Vea también

13.02.2025 12:36 PM

13.02.2025 12:36 PMGold is experiencing a modest intraday increase, although it remains below the record high reached earlier this week. However, the lack of momentum is limiting further upside movement.

Investor concerns over the potential consequences of President Donald Trump's trade tariffs—which could trigger a global trade war—continue to support demand for safe-haven assets like gold.

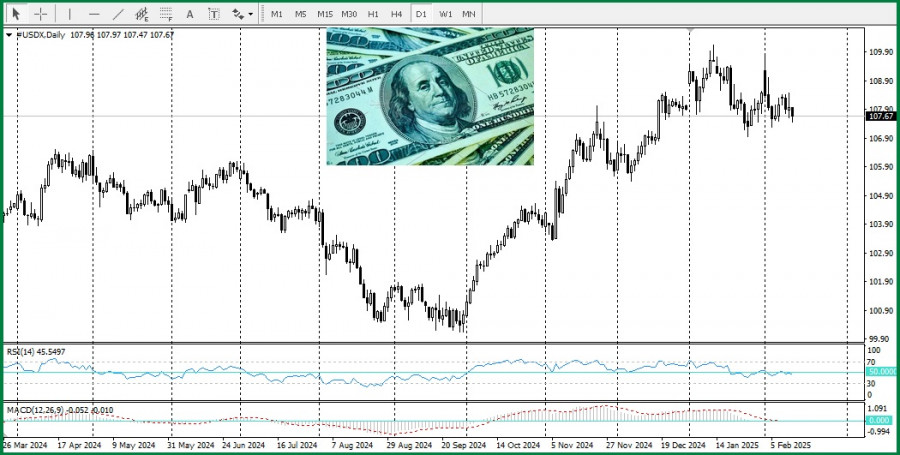

Additionally, the decline in U.S. Treasury yields is weighing on the U.S. dollar, pushing it toward a weekly low, which in turn is boosting gold prices.

Expectations that Trump's protectionist policies could further exacerbate already high U.S. inflation make gold an attractive hedge against rising prices. However, Wednesday's stronger-than-expected Consumer Price Index (CPI) reaffirmed that the Federal Reserve may maintain its hawkish stance, which limits gold's upside potential.

Today, attention shifts to the Producer Price Index (PPI) for further trading opportunities.

From a technical perspective, the daily Relative Strength Index (RSI) remains in overbought territory, signaling the need for caution before initiating new long positions.

Bulls are likely to pause near the all-time high in the $2942–$2943 zone, reached on Tuesday, which now serves as a key resistance level.

If gold prices fall below the psychological level of $2900, this could open the way for a decline toward yesterday's low near $2864.

Further downside pressure could accelerate a corrective pullback, with intermediate support around the $2834–$2832 region, before testing the next major support level at $2800.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.