See also

28.03.2025 11:39 AM

28.03.2025 11:39 AMMarkets are now fully convinced that the U.S. President will follow through on his plans to implement severe customs tariffs aimed at closing the domestic market and, in doing so, stimulating domestic manufacturers.

Understanding this, investors have essentially paused trading, waiting to see what happens on April 2.

When observing the behavior of stock, commodity, debt, and currency markets — along with the crypto market — it becomes clear that activity is waning. Watching Trump and his dynamic personality, anything can be expected on April 2. In the past, he has made dramatic promises only to just as easily backtrack on them.

So, what might happen on Wednesday, April 2?

Two scenarios are likely on the table, based on the personality of the 47th U.S. President.

Scenario one: He theatrically announces the restrictive measures previously outlined. In this case, a localized wave of negativity can be expected, triggering broad market selloffs. The extent of the downturn will depend on Trump's commentary — how long the measures will last, what accompanying conditions they will carry, and so on.

Scenario two: A softer approach, where only partial measures are enacted — for instance, not all promised tariffs are implemented, or some are delayed for certain countries. This scenario would allow loopholes for imports to enter the U.S. The markets may react positively to such news, as the worst-case scenario is already largely priced in.

This is the dilemma investors currently face. Because of the uncertainty factor, market activity has stalled — no one wants to take risks and most prefer to adopt a wait-and-see approach.

What can we expect from the markets today?

Most likely, no significant movements are expected across market segments. Consolidation ahead of April 2 is the most probable scenario. The ICE U.S. Dollar Index will likely hover just above the 104.00 mark. Equities could trade sideways, gradually moving toward the lower ends of their ranges. Gold is expected to find support amid uncertainty and global geopolitical tensions. Crude oil prices will likely remain under pressure, correcting lower from their recent local highs.

Daily Forecasts:

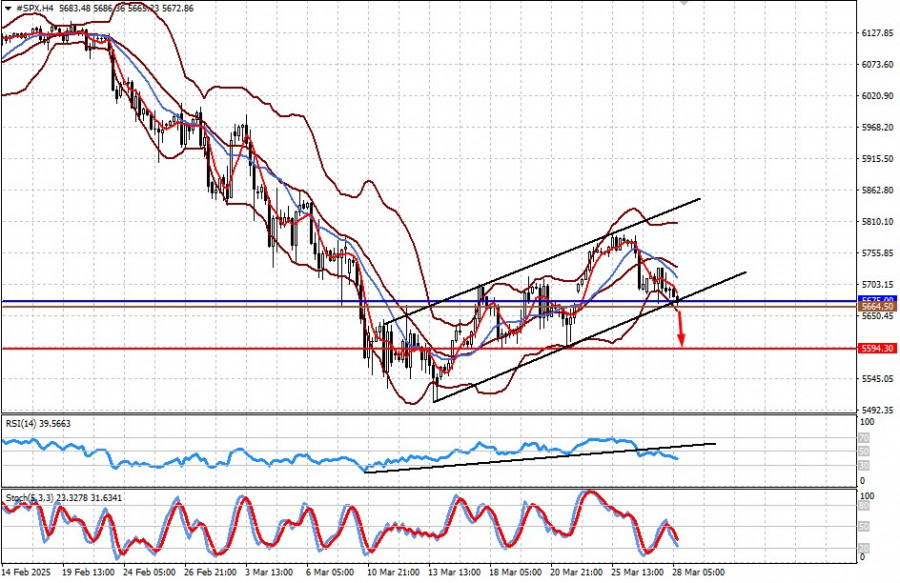

#SPX The CFD contract on the S&P 500 futures is resting on the short-term uptrend support line. A breakout below the 5675.00 level and a sustained move lower could lead to a decline toward 5594.30. The 5664.50 level may serve as an entry point.

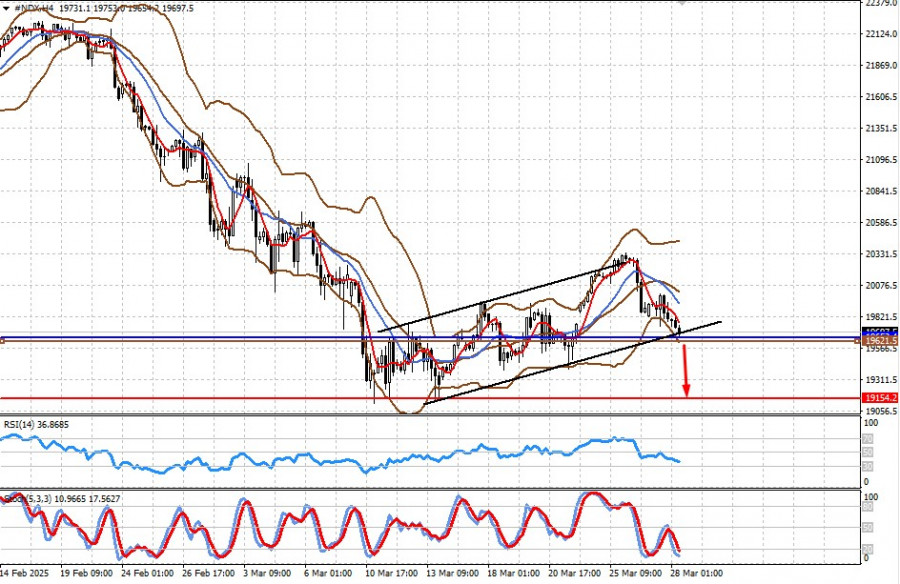

#NDX The CFD contract on NASDAQ 100 futures is also positioned at the short-term uptrend support line. A breakout below the 19652.40 level and a consolidation under it may lead to a drop toward 19154.20. The 19621.50 level may serve as an entry point.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.