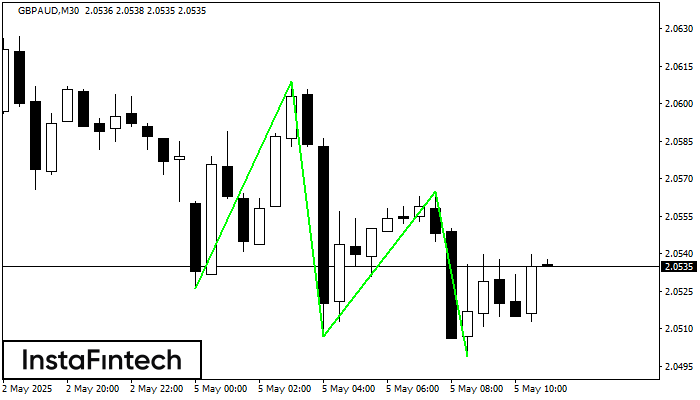

Triple Bottom

was formed on 05.05 at 10:00:09 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has formed on the chart of GBPAUD M30. Features of the pattern: The lower line of the pattern has coordinates 2.0609 with the upper limit 2.0609/2.0565, the projection of the width is 83 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 2.0526, the price is most likely to continue the upward movement.

Figure

Instrument

Timeframe

Trend

Signal Strength