Vea también

14.08.2024 12:18 AM

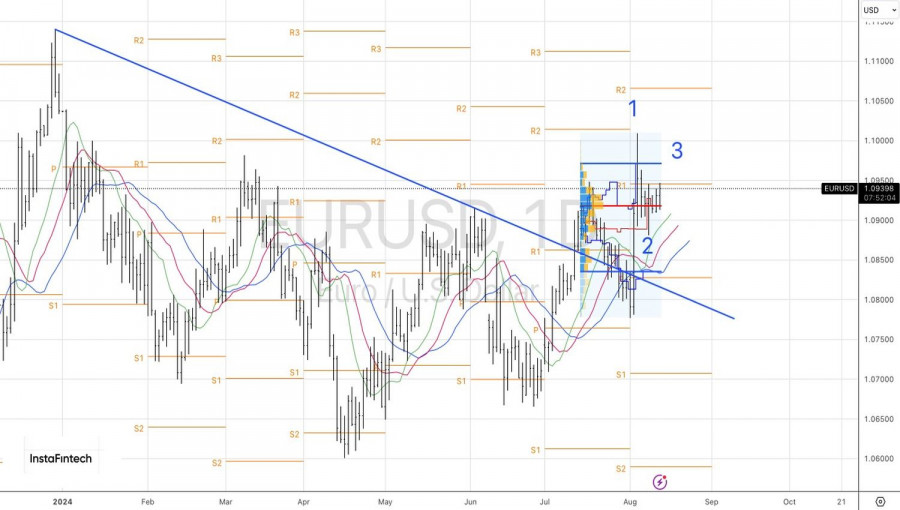

14.08.2024 12:18 AMMuch ado about nothing. In anticipation of the release of the US Producer Price Index, there were many speculations about a strong market reaction to inflation surprises. In reality, the unexpected slowdown in the PPI resulted in a modest attempt by EUR/USD to break out of the short-term consolidation range of 1.088–1.094. The bulls didn't achieve significant gains on their first attempt. Should they wait until Wednesday for the CPI data to be released?

In July, producer prices slowed to 0.1% month-over-month and 2.2% year-over-year. The core PPI remained unchanged compared to June and increased by 2.3% over 12 months. The significant aspect is the first reduction in service inflation in a long time. The figures suggest a developing disinflationary process in the US and provide the basis for the futures market to increase the probability of a 50 bps rate cut by the Federal Reserve in September from 49% to 54%.

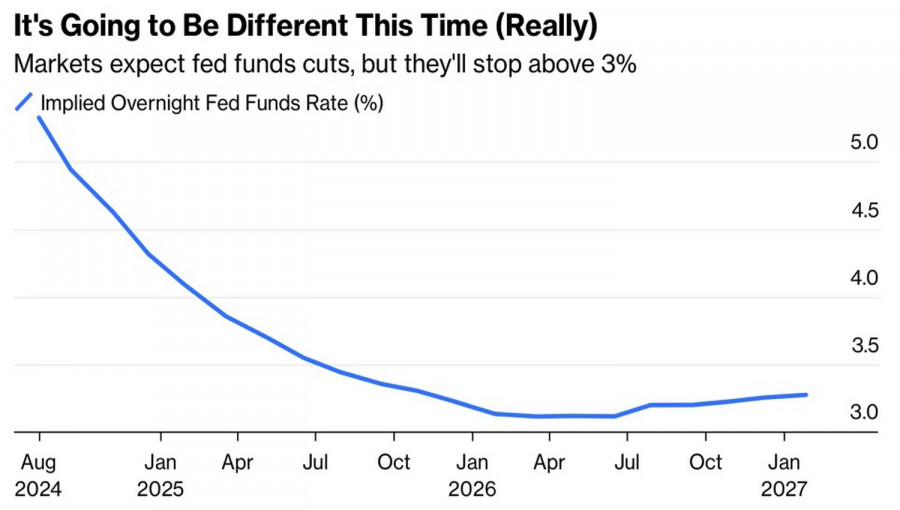

The futures market still believes that the Fed will cut borrowing costs by 100 bps in 2024, which implies activity at each of the three remaining FOMC meetings this year. In 12–18 months, the rate is expected to fall to 3%, a clear bullish signal for EUR/USD.

Market Expectations for the Federal Funds Rate

Goldman Sachs considers such forecasts overstated and views the market reaction to the US employment data for July as excessive. In reality, there is no talk of a recession in the US. The American economy appears weaker than before, but GDP can still grow above trend. This performance allows the Fed to avoid rushing into easing monetary policy. As soon as the market realizes it, the story of early 2024 with the strengthening of the U.S. dollar will repeat itself. In this regard, Goldman Sachs recommends selling EUR/USD.

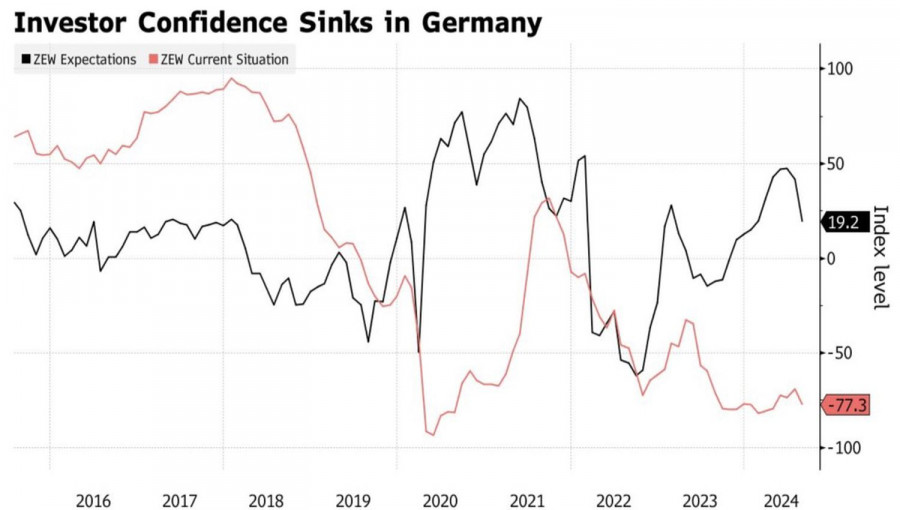

This strategy is supported by the decline in investor confidence in the German economy in August to its lowest level since January amid turmoil in global financial markets. As a pro-cyclical currency, the euro reacts strongly to deteriorating global economic conditions. If the US, China, Japan, and Germany face trouble, EUR/USD will likely head south.

Dynamics of Investor Confidence in the German Economy

However, the release of the data on the US Consumer Price Index will answer all the questions. This opinion is present on Forex, but, as with the PPI, it may be much ado about nothing. Investors gradually shift their focus from inflation to recession, so the market reaction might be muted. We'll wait and see.

Technically, on the EUR/USD daily chart, the bulls' failure to break the resistance at the pivot level of 1.0945 indicates weakness among the bulls. However, a second attempt might be more successful, so a re-entry into long positions after successfully testing the upper boundary of the 1.0880-1.0940 consolidation range is worth considering.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.