See also

20.06.2025 09:01 AM

20.06.2025 09:01 AMMarkets are digesting Donald Trump's announcement that a decision on U.S. strikes against Iran will be made within two weeks. The White House could have acted at any moment but has given Tehran time to return to the negotiating table over its nuclear program. Oil sees this as de-escalation and is falling. But will the S&P 500 interpret it the same way after Juneteenth? It's reopening after the holiday coincides with "triple witching," which increases the risk of sharp volatility.

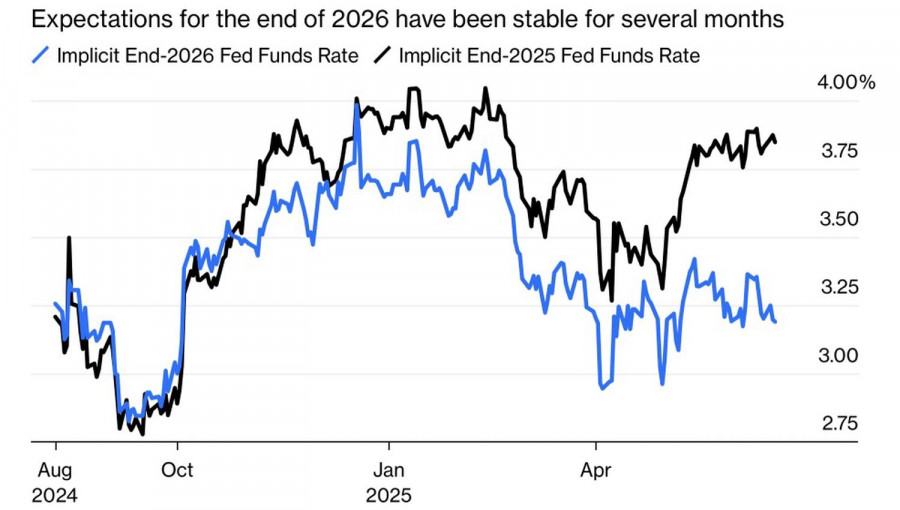

Once every quarter on Friday, futures contracts worth $6.5 trillion expire. The market becomes wild and unpredictable. Given how it's moved so far, predicting direction becomes nearly impossible. Retail investors will likely attempt to buy the dip in the S&P 500 out of habit. Major players remain concerned about the conflict in the Middle East, the upcoming end of the 90-day U.S. tariff moratorium, and the Federal Reserve's intent to keep the federal funds rate elevated for a long time. Seven officials forecast that it will remain unchanged through 2025.

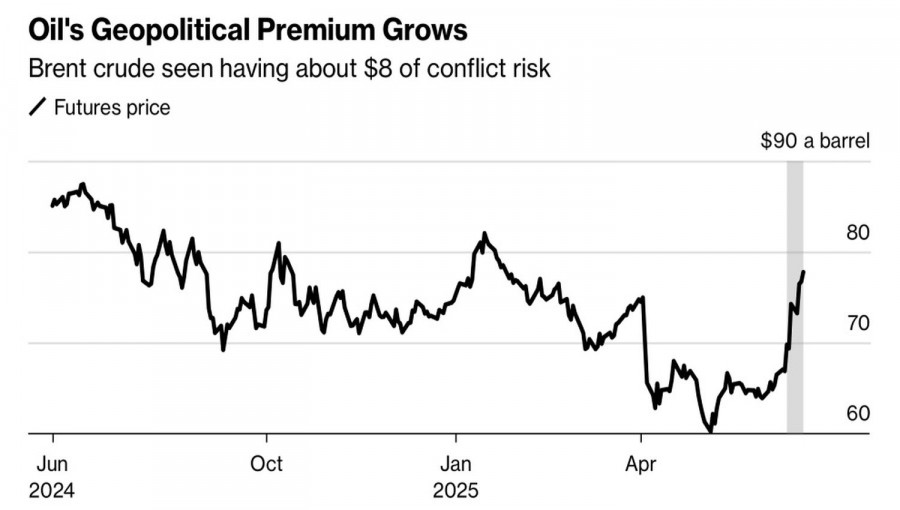

According to Citigroup, Iran's partial closure of the Strait of Hormuz could send Brent crude soaring to $90 per barrel, impacting 3 million bpd. This key oil artery has a throughput capacity of 18–20 million bpd, about one-fifth of global supply. Barclays projects $100 per barrel, and Capital Economics warns of a rise to $130–150. Such an apocalyptic scenario would undoubtedly trigger a global economic crisis. Historically, recessions in developed economies have become inevitable when oil prices double.

Since Israel began attacking Iranian infrastructure, the risk premium for Brent has surged to $8 per barrel. The risk of a Brent reversal now exceeds that seen at the onset of the Ukraine conflict in 2022. Back then, the concern was the exclusion of a top producer from the system. Now, it's about supply chain breakdowns.

Events in the Middle East have overshadowed trade wars, the U.S. economic slowdown, and the Federal Reserve's monetary policy. Investors are debating whether the U.S. will become involved in the conflict, where oil prices are heading, and how those dynamics will affect the broader stock index.

A reason for optimism might be that rising geopolitical risks tend to impact Europe more negatively than the U.S. Europe is a net oil importer, and a slowdown in its economy increases the risk of pullbacks in European stock indices. Capital may begin flowing back into the United States.

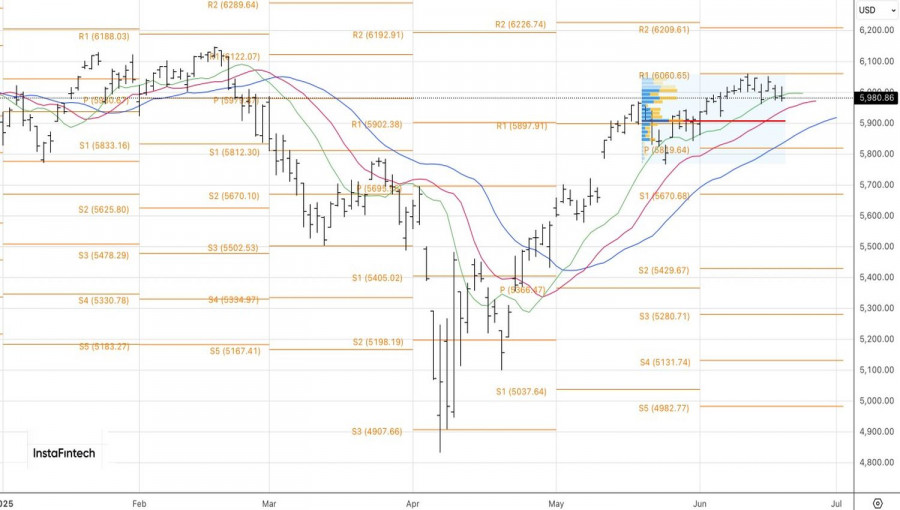

Technically, on the S&P 500 daily chart, the bears have managed to break through the first of three dynamic supports represented by moving averages. Two more remain. As long as prices remain below 6060, it makes sense to focus on selling the broader stock index with downside targets at 5900 and 5800.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.