See also

10.02.2026 01:34 PM

10.02.2026 01:34 PMMarkets are swinging from calm to storm and back again. Beijing's reported ban on Chinese banks buying US Treasuries has sent shock waves. After that, Forex enjoyed a temporary lull. However, fresh shocks could come from US employment, inflation, and retail sales reports — the very data that will clarify the Fed's stance and affect EUR/USD's outlook.

The US central bank is still ruling market sentiment. The ECB has already set its near-term monetary course. According to Bundesbank President Joachim Nagel, the ECB is unlikely to ease policy in response to slowing inflation. That scenario is already factored into the ECB's forecasts; the bank expects consumer prices to return to target later on.

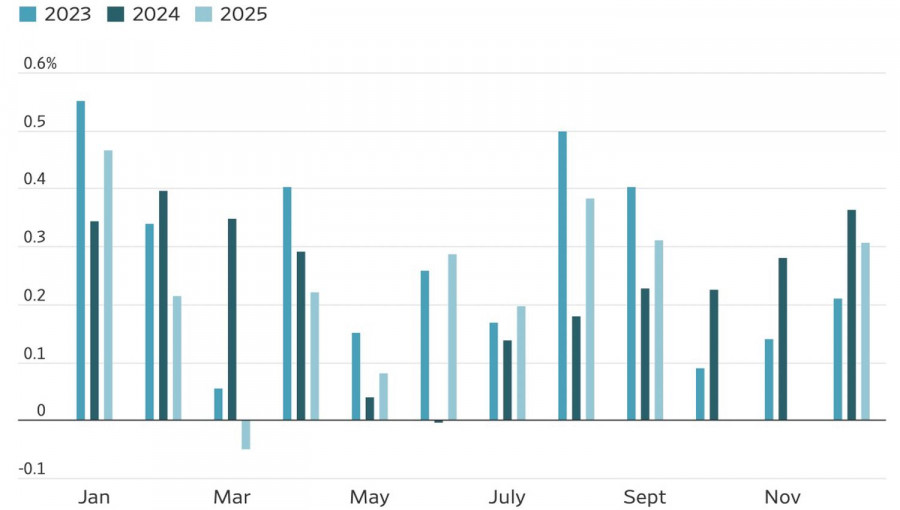

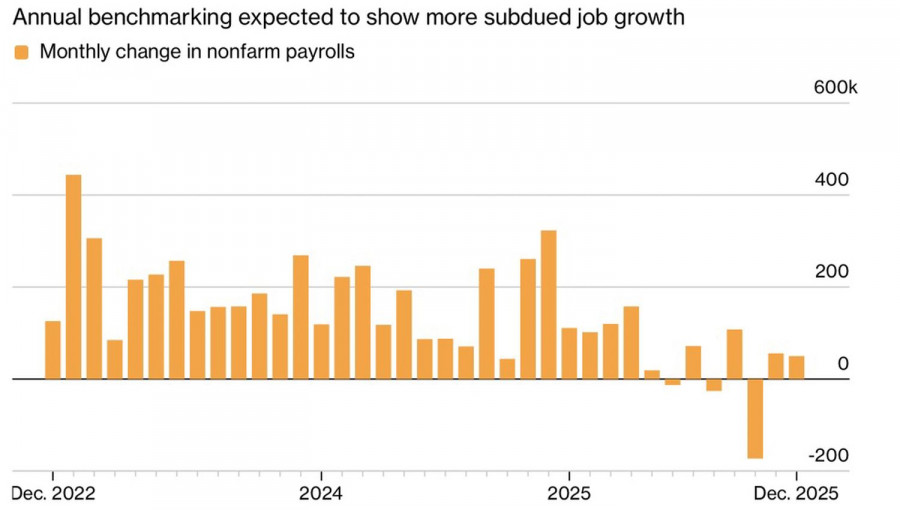

US inflation dynamics

The futures market is pricing in a 75% probability of a Fed rate cut in June and a 37% chance it will happen in April. The White House would prefer rate cuts sooner rather than later. After all, debt service costs, social security payments, Medicare and Medicaid spending grew 8–9% in the first four months of fiscal 2025–2026. Their share of the budget jumped from 57.6% to 61.2%.

It's no wonder Donald Trump is unhappy with high interest rates. The president claims that confirming Kevin Warsh as Fed chair would boost the US economy by 15% — a figure rarely seen over the past 70–80 years. Over the last decade, US GDP grew on average by about 2.8%.

The White House clearly confuses wishful thinking with reality, and its puppets play along. FOMC member Stephen Miran said many issues could be solved by shrinking the Fed's balance sheet. Kevin Warsh has previously blamed an inflated balance sheet for high US inflation.

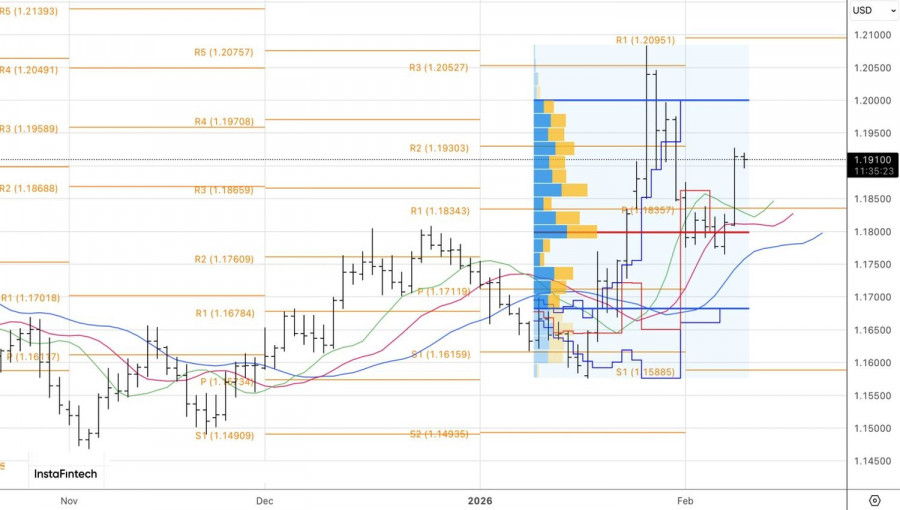

Technical picture

On the daily chart, EUR/USD is in short-term consolidation after a strong rally. A new local high at 1.193 would allow adding to long positions opened from 1.1835. At the same time, we should watch for the risk of a 1-2-3 reversal pattern forming. A necessary condition for that would be a drop of the euro back below the pivot level at $1.1835, the key support area.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.