See also

27.03.2025 12:41 AM

27.03.2025 12:41 AMThe euro is retreating cautiously, worried about a potential trade war between the European Union and the United States, while the dollar is on track for its worst month in over a year. Five consecutive days of EUR/USD declines have slightly improved the greenback's position, but the truth is hard to ignore—widespread disappointment with Donald Trump's policies is prompting traders to sell the dollar.

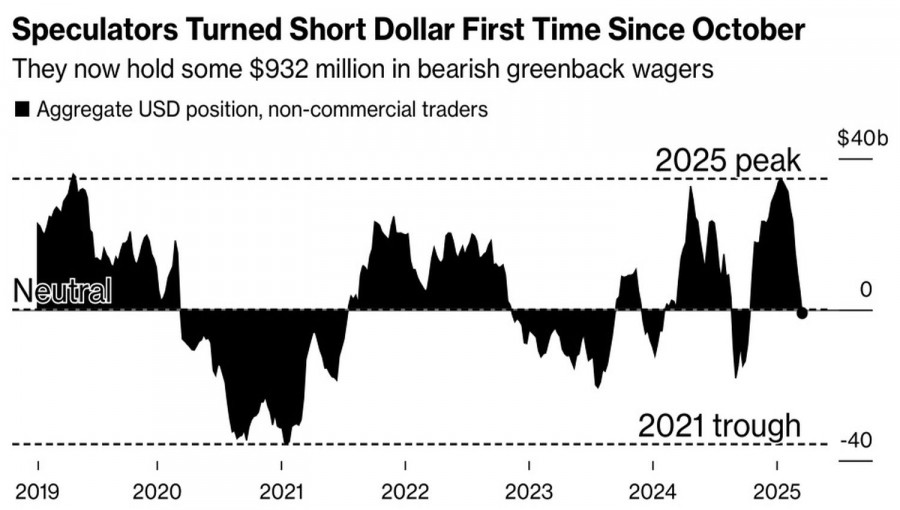

Speculators have become net sellers of the U.S. dollar for the first time since the November presidential election. Citigroup has lowered its forecast for the dollar over the next 6 and 12 months, and Credit Agricole also expects the USD index to fall. The bank admits it underestimated the impact of trade wars, public sector layoffs, and immigration restrictions on the U.S. economy. According to their outlook, the economy will cool faster than anticipated, providing a reason to buy EUR/USD.

Before the 47th president's inauguration, markets were convinced that White House tariffs would hurt other economies more than the U.S. However, recent data suggests otherwise. Weak retail sales, consumer sentiment, and business activity in the U.S. point to a potential slowdown in GDP growth in Q1. Europe, by contrast, is benefiting from the front-loading of U.S. imports ahead of the tariffs and Germany's fiscal stimulus.

Rising European purchasing managers' indices, business climate indicators, and consumer confidence give EUR/USD a bullish tone. The U.S. tariff threat still looms over the eurozone, but it's a double-edged sword. Bank of France Governor Francois Villeroy de Galhau stated that the tragedy of Donald Trump's policy is its replacement of a win-win economic scenario with one where everyone ends up losing.

The more tariffs imposed, the higher the risk of a U.S. recession. The White House understands this, which is why there are growing rumors in the media about selective tariffs, delays in duties on car imports, semiconductors, and pharmaceuticals, and the possible exclusion of certain countries from the blacklist. No one knows what the outcome will look like.

Still, a large-scale U.S.–EU trade war remains the main risk factor for the EUR/USD uptrend. Germany's fiscal stimulus may cushion the blow to the eurozone economy but won't eliminate it. Meanwhile, the White House is preparing for tax cuts, which could support the U.S. dollar. There are many possible outcomes—traders must adjust their outlooks and positions accordingly.

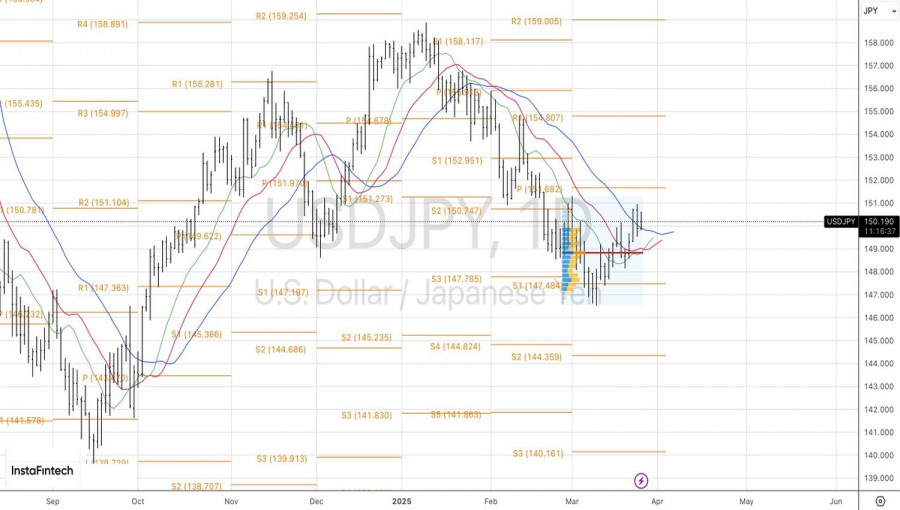

On the daily EUR/USD chart, bears have pulled the pair away from its fair value at 1.0845. A break below the local low at 1.0775 could extend the decline. However, a rebound from 1.0715 would serve as a signal to buy.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.