See also

16.05.2025 11:40 AM

16.05.2025 11:40 AMInvestors are so confident that Donald Trump is following the stock market's lead that the S&P 500 no longer needs a reason to rise. The broad equity index had been waiting for good news from China, but Alibaba's earnings disappointed investors. Meta Platforms also delivered a setback, delaying the rollout of artificial intelligence technologies. Recent economic data points to a slowing US economy, but the crowd doesn't care. It's hooked on buying.

According to Bank of America, retail investors have been buying US stocks for 22 weeks straight—the longest streak since tracking began in 2022. In contrast, positioning in equities among systematic funds is at one of the lowest levels since 2010, according to Deutsche Bank.

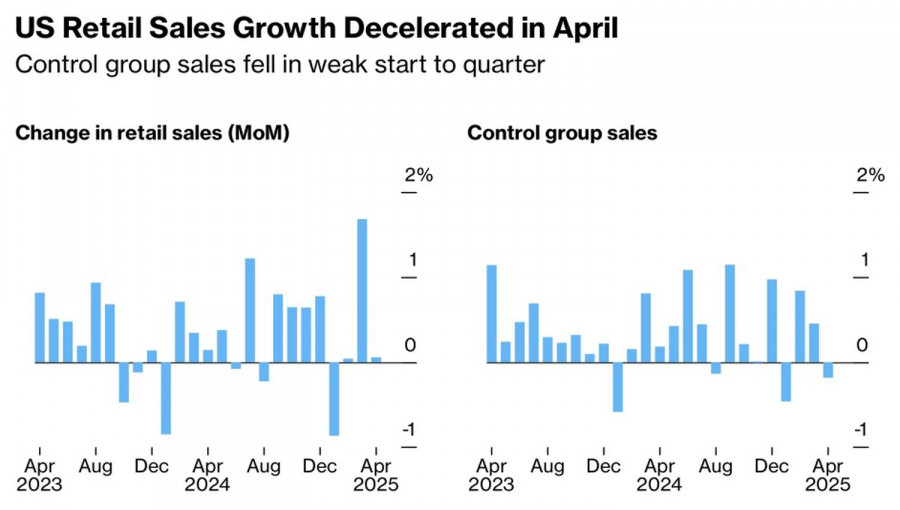

The crowd shows little reaction to the first drop in industrial production in six months or to falling producer prices, which signal weak domestic demand. Instead, it's more excited about a modest 0.1% uptick in retail sales, which beat forecasts. Never mind that Pantheon Macroeconomics warns that sales will likely weaken significantly in May and June, as the wave of pre-tariff consumer spending has already passed.

US retail sales trend

Retail investors are focused on the decline in Treasury yields, which theoretically reduces corporate costs. Few care that the drop in bond yields stems from weak macro data, so weak that JP Morgan is once again discussing the possibility of a recession. The futures market is now pricing in a more aggressive Fed easing cycle in 2025, increasing expectations from under 50 to 55 basis points. The crowd sees this too as another reason to buy the S&P 500.

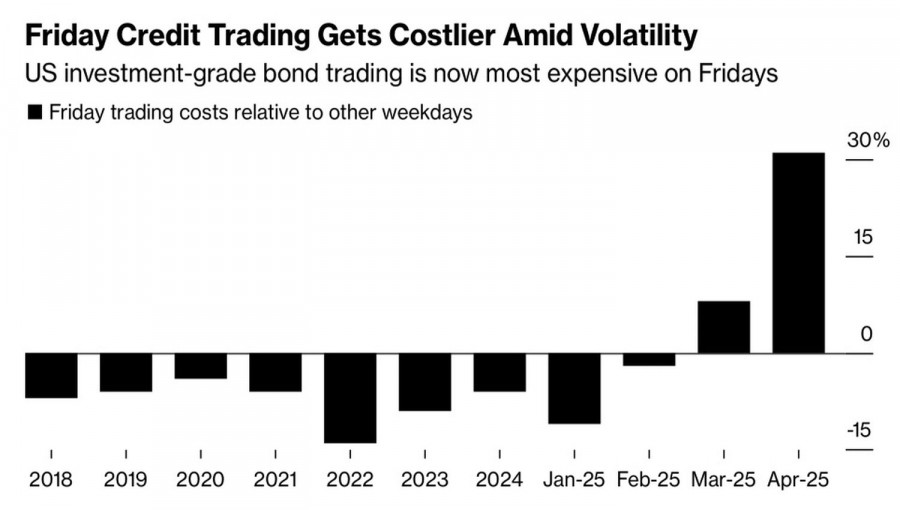

So-called "dumb money" is more captivated by seasonal patterns. For instance, Fridays are becoming more expensive days for trading, including in corporate bonds. Previously, investors would use the end of the week to reflect on long-term stock prospects—now they're on edge. The reason? Donald Trump's habit of dropping major news over the weekend.

Trading cost dynamics

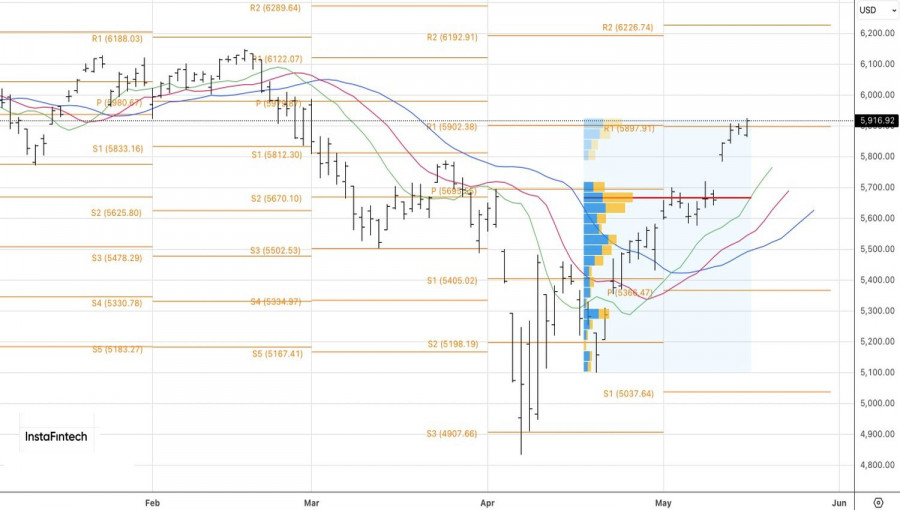

Unless something truly spooks the crowd, it will keep inflating the S&P 500 bubble. Possible triggers for more stock buying could include progress in US-EU trade negotiations or signs of a ceasefire in Ukraine. Retail investors hear what they want to hear, and while the smart money stays on the sidelines, they continue aggressively building long positions in the broad index.

Technically, on the daily chart of the S&P 500, the bulls have managed to take control of the red line near 5,900 and push prices toward the record high reached in February. That level is about 4% away, and the breakout longs still make sense to hold. However, a drop in the index below 5,865 would be a signal to flip and go short.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.