See also

21.05.2025 12:26 AM

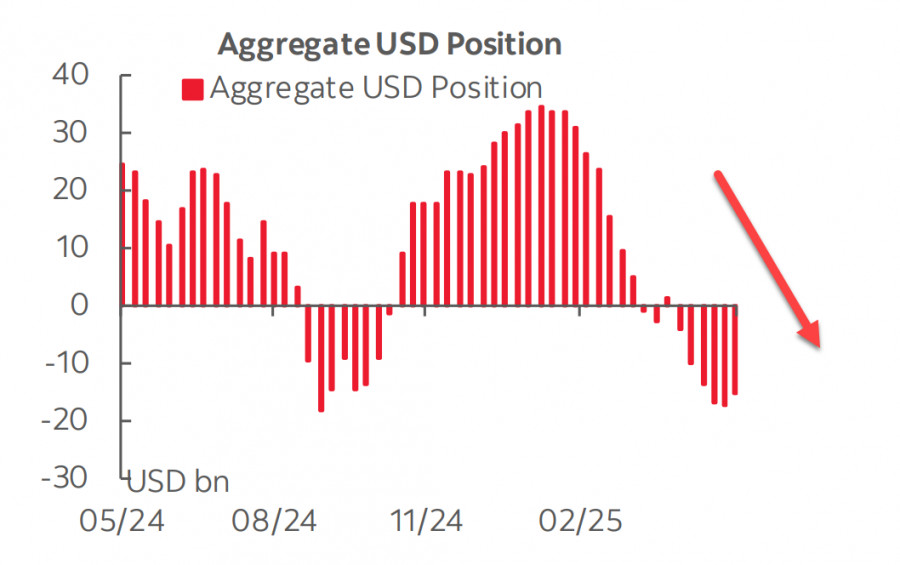

21.05.2025 12:26 AMAs the CFTC report showed, investors are still not very impressed that the US and China have managed to reduce trade tensions and take a pause for negotiations - the combined short position in USD against major currencies decreased by only 0.7 billion, bringing the total to -$16.7 billion.

The S&P 500 index staged an impressive rebound after one of the most dramatic sell-offs in history, returning to the level it held before the start of the tariff wars. However, doubts remain about the sustainability of this rally.

It's worth noting that the U.S. market wasn't the only one rallying—Canada hit an all-time high, while China, South Korea, Australia, and several European countries also posted record highs. The primary driver, of course, was the decline in global risks, which could have spiked if Trump's team had pushed its interpretation of fairness more aggressively.

The University of Michigan Consumer Sentiment Index dropped sharply in May from 52.2 to 50.8—almost hitting a historic low—and it's now declining faster than it did at the height of the COVID crisis. Meanwhile, inflation expectations have risen: the 1-year outlook jumped to 7.3%, the highest since 1981 (during the energy crisis), and the 5-year outlook climbed from 4.4% to 4.6%. In other words, consumers see the inflation picture quite differently despite seemingly clear signs of disinflation.

A federal budget surplus report showing a surplus of $258.4 billion—the second-largest on record—supported the dollar's strength. However, the evidence of slowing inflation remains unconvincing, at least for now. Inflation expectations among both businesses and consumers are rising, not falling, contradicting official data.

The U.S. dollar appears stronger than it was a week ago and is expected to strengthen further against most competitors in the short term. However, this strengthening is largely preventive in nature, as the outcome of the deal with China remains uncertain, and it's not even clear if there will be a deal at all.

We do not see strong grounds for a new all-time high or continued growth for the S&P 500 index.

After consolidating above the 5780 level, some additional upside was justified, but the signs of a looming recession in the U.S. economy are too obvious to ignore. We expect a reversal downward toward 5500. A less likely scenario is a move to 6150 followed by a later reversal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.