See also

08.05.2025 09:17 AM

08.05.2025 09:17 AMGold experienced a slight uptick following the Federal Reserve's meeting, where interest rates were kept unchanged and Fed Chair Jerome Powell stated that the central bank is in no rush to cut them despite uncertainties stemming from the trade war. However, prices were soon hit by a significant sell-off—and here's why.

The modest increase in gold prices reflected the precious metal's traditional role as a "safe haven" during times of economic and geopolitical instability. Powell's comments about maintaining a cautious stance on rate cuts, despite the ongoing trade war, emphasized the Fed's commitment to controlling inflation and preserving economic stability. At the same time, his remarks heightened concerns about the outlook for economic growth in a climate of uncertainty. The Fed's decision to keep rates steady, combined with its reluctance to rush into easing, can be interpreted as a sign that the central bank sees risks associated both with rising inflation and a potential economic slowdown. In such an environment, investors often turn to gold to protect their assets.

However, it's crucial to understand that the impact of the trade war on the global economy remains a key factor influencing gold market sentiment. Escalating trade tensions can lead to slower economic growth, increased inflation, and greater uncertainty—all of which traditionally boost demand for gold as a defensive asset.

As noted earlier, during the Asian session, gold prices collapsed from a high of $3420 to around $3300 following news of upcoming US-China trade talks in Switzerland—seen as a critical stage in the prolonged trade dispute. This eased market tensions and prompted investors to unwind their gold positions in favor of riskier assets. The optimism surrounding the meeting is underpinned by both sides recognizing the need for compromise to stabilize global trade and prevent further negative consequences.

Investors will continue to closely monitor the latest trade moves from the White House. Yesterday, President Trump stated he does not intend to lower tariffs for China in advance of the key meeting in Switzerland. This comment introduced fresh uncertainty regarding the outlook for trade negotiations and further deepened concerns about a potential global economic slowdown.

In the near term, heightened volatility is expected in the gold market, as any outcomes from the upcoming talks could either renew demand for bullion or trigger a larger sell-off of the asset.

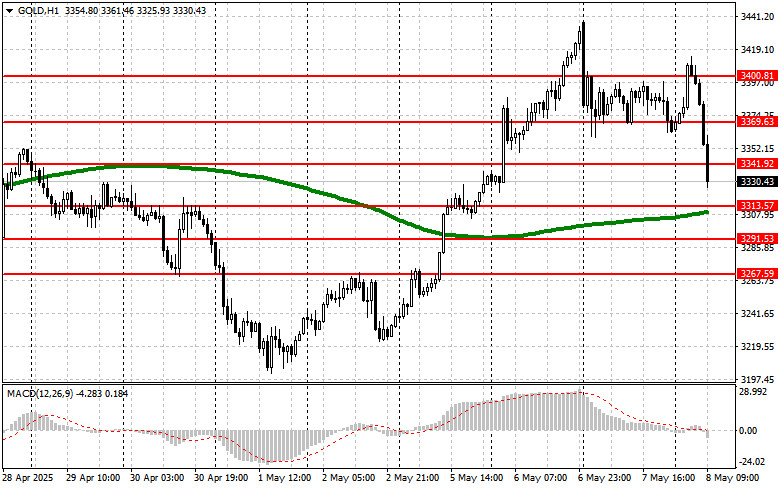

Technical Picture for Gold Buyers need to break through the nearest resistance at $3340 to aim for $3369, above which a breakout will be quite challenging. The ultimate target would be the $3400 level. In case of a decline, the bears will attempt to seize control around $3313. If successful, a break of this range would deal a serious blow to the bulls and push gold down to a low of $3291, with the potential to reach $3267.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.