Vea también

14.06.2022 11:00 AM

14.06.2022 11:00 AMHello, dear traders!

In this article, we will analyze the technical picture of NZD/USD, which is now seen by many as the major currency pair along with EUR/USD, GBP/USD, USD/JPY, USD/CHF, and commodity pairs AUD/USD and USD/CAD. The Reserve Bank of New Zealand is going to tighten its monetary policy by hiking rates. Inflation in the country soared after the COVID-19 pandemic when energy and commodity prices spiked. So, let's begin with the weekly time frame of NZD/USD.

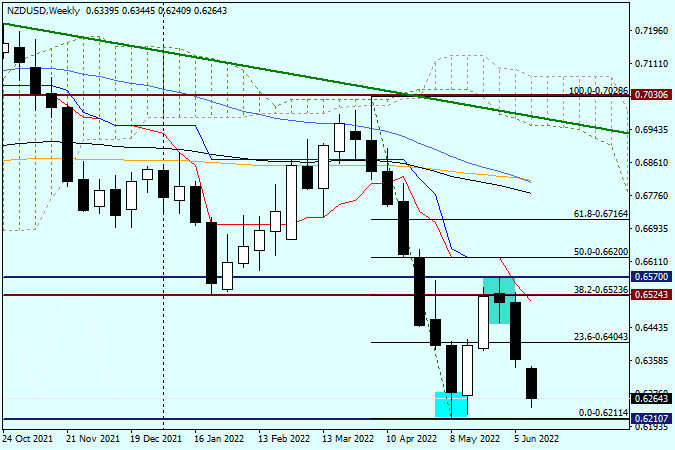

Weekly

On the weekly chart, we can see the 0.6211 low and the highlighted lower shadow of the candlestick from which the kiwi started to retrace up. The fact the pair's upward move is just a correction is clearly seen thanks to the Fibonacci grid drawn between 0.7028 and 0.6211. As we can see, the quote went slightly above the Fibonacci retracement of 38.2 and then encountered strong resistance at 0.6570. As a result, a reversal candlestick pattern emerged on the weekly chart. At least it looks like a reversal pattern in terms of its shape. After the formation of this candlestick, a downward reversal occurred.

The pair showed strong movement last week, which only confirmed the reversal pattern. It is only Tuesday, but the quote is already moving down fast. The candlestick is now acquiring a lower shadow. However, ahead of the FOMC meeting and due to the fact it is only the beginning of the trading week, the technical picture may change dramatically. The one thing is clear so far – should the price close below the key support of 0.6211, bulls will be pushed off the market entirely. Alternatively, if the pair goes up, the bearish resistance of 0.6570 will be broken in case of a true breakout only. Anyway, both scenarios seem unlikely at this point.

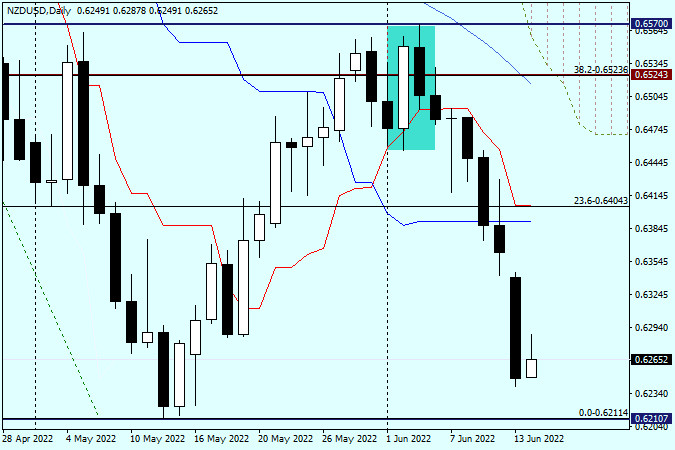

Daily

On the daily chart, a downward reversal of NZD/USD from the 0.6570 mark is clearly visible. It could be seen as the Harami candlestick pattern, consisting of two candlesticks. The second candlestick is bearish, and it should certainly be within the body of the previous white candlestick. The closing price of the white candlestick is 0.6550 and the open price of the bearish one is 0.6549. This means that the bearish candlestick formed on June 3rd is within the body of the previous bullish candlestick. As we can see, this is what the market needed to start selling aggressively. It should also be mentioned that the Harami reversal pattern is by no means the strongest one.

Today, the kiwi is trying to retrace up although the current daily candlestick looks not so good. So, it is wiser to go short today. Short positions could be opened after a true breakout at 0.6211 support with further consolidation and a bounce to the broken level. Likewise, they can be considered from 0.6400 after the quote has increased to the 0.6390-0.6405 range, where the red Tenkan Line of the Ichimoku indicator passes.

Good luck!

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.