Vea también

27.03.2025 09:13 AM

27.03.2025 09:13 AMThe higher the climb, the harder the fall. The S&P 500 tumbled in response to Donald Trump's announcement of 25% tariffs on automobiles. There will be no exceptions, although countries included in the North American Free Trade Agreement will receive preferential treatment for auto parts exports to the US. Europe and Japan are threatening retaliation, and fear has returned to equity markets.

Some of the most heavily sold stocks were names from the Magnificent Seven, which are now set to face their worst quarter in two years. Competition from China in electric vehicles and artificial intelligence has put an end to American exceptionalism — and this is just the beginning.

Magnificent Seven Quarterly Dynamics

Although Donald Trump has labeled former allies as freeloaders — draining the US of jobs and wealth — the country's GDP growth has long been fueled by globalization. By undermining it with protectionist policies, the White House risks a slowdown in GDP growth as early as Q1, with the Atlanta Fed's leading indicator pointing to just 0.2% growth. That's bad news for the S&P 500.

The US may appear to hold the upper hand in the trade war, giving Trump room to toss around tariff threats. However, the country runs a large current account deficit, which requires continued inflows of foreign capital into Treasury markets. Will China, Japan, and Europe, now targeted by these import tariffs, continue to finance it? The EU's retaliation plan includes reducing its holdings of US debt — a painful payback for the trade conflict. What if Beijing and Tokyo follow suit?

The outsized share of US equities in global portfolios is also a product of international cooperation. Capital is already flowing out of US markets, but the outflow is far from over. It remains to be seen how much a coordinated response from global economies will ultimately cost the United States.

A narrowing US budget deficit could also spell trouble for the S&P 500. By mid-year, the debt ceiling will be back in the spotlight, and Trump's plans to cut $4.5 trillion in taxes, $2 trillion in spending, and $2.5 trillion in tariffs may prove difficult to implement. In any case, Washington is moving towards fiscal consolidation, which will further slow US GDP growth. In a high-inflation environment, the Fed is unlikely to come to the rescue.

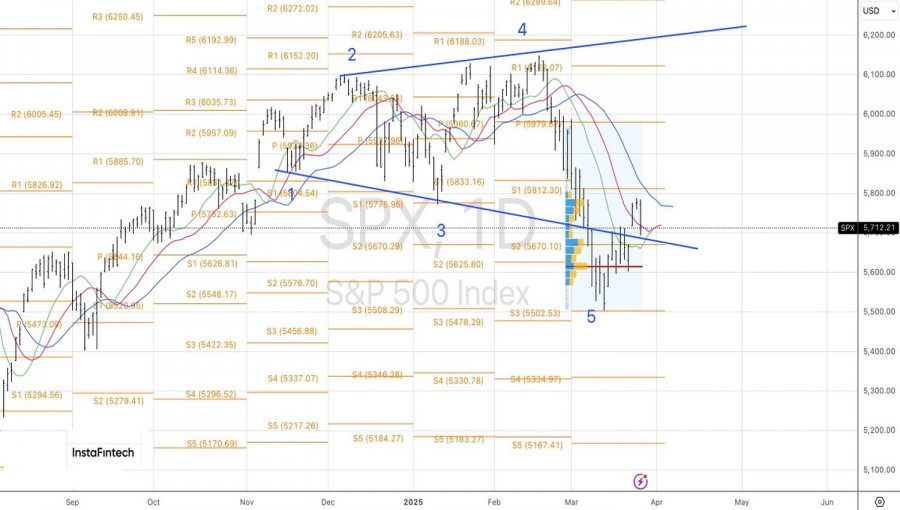

From a technical point of view, the S&P 500 pulled back earlier than expected on the daily chart. The 5,815 level was not reached, but the key now is to identify the boundaries of a medium-term consolidation range — likely between 5,500 and 5,790. It may make sense to sell the index on rallies and look to buy back near the lower boundary of the trading range.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.