Vea también

21.04.2025 07:29 PM

21.04.2025 07:29 PMTrade Breakdown and Tips for Trading the Euro

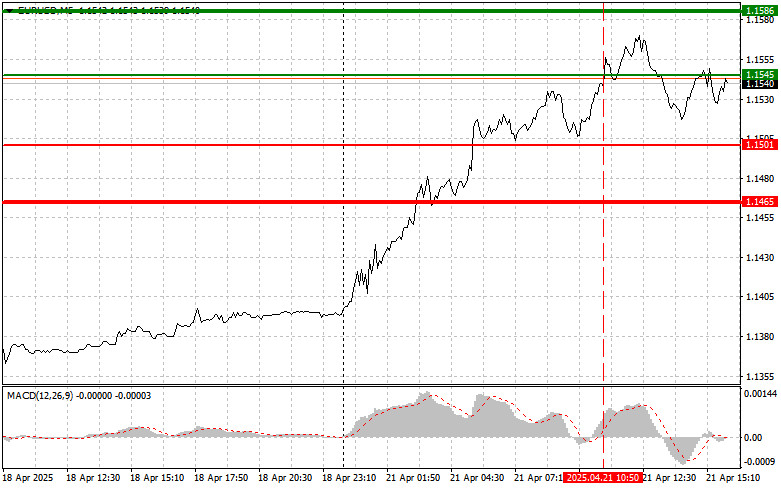

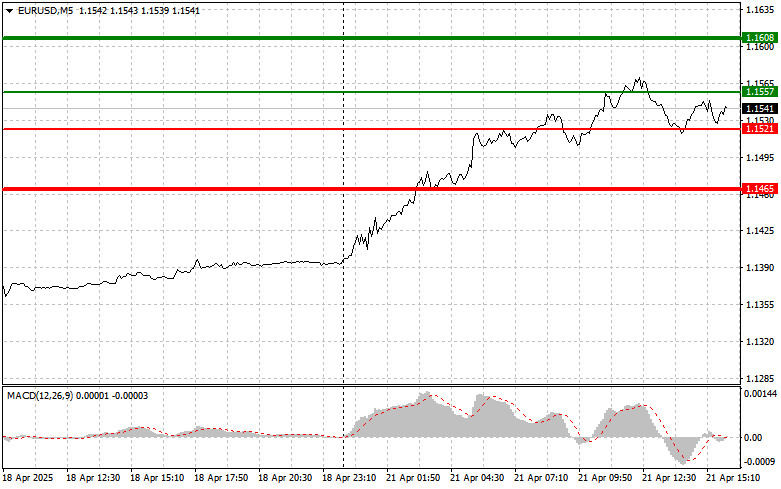

The price test at 1.1545 occurred when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential. For that reason, I did not buy the euro.

The lack of data from the eurozone allowed the euro to continue rising. In the second half of the day, the speech by Chicago Federal Reserve Bank President Austan Goolsbee will be the key event, offering insight into the current views of FOMC members regarding the future of interest rates. Market participants will closely analyze any clues on whether Goolsbee holds a more hawkish or dovish stance and what factors he considers most important in setting monetary policy.

The publication of the Leading Economic Index is not a major event for the currency market. This index is traditionally seen as a forecast of future economic activity. A decline in the index may indicate a slowdown in economic growth, while an increase suggests a potential acceleration.

As for the intraday strategy, I will focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro when the price reaches the 1.1557 area (green line on the chart) with the goal of rising to 1.1608. At 1.1608, I plan to exit long trades and open short positions in the opposite direction, targeting a 30–35 point move from the entry point. Continued euro growth is expected in line with the new upward trend. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1521 level, at a time when the MACD indicator is in oversold territory. This will limit the downward potential of the pair and trigger a bullish reversal. Growth to opposite levels of 1.1557 and 1.1608 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1521 (red line on the chart). The target will be 1.1465, where I intend to exit short trades and immediately buy in the opposite direction (targeting a 20–25 point rebound from the level). However, pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to move downward from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1557 level when the MACD indicator is in overbought territory. This will limit the pair's upward potential and trigger a bearish reversal. A decline to the opposite levels of 1.1521 and 1.1465 can be expected.

What's on the chart:

Important Note for Beginner Forex Traders

Beginner traders should be very cautious when making market entry decisions. Before the release of important fundamental data, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without using stop-losses, you can quickly lose your entire deposit, especially if you don't practice money management and trade with large volumes.

And remember: to trade successfully, you must have a clear trading plan—like the one I've presented above. Spontaneous decisions based on current market conditions are, by default, a losing strategy for intraday trading.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

Los futuros del petróleo Brent se acercaron a la zona de resistencia descendente, pero no lograron consolidarse por encima, retrocediendo hacia abajo. El panorama técnico sigue siendo tenso: el precio

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.