Vea también

25.02.2025 09:49 AM

25.02.2025 09:49 AMAfter the markets reacted to the news of the U.S.-Russia negotiation process that was initiated following Donald Trump's call to Vladimir Putin, investors have shifted their focus back to the U.S. trade wars with several countries.

Initially, there was optimism regarding improved U.S.-Russia relations; however, the reality that Trump remains the key decision-maker proved less promising. On Tuesday, the U.S. dollar index (ICE) strengthened to 106.7, recovering from an 11-week low. This rebound followed Trump's announcement that tariffs on Canada and Mexico "will be imposed" after a one-month extension expires next week. Hopes that these two countries could negotiate a resolution with Trump's administration faded after his follow-up comments, prompting markets to adjust their expectations accordingly.

Market participants are now focusing on the upcoming PCE Price Index report and the second revised estimate of Q4 GDP, which could offer further clarity on the direction of monetary policy.

Last week, the U.S. Services PMI unexpectedly fell to 49.7 from 52.9, despite strong growth in the manufacturing sector. Additionally, consumer sentiment from the University of Michigan weakened notably due to concerns over persistent inflation, which could continue to rise given Trump's protectionist stance.

Against this backdrop, U.S. stock markets still lack a clear directional trend. The only assets showing a distinct movement have been the U.S. dollar on Forex and gold prices. The dollar declined due to uncertainty about future Federal Reserve policy, while gold prices surged as investors sought safe-haven assets. In response, SPDR Gold Trust, the world's largest gold-backed ETF, reported that its holdings increased to 904.38 tons on Friday—the highest level since August 2023.

I expect that both the U.S. stock market and the cryptocurrency market will remain in a consolidation phase, moving within sideways ranges. The dollar may experience a temporary rebound on the ICE index, reaching 106.75, but this should not be seen as a trend reversal. This week's market focus will be on the PCE index report, which is a key factor in the Fed's interest rate decisions, as well as the second estimate of Q4 2024 GDP.

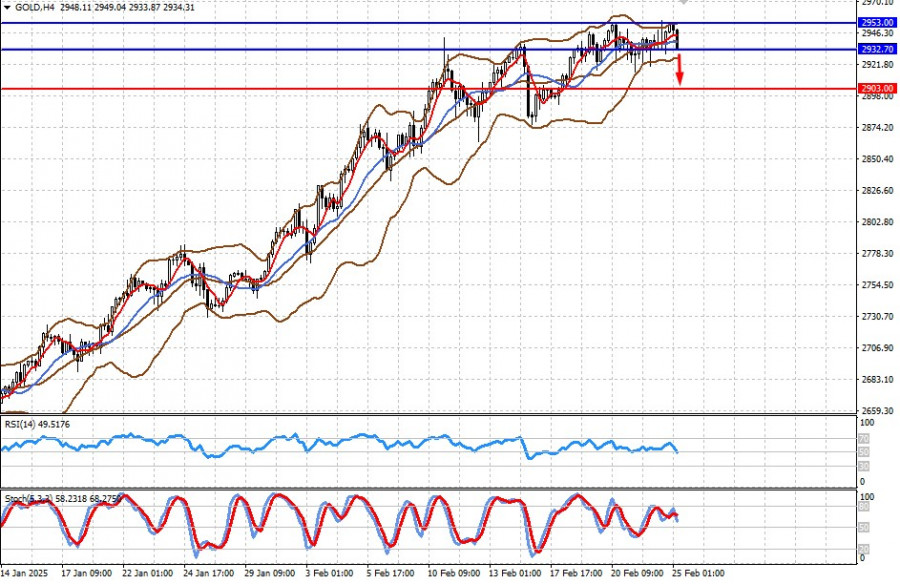

Gold prices remain near their historical high, but due to overbought conditions, a local decline to $2,903.00 is possible if the $2,932.70 level is breached.

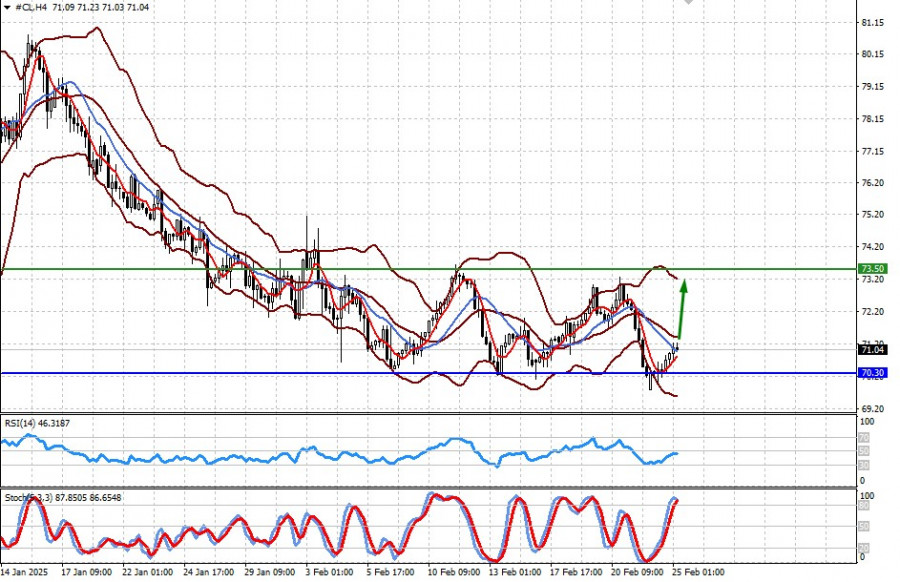

The price of U.S. crude oil (WTI) remains in the $70.30–$73.50 range and may continue fluctuating within this range for some time. This is due to the current market balance between supply and demand. Given this equilibrium, a short-term upward move to the upper boundary of the range is likely.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.