See also

27.06.2025 12:08 AM

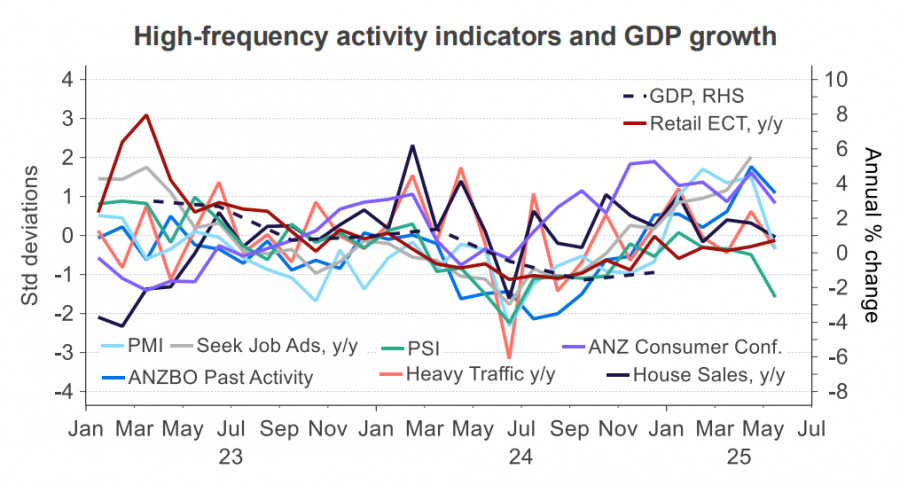

27.06.2025 12:08 AMNew Zealand's GDP grew by 0.8% in the first quarter, exceeding the forecast of 0.7%, and this was one of the reasons behind the renewed growth of the kiwi. At the same time, this factor is not particularly significant, especially considering that many other indicators suggest that growth remains unstable.

The main intrigue at the moment lies in whether the Reserve Bank of New Zealand (RBNZ) will decide on another rate cut in July or opt for a pause until August. Most experts predict that a cut will still occur, given that recent PMI and PSI data came in weak, the housing market is moving sideways, and consumer demand remains questionable.

However, there are counterarguments – first-quarter GDP growth above expectations and rising inflation expectations. Forecasts are gradually shifting in favor of a pause, which supports the Kiwi's growth since a rate cut just a week or two ago seemed obvious and was already priced in. Since consumer demand remains weak and the labor market has not yet recovered, inflation expectations do not pose a serious threat – especially considering that the RBNZ already views the current rate as within the neutral range.

If sentiment in favor of a pause continues to grow, the kiwi will resume its upward movement – this is the most obvious conclusion from the emerging picture. This growth is also fueled by the weakness of the U.S. dollar, which is becoming more pronounced as the dollar's status as a reserve currency is increasingly questioned. While this process hasn't yet snowballed, creating an illusion of stability, there are more and more signs that investor confidence in the dollar continues to decline. Under such conditions, signals of an approaching recession in the U.S. could become a decisive trigger for a further decline in the dollar from its current levels.

The trigger was the news that U.S. President Trump intends to consider the question of a successor to Jerome Powell as Fed Chair before the end of his current term – that is, in the coming months. The standoff between Trump and Powell, who hold opposing views on Fed monetary policy, has reached a peak, and markets fear that the Fed may lose its independence. Although this threat remains hypothetical, the market reaction is negative, and the dollar is under intense pressure.

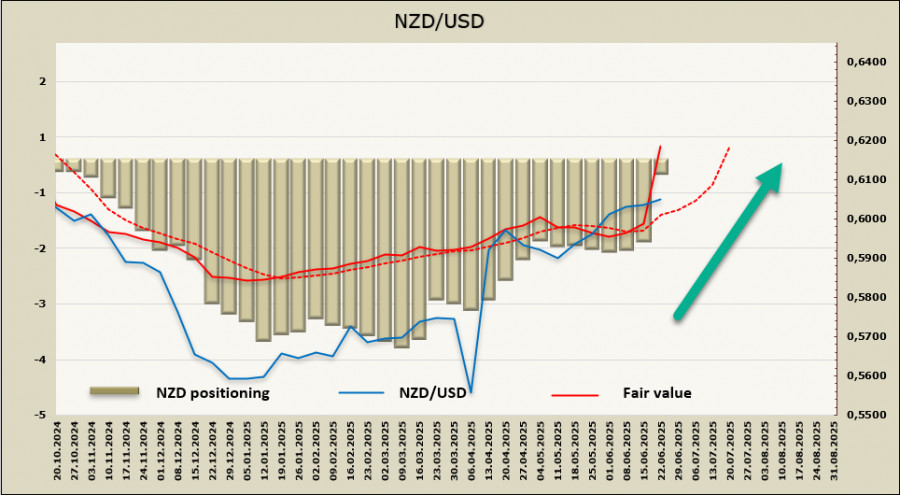

For the first time since October 2024, the short position on the kiwi has been virtually liquidated, with a weekly change of +$1.209 billion, and the bearish imbalance has shrunk to a symbolic $77 million. The estimated price is rising sharply, remaining noticeably above the long-term average, which supports expectations for a continued rise in NZD/USD.

The Kiwi experienced a fairly deep correction, but the bullish momentum is strong, and going forward, we see the path only upward. The nearest target is a firm break above 0.6082, after which, if the current trend persists, the Kiwi will continue to rise toward 0.6373. Something very unexpected would need to happen to disrupt this scenario.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.