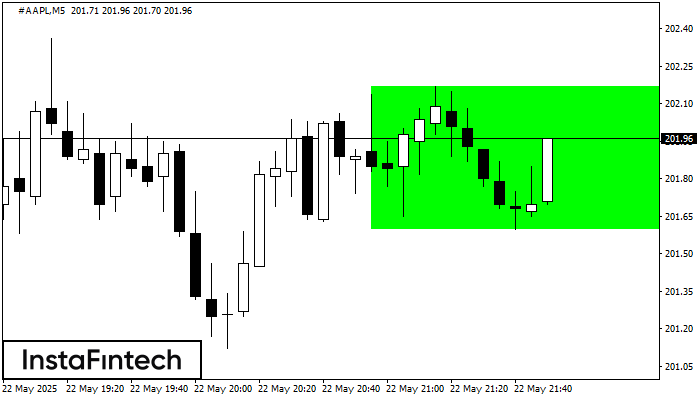

Bullish Rectangle

was formed on 22.05 at 20:52:50 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #AAPL formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border 201.60 – 201.60 and upper border 202.17 – 202.17. In case the upper border is broken, the instrument is likely to follow the upward trend.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength