See also

17.06.2025 04:48 AM

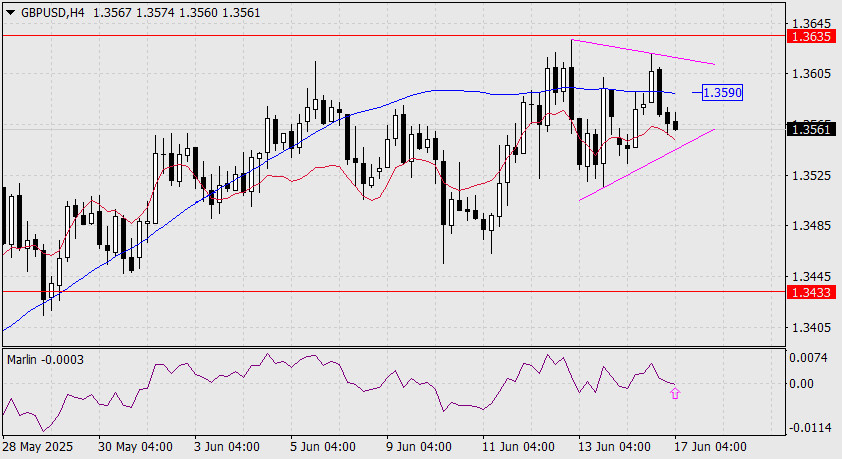

17.06.2025 04:48 AMThe British pound is gradually squeezed between the MACD line on the daily chart and the resistance level at 1.3635. The key question now is: which direction will the price break in the coming days?

The Marlin oscillator testing the lower boundary of its own channel increases the likelihood of an upward breakout. A confirmation would be a break above the 1.3635 level. The nearest target would then be the inner price channel line at 1.3760, followed potentially by continued growth toward 1.3834—the peak from October 2021.

The price is currently moving below the MACD line on the four-hour chart, but this is generally a neutral sign within triangular formations. However, if the price consolidates above the MACD line (1.3590), it would signal an upcoming bullish breakout from the triangle, especially since no firm break above this line has occurred since the triangle's formation.

The Marlin oscillator's signal line shows an intention to turn upward from the zero line, which is an additional sign of a possible pound rally.

Today, the U.S. will release May retail sales data (forecast: -0.6% after a modest 0.1% increase in April) and industrial production data (expected at 0.0% growth). Such figures could help prevent the pound from falling in the short term.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.