See also

06.06.2025 08:17 AM

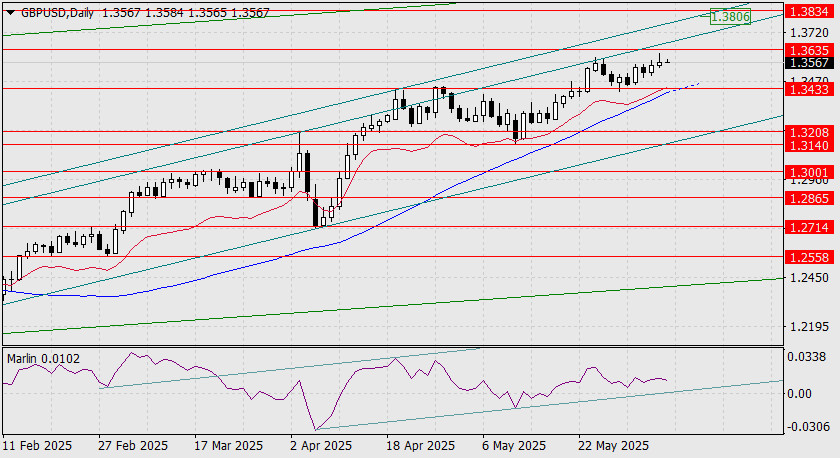

06.06.2025 08:17 AMGBP/USD Amid yesterday's brief optimism over the ECB's decision to cut rates and nearly complete the easing cycle, the pound almost reached the target level of 1.3635. Today began neutrally, apparently in anticipation of U.S. employment data, but the Marlin oscillator looks weaker with each passing day.

If the U.S. data fails to boost the pound, the target level of 1.3834 will remain out of reach due to the approaching correction in the stock market. Here, the key level is support at 1.3433, which will be pierced tomorrow by the MACD line, and if the price can break through this level, a medium-term decline could begin as early as next week. Despite such bearish signals, we maintain the pound's growth toward the target range of 1.3806/34 as the main scenario.

On the four-hour chart, the price has been rising steadily along the MACD line since May 29. This gradual upward movement creates conditions for a potential activation of bearish sentiment at the appropriate moment. The Marlin oscillator, developing within a range, also warns of this. The market is tired; it needs a trigger — and today it will get one.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.