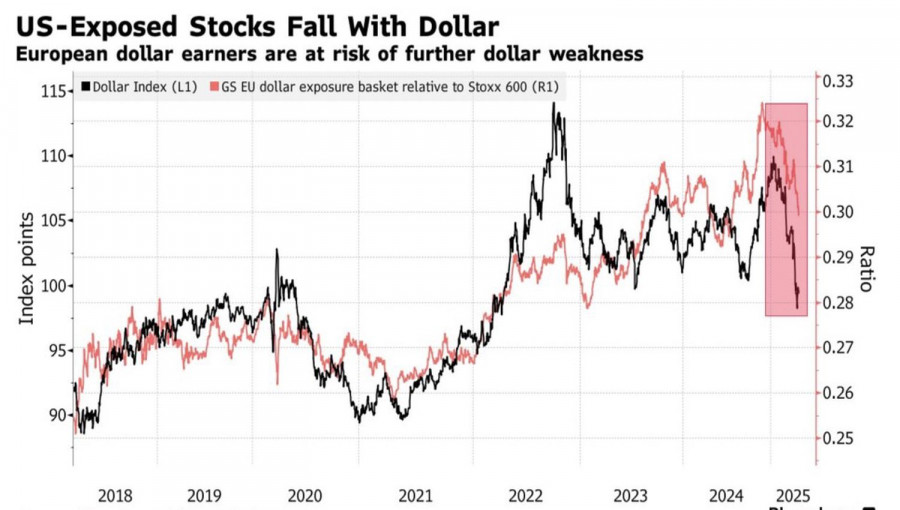

The sell-off in Magnificent Seven stocks wasn't the only reason behind the broader market correction. Due to the erosion of U.S. exceptionalism, capital outflows from the New World to the Old also significantly impacted the S&P 500. But here, too, there are signs of improvement.

The Eurozone is much more export-oriented than the U.S. In Germany, exports account for over 40% of GDP, whereas in the U.S., that figure is just 11%. As a result, about 60% of companies in the EuroStoxx 600 generate sales abroad. A decline in the U.S. dollar index hurts their corporate earnings.

Add to this the renewed investor confidence in the "Trump put" — the idea that the U.S. president is ready to step in to support the market in the event of a significant downturn — and the rally in the broad stock index becomes less surprising. Indeed, in recent days, the White House has adopted an increasingly conciliatory tone. According to insider reports from The Wall Street Journal, auto tariffs are expected to be eased, and Treasury Secretary Scott Bessent is hopeful that Congress will extend tax breaks by July 4.

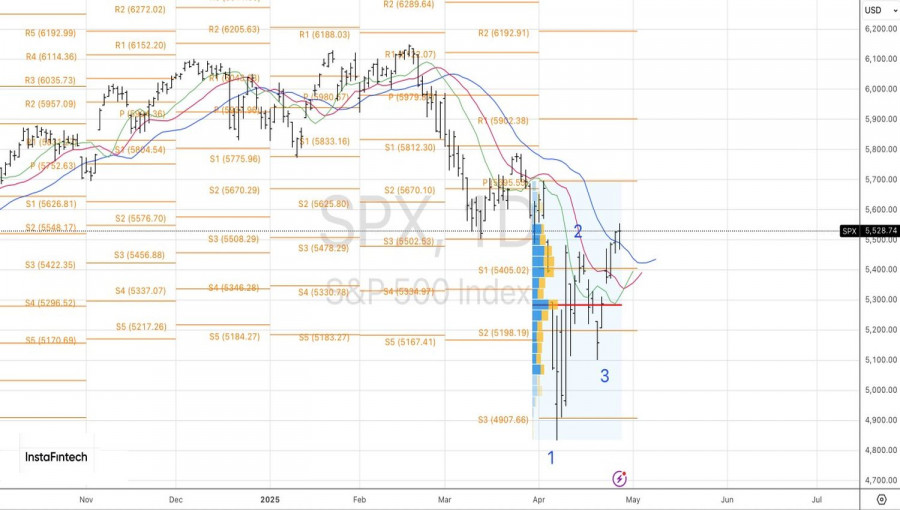

What once seemed like a trained crowd of investors buying the dip now appears very different. If Donald Trump and his team are ready to throw a lifeline to the U.S. stock market, Europe isn't as strong as it once seemed, and the Magnificent Seven have found their footing again — then the S&P 500 rally could very well continue.

Technically, a doji bar with a long lower shadow has formed on the daily chart of the broad index. A breakout above its high, near 5550, would allow further build-up of long positions opened from the 5500 level. From there, the S&P 500's fate will depend on whether it can break through the resistance zones at 5625 and 5695.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.