See also

09.06.2025 12:07 AM

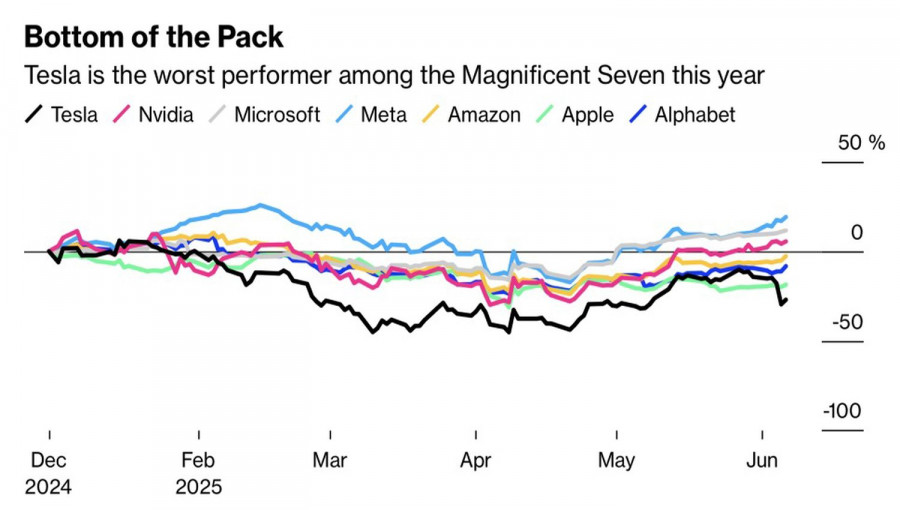

09.06.2025 12:07 AMWhich is stronger — money or power? The answer to this question became clear very quickly. In the conflict between the most influential president in the world, Donald Trump, and the wealthiest man in the world, Elon Musk, it was the Tesla owner who blinked first. His company's stock plunged 14% in a single day after the White House announced it would end all government contracts for the purchase of electric vehicles. This equates to $150 billion. At this rate, one could even imagine Musk slipping from the richest to the poorest person on the planet.

The market enthusiastically received the fact that the conflict was quickly resolved. Musk had every right to be dissatisfied with Trump's big and flashy bill, which eliminated the $7,500 tax credit for purchasing electric vehicles. As a result, Tesla will lose about $1.2 billion, a figure comparable to the company's annual profit.

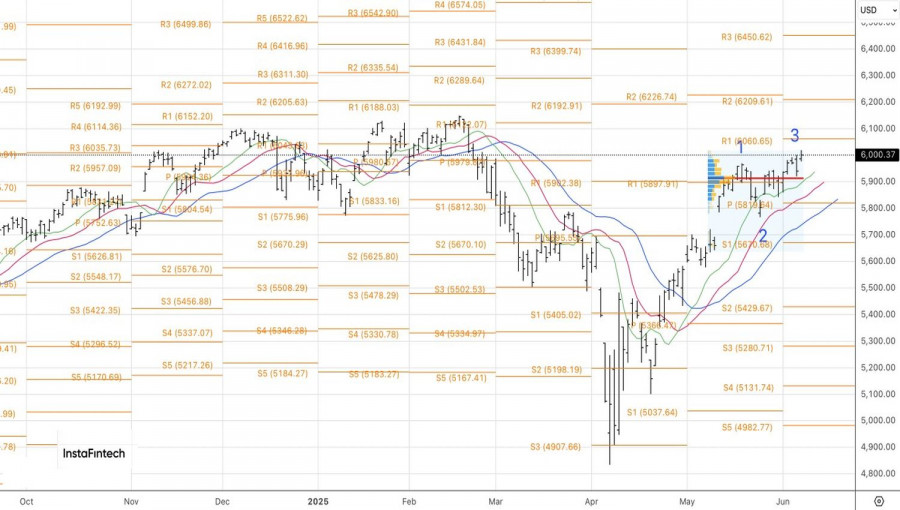

Along with the end of Donald Trump and Elon Musk's mutual criticism, the rally of the S&P 500 above the psychologically important 6000 mark was supported by the White House's announcement of a new round of U.S.-China trade talks scheduled for June 9 in London and the release of the U.S. labor market data for May.

Ahead of its release, investors were alarmed by weak U.S. economic reports, including data on business activity, private sector employment from ADP, and jobless claims. However, the increase in non-farm payrolls by 139,000 — more than Bloomberg experts had forecast — calmed traders' nerves. The worst did not happen, so investors could confidently return to their previous strategy of buying the S&P 500 dip.

This strategy continues to work like clockwork. Investors surveyed by MLIV Pulse are confident that the broad market index will reach 6500. The only difference in opinion was timing: 44% of respondents believe it will happen by the end of 2025, 26% predict the first half of 2026, 11% favor the second half of next year, and the rest expect 2027.

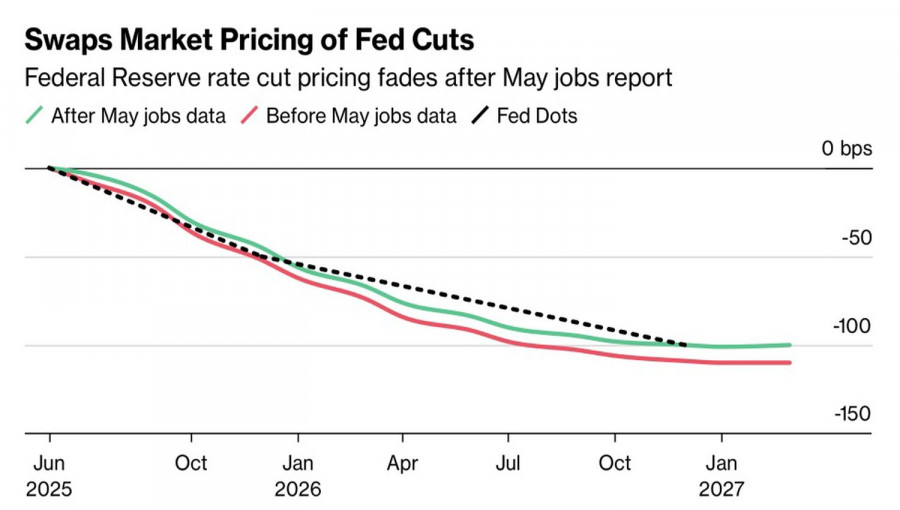

In response to the strong labor market data, Trump demanded that the Federal Reserve cut the federal funds rate by a full percentage point — from 4.5% to 3.5%. However, the futures market, on the contrary, reduced the expected scale of monetary easing to 42 basis points in 2025. Derivatives decreased the chances of monetary policy easing in September from 90% to 70%.

Although the U.S. economy isn't firing on all cylinders, it is far from breaking down. Combined with the de-escalation of trade conflicts and impressive corporate earnings, this has allowed the broad market index to soar by 20% from its April low.

Technically, on the daily chart, the S&P 500 continues the process of restoring its upward trend. Long positions opened from 5945 should be held and gradually increased. The future of the broad market index will depend on the test of the pivot level at 6060.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.