See also

30.05.2025 08:37 AM

30.05.2025 08:37 AMThe euro, pound, and other risk assets, including the Japanese yen, rose sharply against the U.S. dollar, and there were objective reasons for this.

A weak report on the growth rate of the U.S. economy in the first quarter of this year led to a sharp rise in the euro, pound, and yen and a drop in the dollar. Investors, concerned about signs of slowing economic momentum in the U.S., began actively selling off the dollar and shifting into what they perceived as more stable assets.

Several factors further fueled this process. First, the European Central Bank is showing a softer stance on inflation compared to the U.S. Federal Reserve, hinting at the possibility of further rate cuts to stimulate economic growth. Second, global geopolitical tensions also play a role. Uncertainty related to trade conflicts is pushing investors toward safe havens, and the euro, despite its own issues, is viewed as a safer option than the traditionally reserve-status dollar.

In the first half of today, we expect data on Germany's retail sales and the Consumer Price Index, as well as eurozone private sector lending volumes. These indicators will undoubtedly serve as a litmus test for assessing the current state of the European economy. Specifically, Germany's retail sales—the largest economy in the eurozone—are a key indicator of consumer demand. A decline could signal slowing economic growth and reduced consumer confidence, which could put pressure on the euro.

The Consumer Price Index (CPI) is another important indicator the ECB and traders closely watch. A rise in CPI could push the ECB to pause its rate-cutting cycle, typically strengthening the euro. Conversely, a low CPI could force the ECB to continue aggressively easing policy.

Finally, the volume of eurozone private sector lending allows an assessment of how actively banks lend to businesses and households. An increase in lending usually indicates healthy economic growth and business optimism, positively impacting the euro. A decline could signal economic problems and increased caution among lenders, pressuring the currency.

If the data matches economists' expectations, acting based on the Mean Reversion strategy is better. If the data significantly exceeds or falls short of expectations, it's best to use the Momentum strategy.

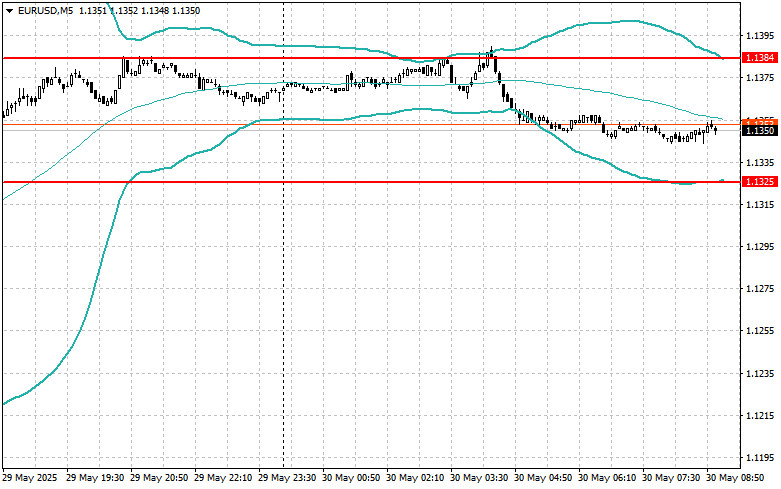

Buying on a breakout above 1.1365 could lead to growth toward 1.1396 and 1.1426;

Selling on a breakout below 1.1336 could lead to a fall toward 1.1296 and 1.1256;

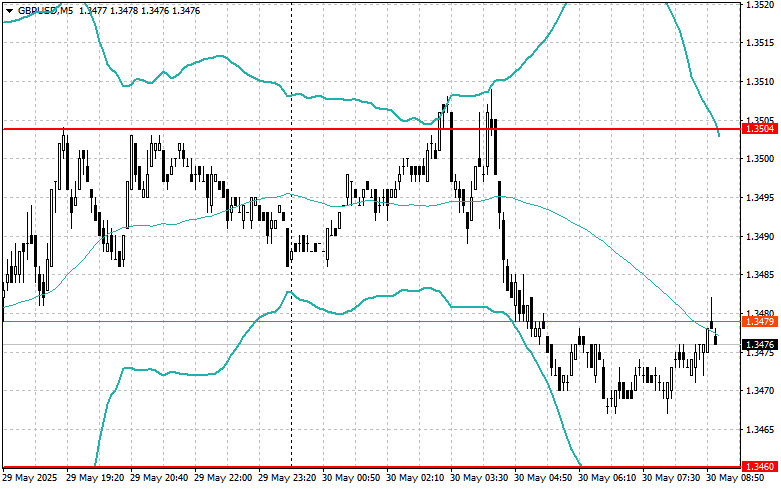

Buying on a breakout above 1.3490 could lead to growth toward 1.3525 and 1.3555;

Selling on a breakout below 1.3460 could lead to a fall toward 1.3416 and 1.3382;

Buying on a breakout above 144.20 could lead to growth toward 144.61 and 144.96;

Selling on a breakout below 143.74 could lead to a decline toward 143.25 and 142.79;

Look for sells after an unsuccessful breakout above 1.1384 upon a return below this level;

Look for buys after an unsuccessful breakout below 1.1325 upon a return to this level;

Look for sells after an unsuccessful breakout above 1.3504 upon a return below this level;

Look for buys after an unsuccessful breakout below 1.3460 upon a return to this level;

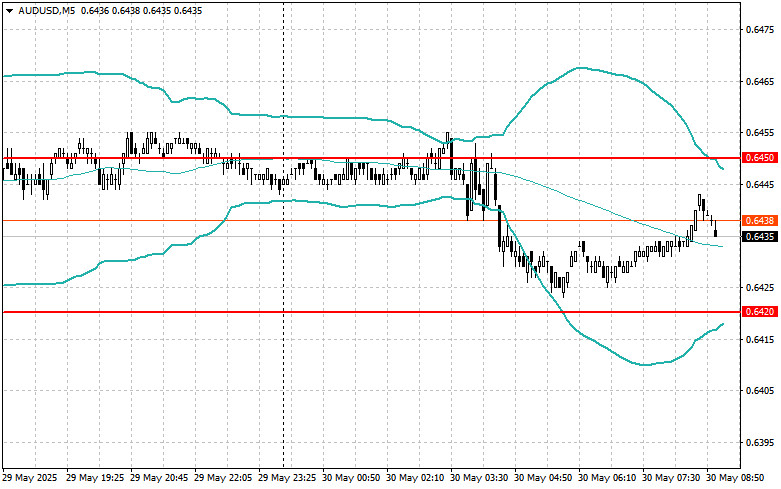

Look for sells after an unsuccessful breakout above 0.6450 upon a return below this level;

Look for buys after an unsuccessful breakout below 0.6420 upon a return to this level;

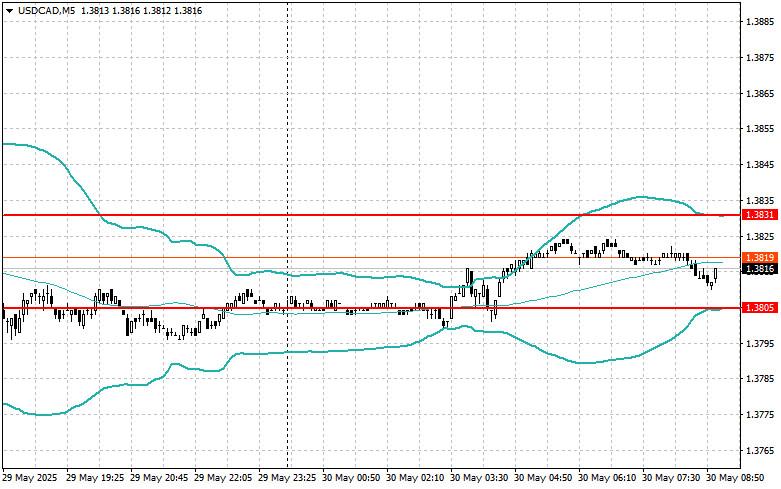

Look for sells after an unsuccessful breakout above 1.3831 upon a return below this level;

Look for buys after an unsuccessful breakout below 1.3805 upon a return to this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the price at 1.1633 coincided with the MACD indicator rising significantly above the zero mark, which limited the pair's upward potential. For this reason

The euro, pound, and other risky assets continued to rise against the U.S. dollar. Confusion among the U.S. Federal Reserve, with significantly differing statements from policymakers, has put pressure

The price test at 154.75 coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell

The price test at 1.3108 occurred when the MACD indicator was beginning its downward move from the zero mark, confirming the correct entry point for selling the pound

The price test at 1.1580 occurred as the MACD indicator began to move above the zero mark, confirming the correct entry point for buying euros. As a result, the pair

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.