See also

30.05.2025 10:33 AM

30.05.2025 10:33 AMThe S&P 500 started the day strong but ended on a downbeat note. Initially buoyed by the U.S. Court of International Trade's ruling that the White House's tariffs were illegal, along with upbeat quarterly earnings from NVIDIA, the broad market index gapped higher at the open. However, once news broke that the tariffs would remain in effect pending an appeal to the Supreme Court—and that the U.S. administration had a "Plan B"—stocks quickly reversed course and sold off.

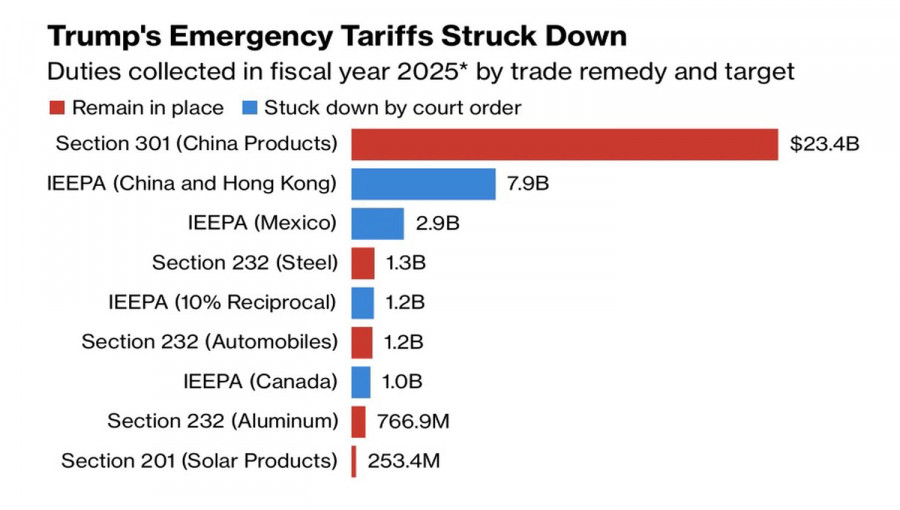

Cancelled and Remaining U.S. Tariffs

The U.S. administration is confident it will win the appeal. Even if it loses, there are other legislative tools it can rely on to reinstate tariffs. In short, the trade war isn't over. The S&P 500's reaction reflected the realization that the Court's verdict only presents a temporary hurdle for the White House. President Trump himself was outraged—how could judges inflict such harm on America? Is it personal animosity against Trump? What other explanation could there be?

Another reason for the S&P 500's roller-coaster ride is growing uncertainty. Companies have adapted to the tariffs, which has helped the index post its best May performance since November 2023. However, the Court's decision could harden the positions of other countries in trade negotiations with the U.S. Moreover, removing the tariffs would strip the U.S. of an important funding source for Trump's "Big Beautiful" tax cut bill. And the bill includes a particularly alarming detail for investors:

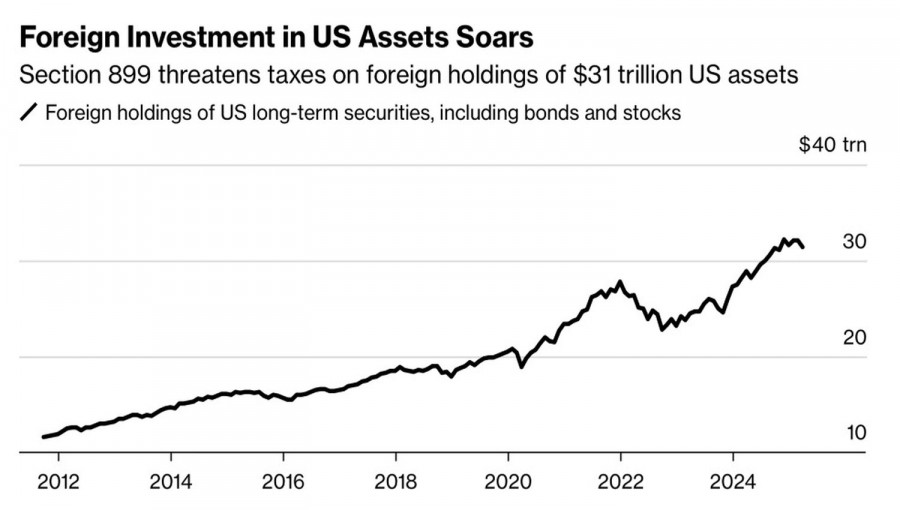

The proposal calls for raising tax rates on residents of countries deemed by the U.S. to have discriminatory policies. The logic is clear—foreigners hold trillions of dollars in U.S. assets, and higher taxes would funnel serious money into the budget.

Dynamics of the U.S. Asset Holdings by Non-Residents

However, non-residents are already spooked by the uncertainty surrounding Trump's policies. New taxes could drive them away completely, leaving the U.S. without buyers for its Treasury bonds. Financing the huge budget deficit would then become a major challenge, threatening both the economy and stock market indices.

Donald Trump also discussed rate cuts during a meeting with Fed Chair Jerome Powell. Trump pointed out that Powell was making a mistake by not lowering interest rates, placing the U.S. at a disadvantage compared to China and other countries. Yet at the same time, the president's pressure on the central bank only adds to investor anxiety. Undermining the Fed's independence is yet another reason for eroding confidence in America.

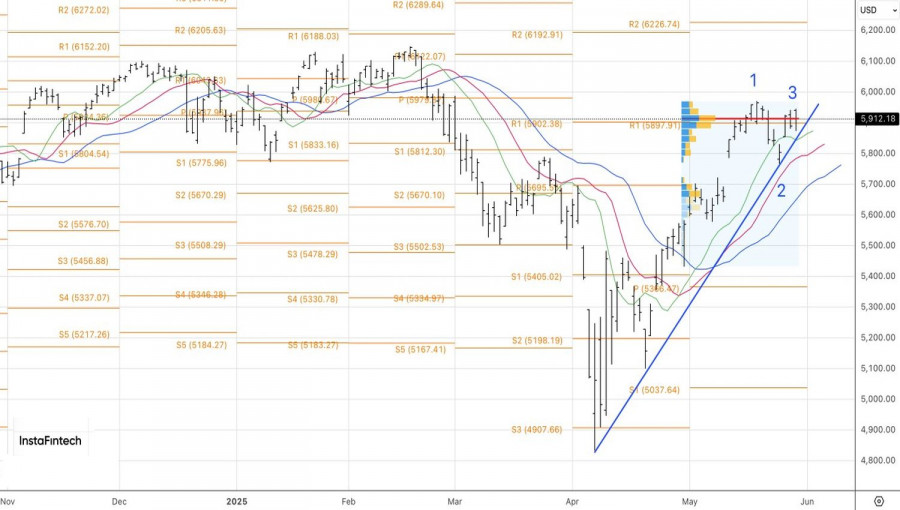

Technical Picture

Technically, nothing has drastically changed on the daily S&P 500 chart. The risks of forming a 1-2-3 reversal pattern remain intact. Breaks below the 5860 and 5815 support levels could serve as new signals to sell the broad market index.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.