Vea también

10.06.2022 09:45 AM

10.06.2022 09:45 AMMy yesterday's assumption that the pound sterling would also be affected by the ECB meeting did actually come true. Yet, the pound got off easy which is quite natural as this was not the Bank of England's meeting. The GBP/USD pair declined by the end of the day although the pace of decline was moderate. The technical picture stayed almost unchanged. Before proceeding to technical analysis, let me remind you about the main challenges of the UK economy. They include record-high inflation and high taxation. With the weakness in the housing and construction sectors and low consumer confidence, we can assume that the UK economy has closely approached a recession. Besides, analysts' forecasts for inflation are also pessimistic.

It is predicted that the conflict in Ukraine and disruptions to supply chains in China due to COVID-19 may push inflation up to 10% by the end of this year. Against this background, UK Prime Minister Boris Johnson is trying to regain trust. He advocates for lower taxation and regulatory reforms. Earlier, Johnson argued that the British government has all the tools to support the economy. But as it turns out, reforms are necessary at this stage.

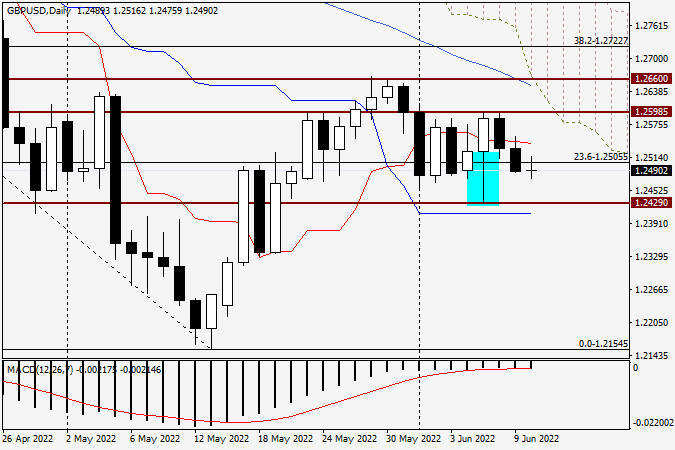

Daily chart

Before moving on to the daily chart, I would like to remind you that the main fundamental event today will be the CPI data release in the US. As for the technical outlook for the GBP/USD pair, it stays almost unchanged. Bears are approaching the resistance at a very strong technical level of 1.2600. The support is found at the low from June 7 at 1.2429. As we can clearly see on the chart, the pair closed yesterday's session in the middle of this range. I think it is important to note that the second daily candlestick in a row closes below the red Tenkan line of the Ichimoku indicator. If today's candlestick closes below this line again, this will indicate that the quote settled there and is very likely to decline towards a strong support zone of 1.2429-1.2409 where the blue Kijun line is located.

This scenario will be very favorable for the pound bulls. The current technical picture shows no clear signals for opening new positions since neither the above-mentioned resistance nor the support has been broken. The pair is still trading in the middle. Besides, today is Friday, the last day of the trading week, so entering the market might not be a good idea. As for me, I prefer to buy the pair from the price zone of 1.2430-1.2400. This is where I see very strong support. However, for this, the GBP/USD pair needs to decline to the above-mentioned zone and form a bullish candlestick pattern. While none of this is happening, I recommend staying out of the market today. Probably on Monday, we will get more technical signals.

Good luck!

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.