See also

09.12.2025 09:36 AM

09.12.2025 09:36 AMNo one is ready to take risks. Investors opted to lock in profits ahead of the FOMC meeting, causing the S&P 500 to step back and move away from record highs. The US central bank is expected to lower the federal funds rate by 25 basis points to 3.75%. However, to placate opponents of this decision, Jerome Powell is likely to adopt a hawkish tone. Signals indicating a pause in the monetary expansion cycle could lead to a correction in the broad stock index.

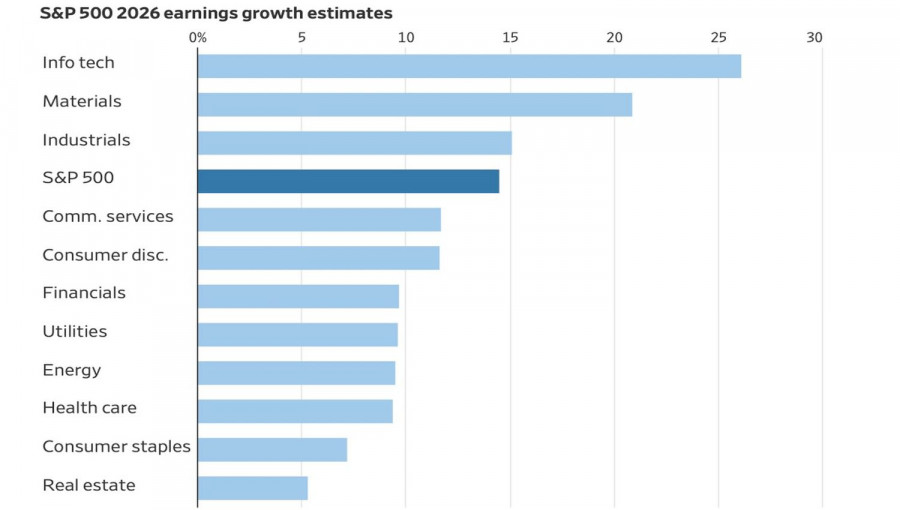

The S&P 500 has gotten back into the game after declining in late October to early November, thanks to expectations for easing monetary policy from the Fed in December, which have alleviated fears about a tech sector bubble. According to Yardeni Research, the share of the information technology and communication services sector makes up an impressive 45% of the broad stock index. Meanwhile, industry earnings are expected to continue to grow in 2026, according to Wall Street experts.

Earnings Forecasts for S&P 500 and Individual Sectors

Yardeni Research recommends moving away from the Magnificent Seven stocks and diversifying portfolios in favor of other securities. Artificial intelligence is transforming every company into a tech company. Indeed, AI is boosting productivity and revenues across other sectors of the S&P 500, while the tech giants may not recoup their colossal investments in new developments.

Oppenheimer Asset Management forecasts that the S&P 500 will grow by approximately 18% next year, reaching 8,100 against the backdrop of stabilizing economic growth and easing monetary policy from the Fed. This estimate is the most bullish on Wall Street. However, faith in the strength of the American economy, in part due to Donald Trump's "Big, Beautiful Bill," provides a basis for optimism. In such conditions, both consumer spending and corporate profits are on the rise.

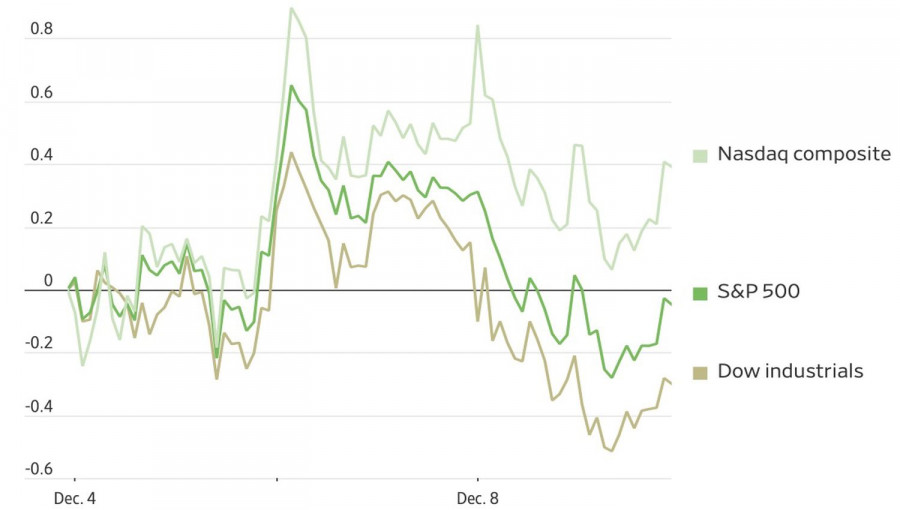

Dynamics of US Stock Indices

Markets continue to believe in the acceleration of the Fed's monetary expansion cycle under the new chairperson, most likely to be Kevin Hassett. He has criticized the central bank's approach to forecasting the future trajectory of the federal funds rate, arguing that its fate depends on data, making six-month projections pointless. The shadow chairman of the Federal Reserve in action raises doubts about the necessity of listening to the current head of the regulator, Jerome Powell.

Markets expect hawkish rhetoric from him as a compromise with the hawks following the rate cut in December. In theory, this should trip up the stock indices. However, investors have learned to buy the dips at the slightest opportunity.

Technically, the daily chart of the S&P 500 has formed a doji bar with a long upper shadow, which could trigger a corrective move. Nonetheless, rebounds from support levels at 6,805, 6,770, and 6,750 should be viewed as buying opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.