See also

07.05.2025 09:28 AM

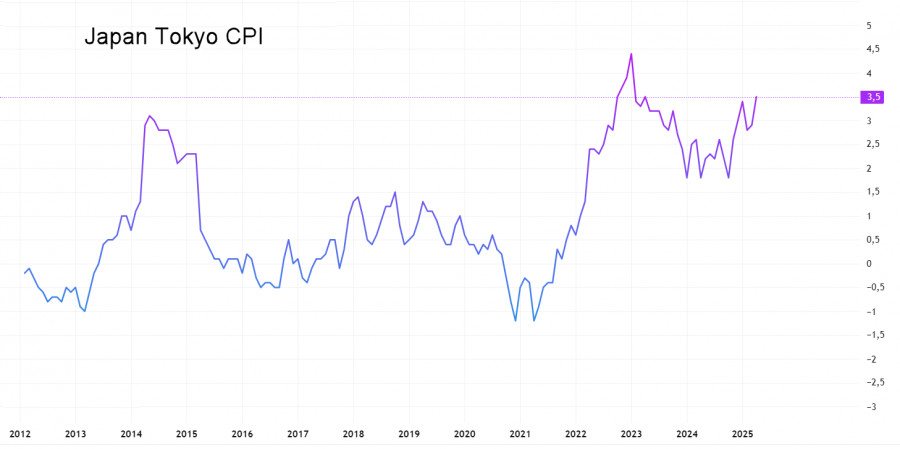

07.05.2025 09:28 AMThe Bank of Japan left its monetary policy unchanged during the monetary policy meeting on May 1. In the "Outlook for Economic Activity and Prices" report, the Bank lowered its forecasts for real GDP growth in both fiscal years 2025 and 2026 due to the impact of U.S. tariffs. However, these are preliminary forecasts based on certain assumptions. Meanwhile, it raised its forecast for core inflation in fiscal year 2025. Recall that inflation rose again in March from 2.6% year-on-year to 2.9%, and in the Tokyo region, it climbed from 2.9% to 3.5% in April, with core indexes also showing excessive growth.

Regarding monetary policy implementation, the Bank reaffirmed its intention to "raise the policy interest rate and adjust the degree of monetary regulation." This has been a long-standing goal for the BOJ since the era of aggressive quantitative and qualitative easing, known as "Abenomics." Over time, significant side effects have accumulated, which need to be addressed. Normalization—this is the term—is the central task facing the BoJ. Without a rate hike, it cannot be achieved.

When Abenomics was launched in 2013, inflation also spiked, but this was primarily due to an increase in the consumption tax, and the effect proved temporary: within two years, deflation returned to Japan. The current price increase, however, is driven by different factors—primarily the pandemic, which paralyzed supply chains and led to global inflation. Every cloud has a silver lining: the current environment provides a convenient opportunity to mitigate the consequences of Abenomics, and all forms of normalization contribute to a stronger yen.

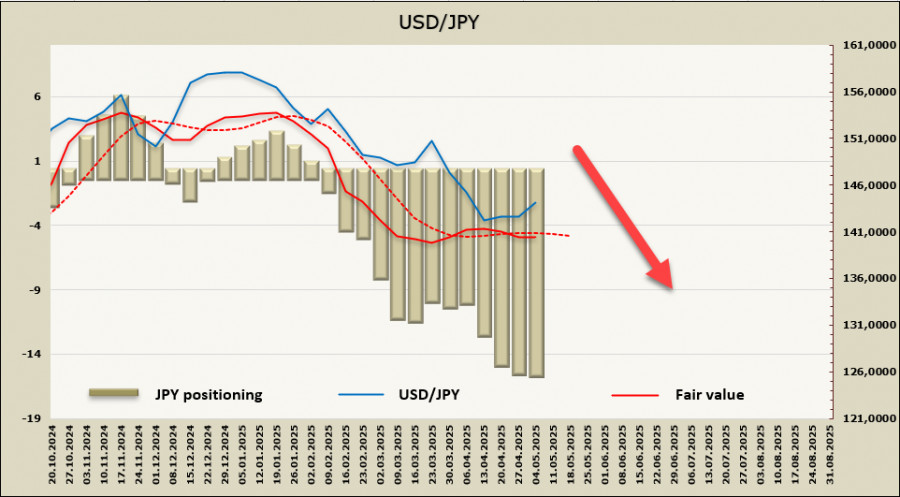

Naturally, Japan is also seeking ways to withstand pressure from the United States. Ongoing tariff negotiations reflect the U.S. desire to see a stronger yen. The market shares this view: the yen is expected to strengthen; otherwise, the talks may stall, which is a less acceptable outcome for Japan than tolerating a strong yen. Positioning supports this sentiment: according to the latest CFTC report, the net long position on the yen has reached $15.74 billion, and the implied price has again fallen below the long-term average.

After hitting a recent low of 139.90 on April 22, the yen entered a shallow correction but remained within a bearish channel, forming another downward impulse. We anticipate that in the second attempt, the support at 139.59 will not hold, leading USD/JPY to move toward the 127–129 range, which may serve as a final destination that satisfies all parties involved. The yen will strengthen, just as Trump wants, and by the time this range is reached, the BOJ will likely raise the interest rate, enabling it to pause again before the next hike.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.