Lihat juga

13.02.2026 12:34 PM

13.02.2026 12:34 PMToday, the euro, British pound, and Canadian dollar were traded using the Mean Reversion strategy. I did not execute any trades using the Momentum strategy.

The absence of important statistics affected market volatility, allowing the Mean Reversion strategy to perform quite well. In the second half of the day, we are expecting important U.S. inflation data. This release is of primary importance for shaping further market sentiment, especially regarding Federal Reserve monetary policy. Of particular interest is the Core Consumer Price Index, which excludes volatile components such as food and energy. This indicator is often regarded by the Fed as a more accurate reflection of underlying inflation trends. If the figure declines, pressure on the dollar will increase significantly. Such a development would signal a potential slowdown in inflation, which in turn could affect expectations regarding future interest rate cuts.

A rise in inflation, as reflected in the data, will likely strengthen assumptions that the Fed may adopt a more prolonged wait-and-see stance. On the one hand, this is positive for the dollar, but on the other, negative for the economy.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If there is no market reaction to the data, I will continue using the Mean Reversion strategy.

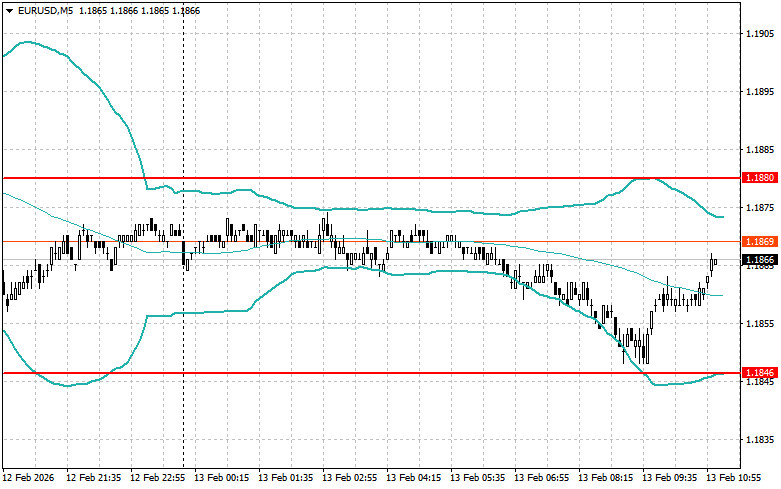

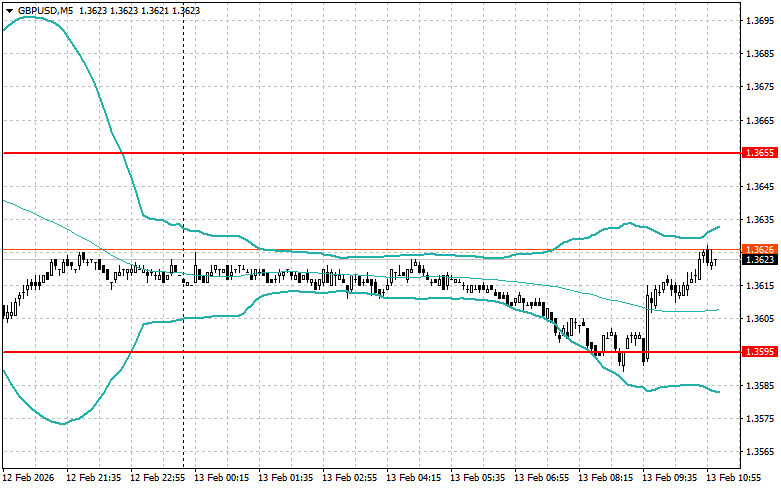

Momentum Strategy (Breakout) for the Second Half of the Day

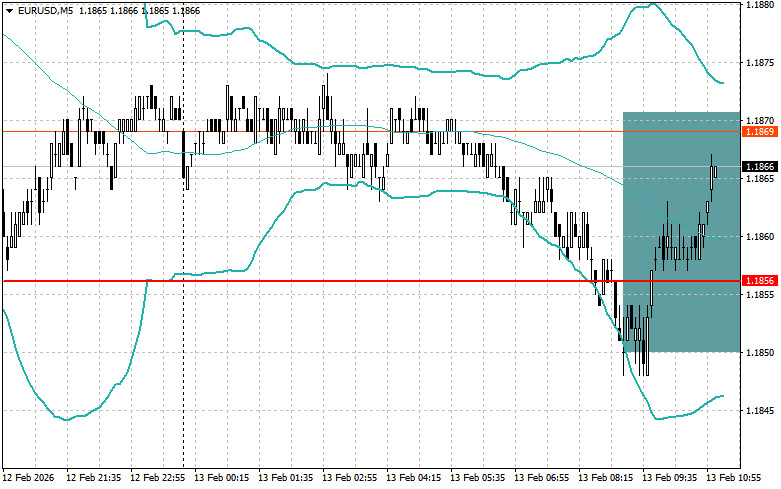

For EUR/USD

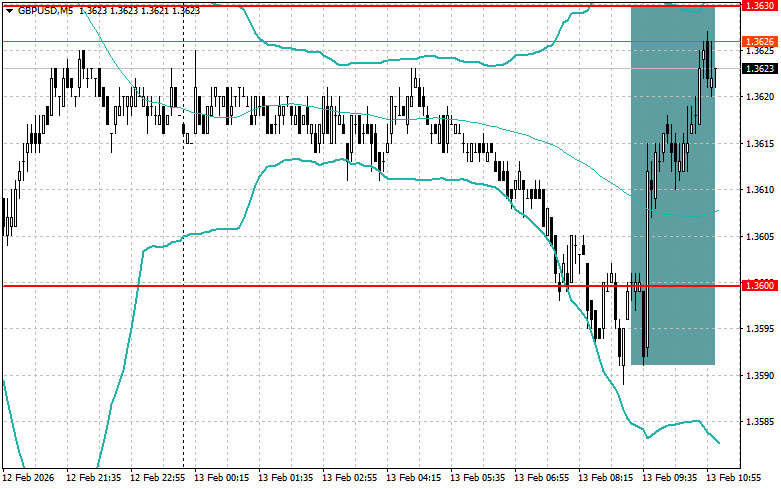

For GBP/USD

For USD/JPY

Mean Reversion Strategy (Pullback) for the Second Half of the Day

For EUR/USD

For GBP/USD

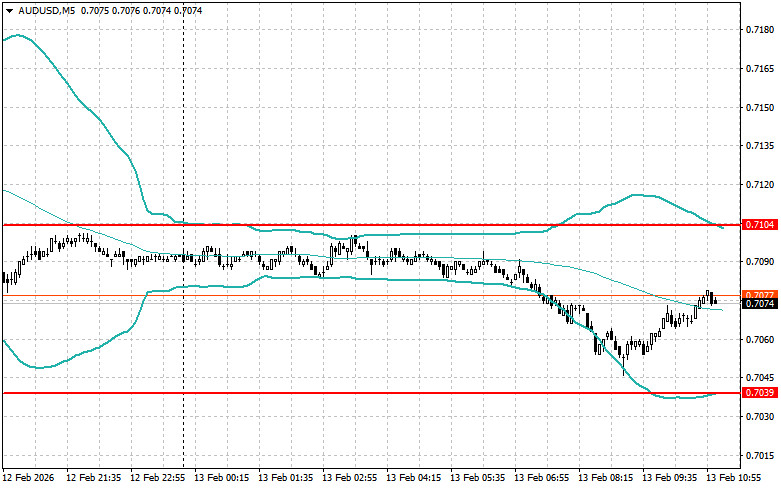

For AUD/USD

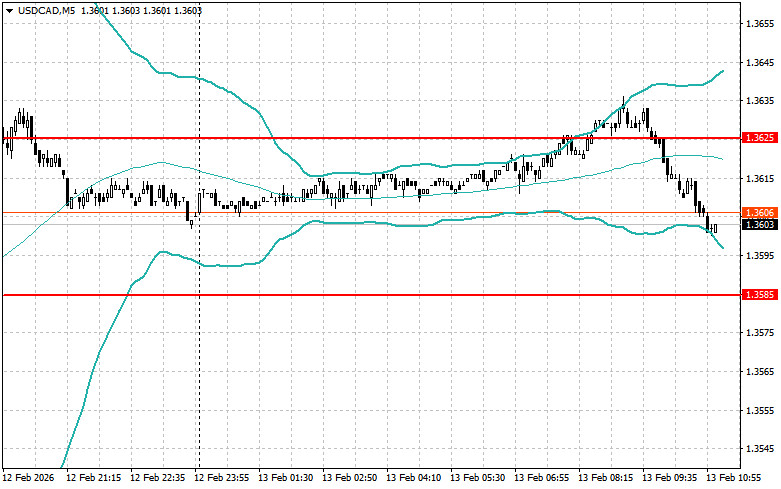

For USD/CAD

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.