See also

12.06.2025 01:20 PM

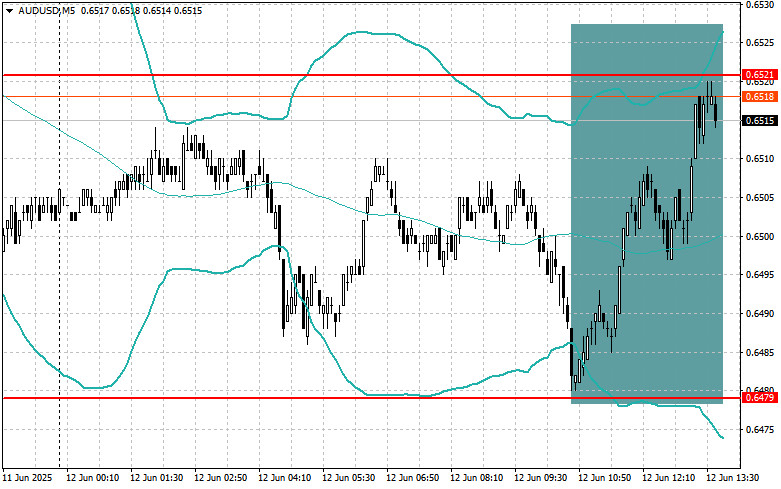

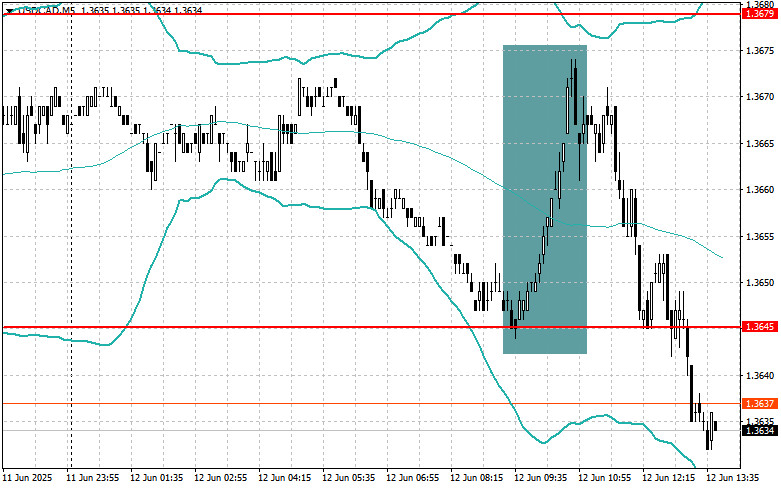

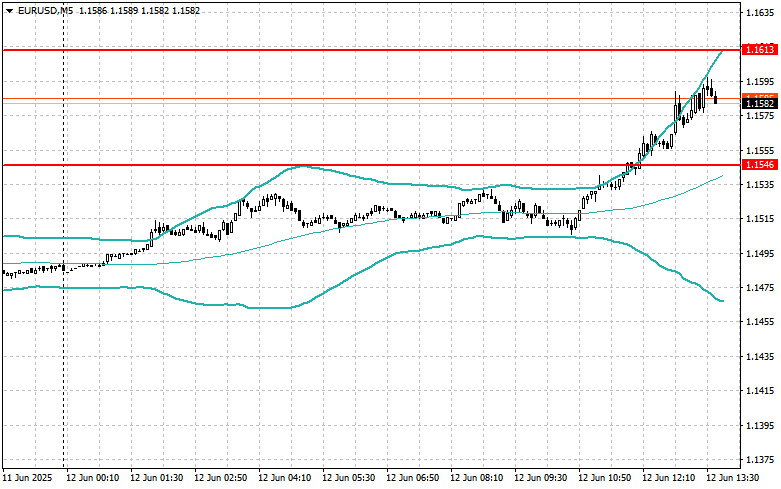

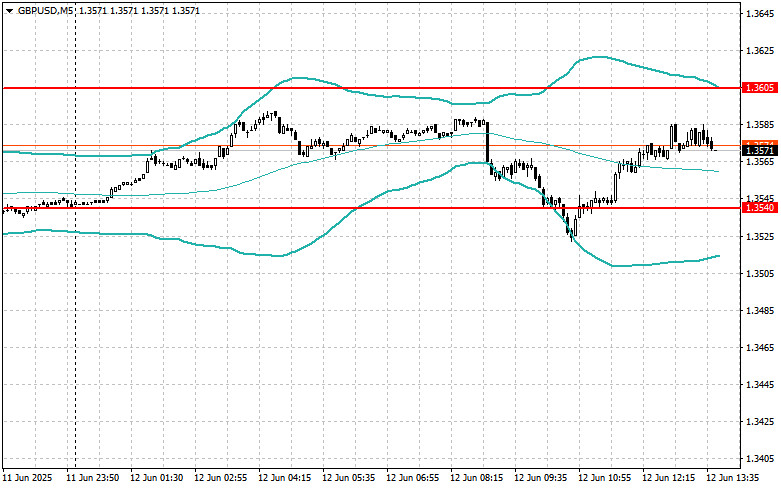

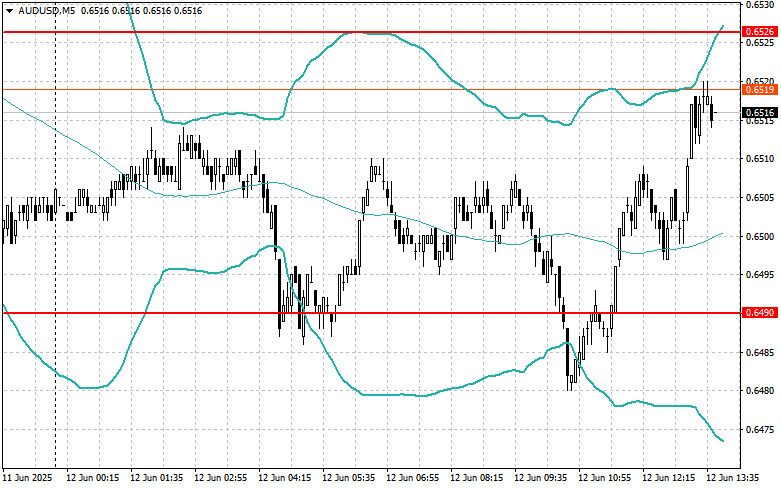

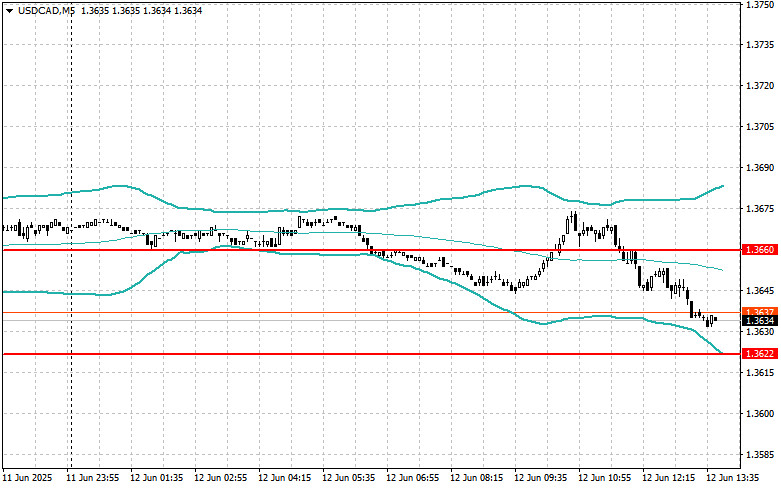

12.06.2025 01:20 PMThe Australian and Canadian dollars performed well today using the mean reversion strategy, while the momentum strategy would have worked nicely with the pound and the euro.

Signs of a slowdown in the British economy had a negative impact on the pound sterling, leading to active sell-offs. Fearing an approaching recession, investors began dumping assets denominated in the British currency. Recent economic indicators show troubling trends: contraction in industry, declining consumer spending, and reduced capital investment—all of which present the Bank of England with a tough policy dilemma.

Later in the day, we expect data on initial jobless claims and the Producer Price Index (PPI) in the U.S. for May. These figures will be key indicators of the health of the U.S. economy and may influence the Federal Reserve's decisions on future monetary policy.

The number of initial jobless claims reflects the current state of the labor market. A rise in this figure could indicate slowing hiring rates and increased layoffs, which would likely weaken consumer spending and economic growth. The PPI, a leading indicator of inflation, measures price changes producers receive for goods and services. An increase in PPI may signal rising consumer prices ahead, as producers typically pass higher costs on to buyers. The Fed closely monitors PPI data to assess inflation risks and adjust policy as needed.

I'll rely on the Momentum strategy if the data shows strong results. If the market shows little reaction, I'll continue using the Mean Reversion approach.

For EUR/USD:

Buy on a breakout above 1.1617, targeting 1.1640 and 1.1675

Sell on a breakout below 1.1575, targeting 1.1545 and 1.1515

For GBP/USD:

Buy on a breakout above 1.3595, targeting 1.3642 and 1.3678

Sell on a breakout below 1.3575, targeting 1.3550 and 1.3516

For USD/JPY:

Buy on a breakout above 143.66, targeting 144.10 and 144.55

Sell on a breakout below 143.25, targeting 142.79 and 142.30

For EUR/USD:

Look to sell after a failed breakout above 1.1613 and return below the level

Look to buy after a failed breakout below 1.1546 and return above the level

For GBP/USD:

Look to sell after a failed breakout above 1.3605 and return below the level

Look to buy after a failed breakout below 1.3540 and return above the level

For AUD/USD:

Look to sell after a failed breakout above 0.6526 and return below the level

Look to buy after a failed breakout below 0.6490 and return above the level

For USD/CAD:

Look to sell after a failed breakout above 1.3660 and return below the level

Look to buy after a failed breakout below 1.3622 and return above the level

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.