See also

13.06.2025 12:20 AM

13.06.2025 12:20 AMThe old becomes new again. The word "recession" again trended in the Forex and other financial markets. May's U.S. Consumer Price Index (CPI) fell short of Bloomberg analysts' forecasts. Following that, the Producer Price Index (PPI) also disappointed. And it doesn't stop there. Continuing jobless claims rose to their highest levels since 2021.

When inflation is stable or decelerating, and the labor market shows signs of stagnation, the Federal Reserve must consider cutting the federal funds rate. This is positive news for EUR/USD bulls, who have successfully pushed the main currency pair above 1.16 for the first time in nearly four years.

Even the guilty are feeling the pressure. The White House was the first to sound the alarm. Donald Trump again called on the Fed to cut rates by one percentage point, while Vice President J.D. Vance labeled the central bank's passivity as negligent behavior. Yet the very uncertainty of the U.S. administration's policies has delivered the biggest blow to the American economy.

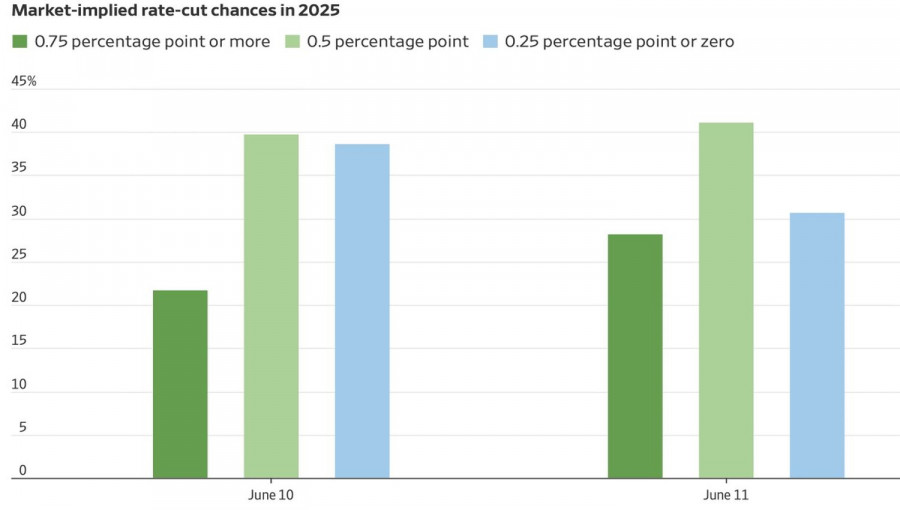

This time, the futures market agrees with the White House. Following the U.S. inflation data, the odds of a rate cut in September jumped from 70% to nearly 80%. The probability of three rate cuts in 2025 is soaring, while the chance of only one is declining. A grim outlook for EUR/USD bears.

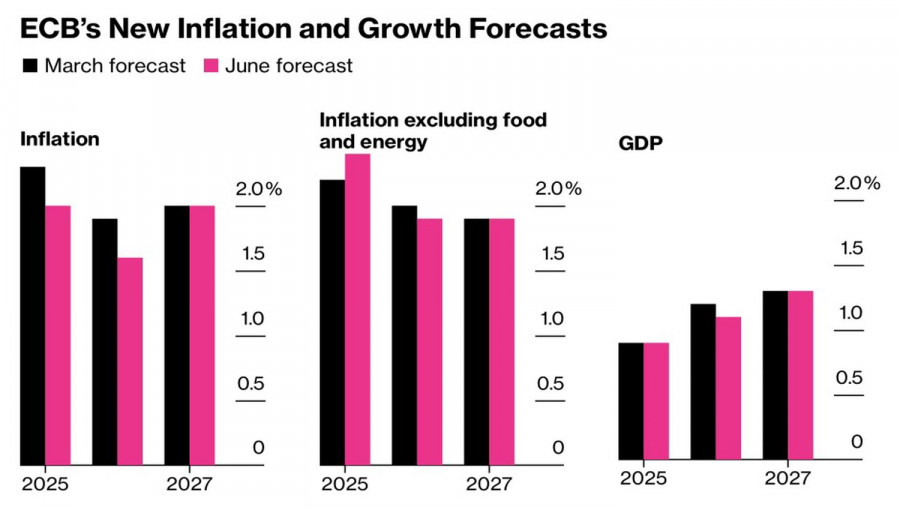

On the other hand, euro bulls are encouraged by comments from European Central Bank Governing Council members. Christine Lagarde stated that the ECB is comfortable with the current level of interest rates and has enough flexibility if the situation suddenly worsens. Isabel Schnabel noted that core inflation is expected to grow by 1.9% this year and next, indicating that prices remain under the central bank's control. With inflation under control, the monetary easing cycle has likely ended.

The euro gains a clear advantage when one central bank stays on the sidelines for a long time and the other prepares to act by cutting rates. Few expected the European economy to hold up well—it's export-oriented, and trade wars were seen as a potential trigger for a deep recession. In reality, the situation was not as dire as anticipated.

By contrast, the U.S., which had previously shown economic growth near 3%, has deeply disappointed in 2025. GDP contracted by 0.2% in Q1, and if the trend continues, the U.S. could officially enter a technical recession in Q2. A weak economy = weak currency. The U.S. dollar proves this once again.

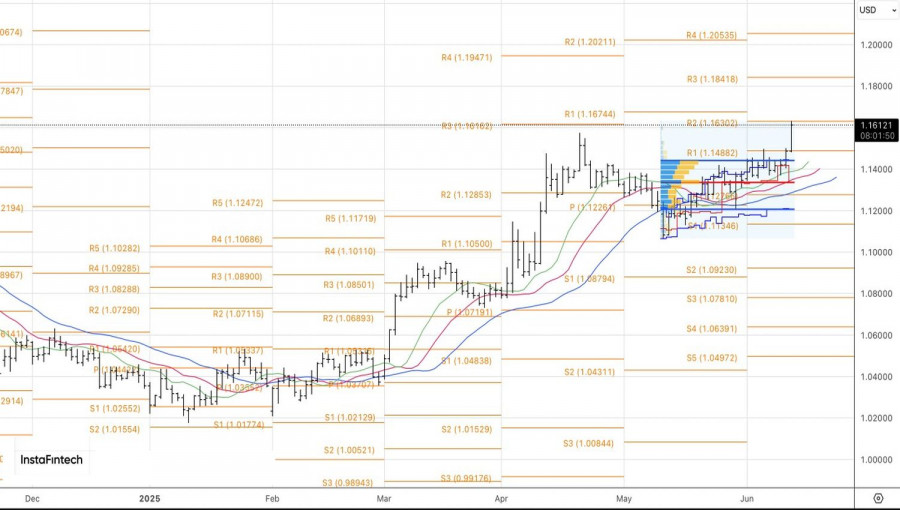

Technical Outlook: On the daily EUR/USD chart, a breakout above the upper boundary of the fair value range, followed by a successful breach of a key pivot level, allowing for long entries from 1.1445 and additions from 1.1490. The first target at 1.1600 has already been reached. Traders should use pullbacks as opportunities to build long positions toward 1.2000.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.