See also

08.05.2025 12:47 AM

08.05.2025 12:47 AMThe labor market report from New Zealand, published on Wednesday, is the last major release before the RBNZ meeting at the end of May. Notably, instead of clarifying the outlook, it only added more uncertainty, as the final figures diverged significantly from forecasts.

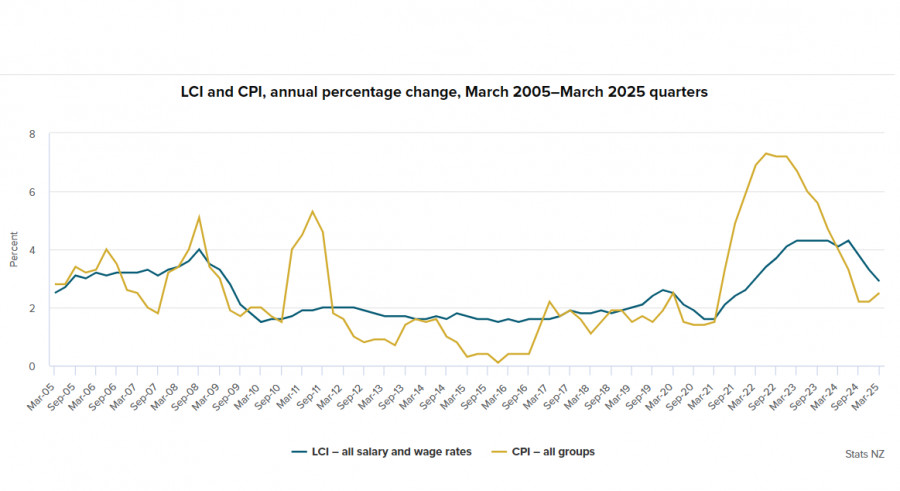

Specifically, the unemployment rate remained unchanged at 5.1%, while a rise to 5.3% was expected due to labor supply growth outpacing job creation in recent months. The employment cost index also showed weaker wage growth than the previous quarter—2.5% vs. 2.9%, with a forecast of 2.7%. This indicator indirectly reflects future inflation expectations, and its slowdown contradicts the rise in inflation seen in Q1.

Overall, the report appears somewhat inconsistent, but is unlikely to alter the RBNZ's rate outlook, as economic prospects amid a possible escalation in the tariff war are expected to take center stage. Forecasting models that once predicted a steady recovery after Q4 already show noticeable deviations toward greater-than-expected downside risks. Following the previous RBNZ meeting, several regional banks lowered their estimates for the terminal rate. For example, ANZ revised its terminal rate projection from 3.0% to 2.5%. When the RBNZ began its easing cycle in August last year, it consistently lowered the rate by 25 basis points at each meeting, skipping only the December one. After the recent April cut, markets expected a pause in May. However, if the RBNZ sees new threats to the economy, it may lower the rate again, from the current 3.5% to 3.25%. This step has not yet been fully priced in, and could exert pressure on the New Zealand dollar.

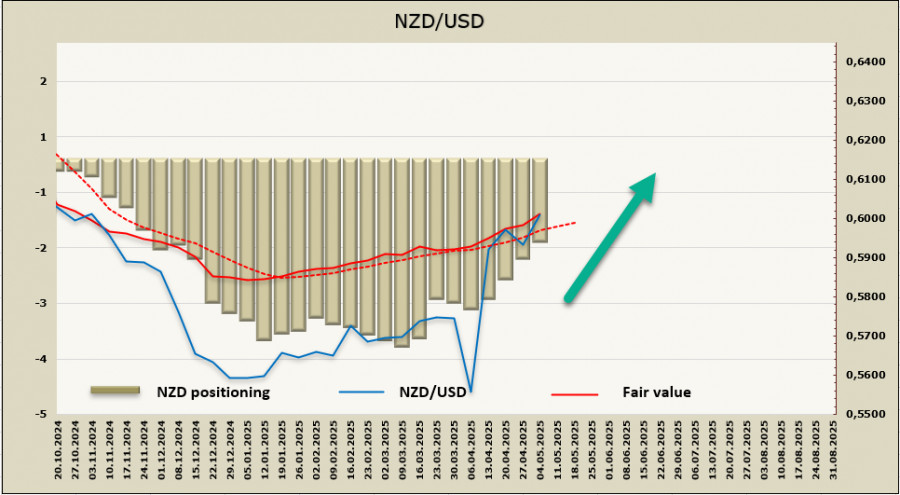

As a result, the risk of increased downward pressure on NZD/USD is growing, and the current bullish impulse appears fragile.

The net short position on NZD continues to shrink, with a weekly change of +$329 million, bringing the total net short position down to –$1.27 billion. Positioning is shifting from bearish to neutral, while the fair value remains confidently above the long-term average, suggesting potential for further upside.

The second attempt to break through the 0.6030 resistance also failed, but the kiwi hasn't lost its bullish momentum. A breakout above this resistance is still expected in the near term. There are no clear bearish reversal signals yet, and the key factor that could slow the rally may appear following the conclusion of the FOMC meeting. If Jerome Powell doesn't surprise markets with hawkish remarks at the press conference, uncertainty could ease, and the U.S. dollar's underlying weakness may reassert itself. The long-term target remains 0.6362, although it's too early to define a timeline for reaching that level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.