See also

07.05.2025 12:32 AM

07.05.2025 12:32 AMThe Australian dollar updated its five-month high against the USD at the start of the new week. NAB (National Australia Bank) revised several of its forecasts concerning the Australian economy and the national currency. NAB now expects the AUD/USD exchange rate to reach around 0.7000 by year-end, near the highs seen on September 30 last year. According to NAB, the aussie's strength is primarily driven by expectations of further USD weakness, as the greenback continues to look increasingly vulnerable.

As for other forecasts, NAB has lowered its GDP growth projection from 2.25% to 2% and raised its forecast for the peak unemployment rate from 4.2% to 4.4%. Much of the revision is due to external factors—chiefly the new U.S. tariff policy—and similar downward adjustments are being made across all major economies, including Japan, Europe, China, and the UK. Australia is less affected by the "Independence Day" trade measures, as exports to the U.S. account for less than 5% of its total exports, an undeniable advantage supporting the Australian dollar's resilience. Indirect pressure via China is a greater concern, which is why Australia is keen for the U.S. and China to reach a tariff agreement and prevent global trade wars from triggering a recession.

Solid Q1 results, manageable inflation, and growing external risks could prompt the Reserve Bank of Australia (RBA) to accelerate the normalization of its monetary policy. There are now forecasts—particularly from NAB and ANZ—that the RBA could cut the interest rate by 50 basis points in May, instead of the 25 previously expected, followed by two additional cuts that could bring the rate down to 3.1% by August. A faster pace of rate cuts might pressure the aussie due to declining yields, but more evident signs of an impending U.S. recession could emerge by summer, which would likely place even greater pressure on the U.S. dollar. Therefore, the AUD/USD exchange rate may rise further, despite RBA cuts—this remains the base-case scenario.

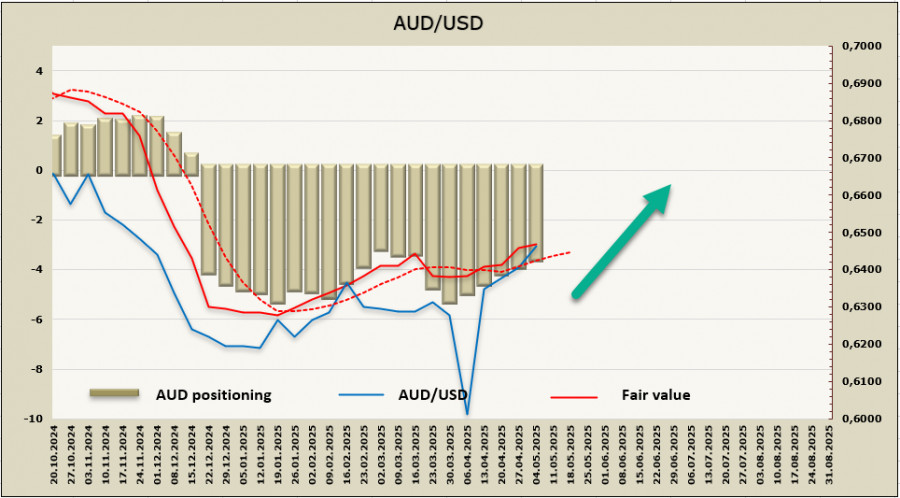

Net short positions in the AUD decreased by $287 million over the reporting week, down to -$3.188 billion. The reduction is slow, and the bearish imbalance has not yet been fully neutralized. Meanwhile, the estimated fair value remains above the long-term average.

As previously anticipated, AUD/USD broke out of its consolidation range to the upside. The next target is the resistance zone at 0.6540/50. If markets interpret Wednesday's FOMC meeting's outcome as more hawkish, a pullback toward 0.6400/10 is possible. However, the trend remains bullish, and any downward correction would be a justified opportunity for new long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.