See also

04.04.2025 12:50 AM

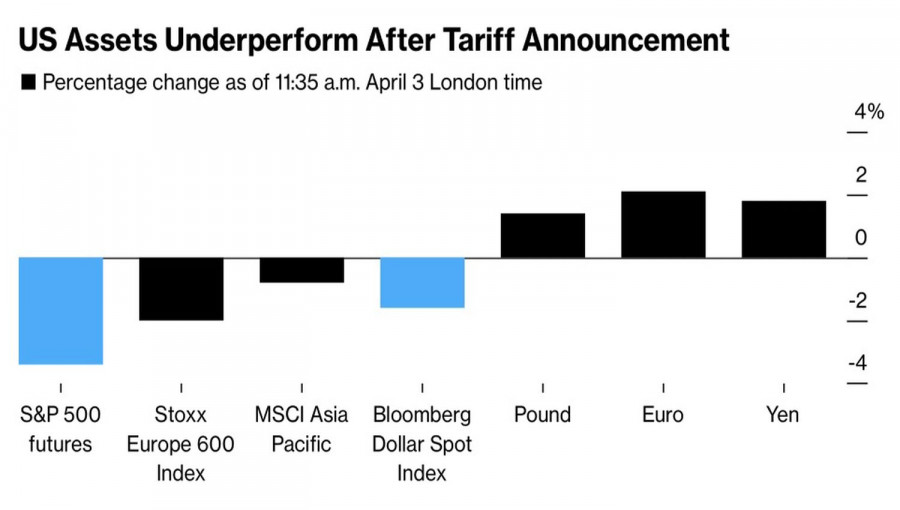

04.04.2025 12:50 AMDon't create a problem for someone else; you might get caught in it yourself. Donald Trump sought to leverage the United States' leading position in the global economy by announcing the highest tariffs in over a century. The White House resident claimed this would return America to its Golden Age. However, financial market reactions tell a different story: the U.S. is emerging as the biggest victim—sending the dollar plunging into the abyss.

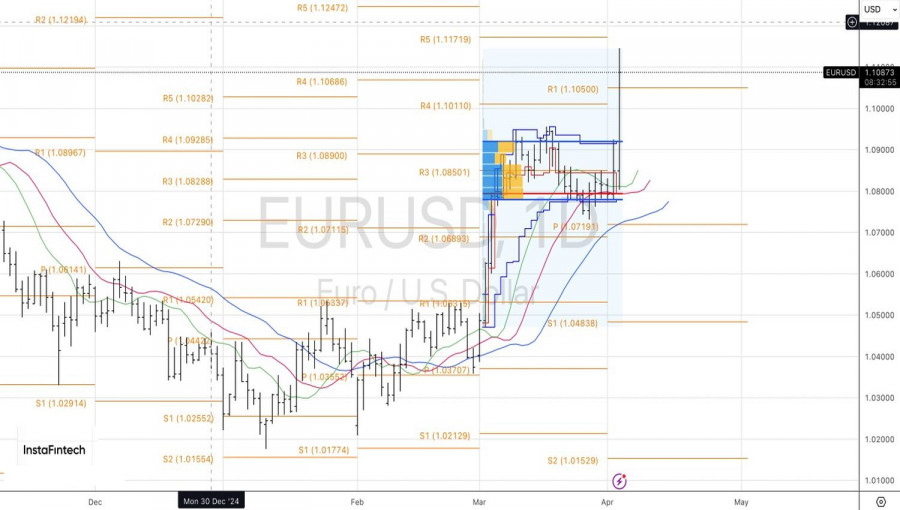

At the turn of 2024–2025, investors were confident that the eurozone and the EUR/USD pair would be the primary victims of Trump's protectionist policies. The logic was simple: the euro area is export-driven, and the euro is a pro-cyclical currency susceptible to the global economic outlook. But theory means little without practice. The main currency pair has soared to its highest levels since early October, which may be far from the ceiling.

Citi expects EUR/USD to reach 1.15, citing the disproportionate impact of tariffs on U.S. markets compared to European ones. According to their estimates, the S&P 500 could lose 11% of its market capitalization due to the broad scope of import tariffs, while European indexes would see only about a 5% drop.

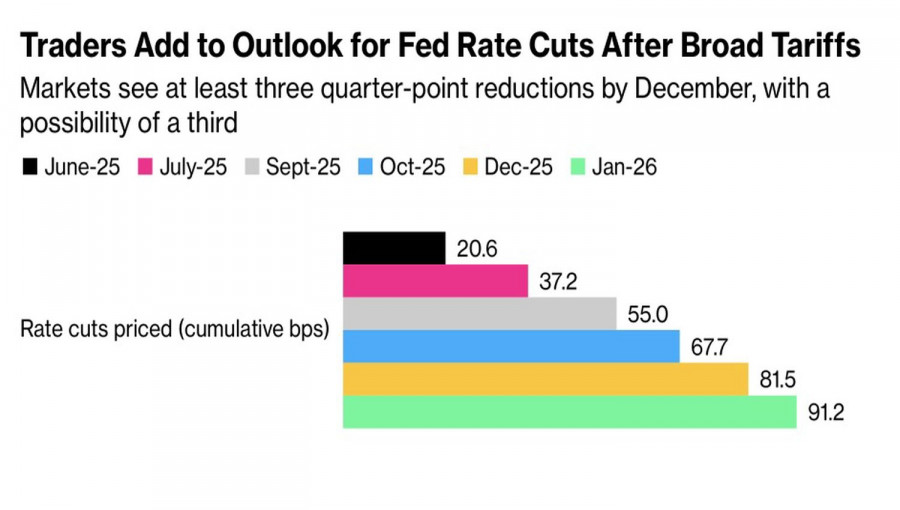

The tariffs have intensified recession risks in the U.S., pushed Treasury yields lower, and raised money market expectations for aggressive monetary easing by the Fed. Derivatives markets now predict 81.5 basis points will cut the federal funds rate by December—implying three rate cuts in 2025, with a possible fourth.

Thus, capital outflows from U.S. equities, falling Treasury yields, rising recession risks in the U.S. economy, and the expected resumption of the Federal Reserve's monetary easing cycle all contribute to an extremely unfavorable environment for EUR/USD bears. The pair's trajectory will depend mainly on how the European Union responds to the White House's tariffs.

The EU appears determined to strike back despite Treasury Secretary Scott Bessent advising other countries not to retaliate against the U.S. import tariffs and warning that rates could go even higher. France and Germany have been particularly vocal, calling for targeted measures against American tech firms and service providers. That would be a painful blow, given that the U.S. runs a services trade surplus with the EU.

However, there are other options. Europe could increase fiscal stimulus and pivot its economy from exports toward domestic consumption, both of which would be supportive of the euro.

On the daily chart, EUR/USD has broken out of consolidation or the "shelf" in the Spike and Ledge pattern. Long positions in the 1.0765–1.0800 zone should be held and increased on pullbacks. Target levels are 1.1220 and 1.1440.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.