See also

28.03.2025 10:09 AM

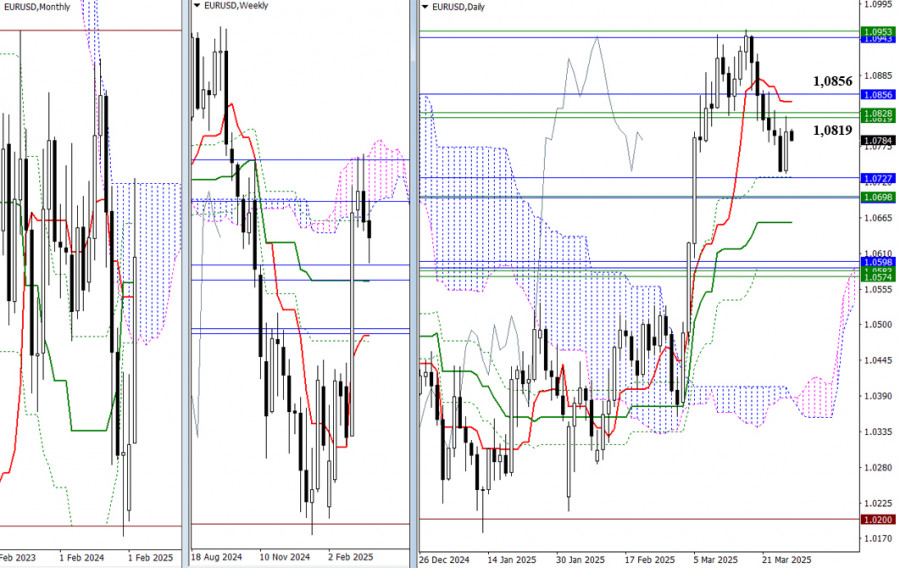

28.03.2025 10:09 AMAs the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes in the 1.0819–1.0856 area. After that, a new opportunity for further growth will open up, with the following targets being the upper boundaries of the weekly (1.0953) and monthly (1.0943) Ichimoku clouds. If the bulls surrender their gains from yesterday, the pair may return to support levels around 1.0727–1.0694.

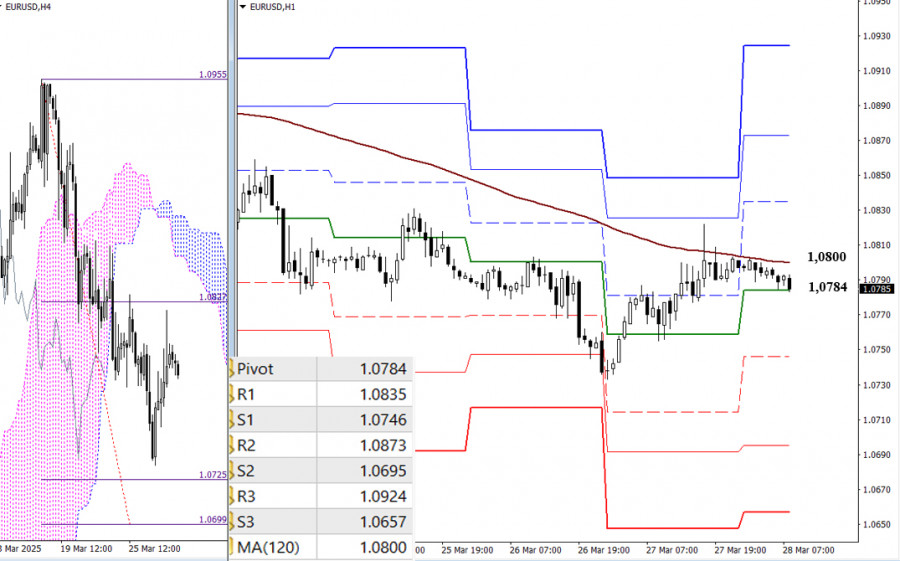

On the lower timeframes, the pair is currently testing the resistance of the weekly long-term trend (1.0800). Holding this level gives a significant advantage. If the bulls manage to consolidate above this level and reverse the trend in their favor, they can test the resistance levels of the classic Pivot Points intraday (1.0835 – 1.0873 – 1.0924). If the trend is not broken, the advantage will remain on the bearish side. If the decline resumes, support will be provided by the classic Pivot Points today at 1.0746 – 1.0695 – 1.0657.

***

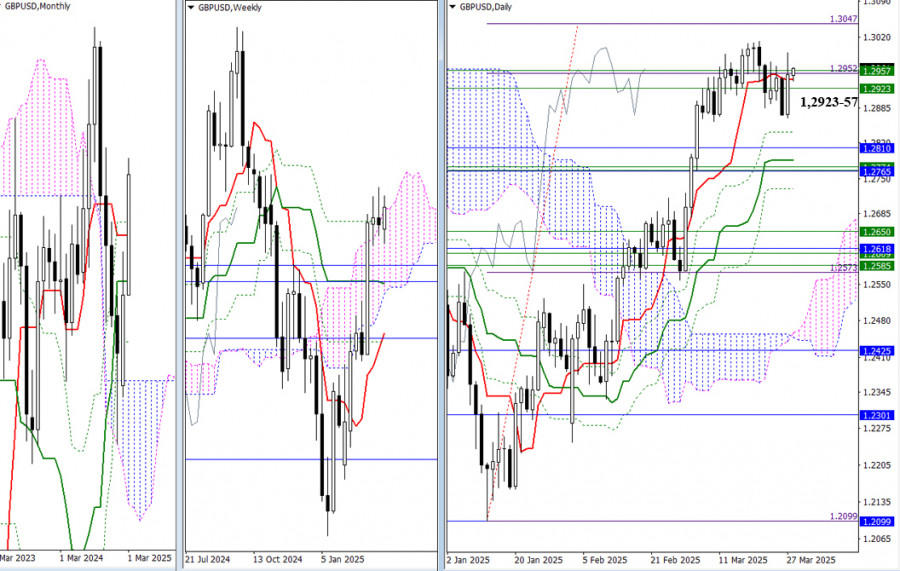

The market remains within a range of uncertainty that has persisted from previous weeks, remaining in the gravitational zone and influence of the weekly levels (1.2923 – 1.2957) and the daily short-term trend (1.2940). The main expectations have not changed, and the key reference points remain in place. The next upside target remains the 100% completion level of the daily breakout target above the Ichimoku cloud (1.3047), while the cluster of levels of interest to the bears is still located around 1.2765–1.2810, where monthly, weekly, and daily supports are gathered.

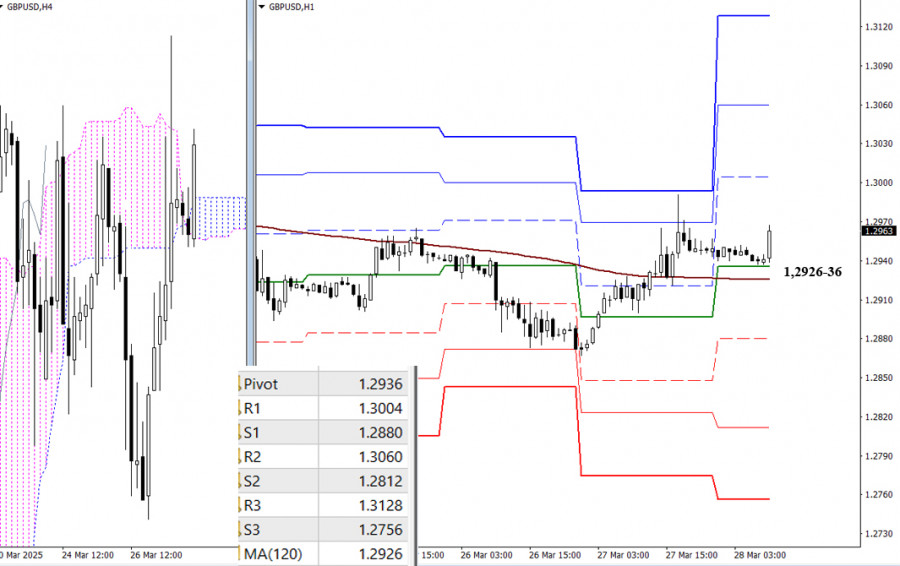

The bulls consolidated above the key levels of 1.2936 (daily central Pivot Point) and 1.2926 (weekly long-term trend), thereby gaining the main advantage on the lower timeframes. Intraday, further upside development today will proceed through the resistance levels of the classic Pivot Points (1.3004 – 1.3060 – 1.3128). A loss of the key levels (1.2936–26) will shift the current balance of power in favor of bearish sentiment. In that case, the market will focus on the support levels of the classic Pivot Points (1.2880 – 1.2812 – 1.2756).

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.