See also

24.03.2025 11:25 AM

24.03.2025 11:25 AMToday, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

News that emerged over the weekend indicates that U.S. President Donald Trump is planning a narrower and more targeted agenda on reciprocal tariffs set to take effect on April 2. This has increased investors' appetite for risk assets, set a positive tone in equity markets, and consequently undermined demand for the precious metal today.

At the same time, U.S. delegations are engaged in talks with Ukrainian officials and are planning meetings with Russian representatives. Earlier this month, Trump and Russian President Vladimir Putin agreed to a 30-day pause in strikes on Ukrainian energy infrastructure, which may help ease tensions in the region.

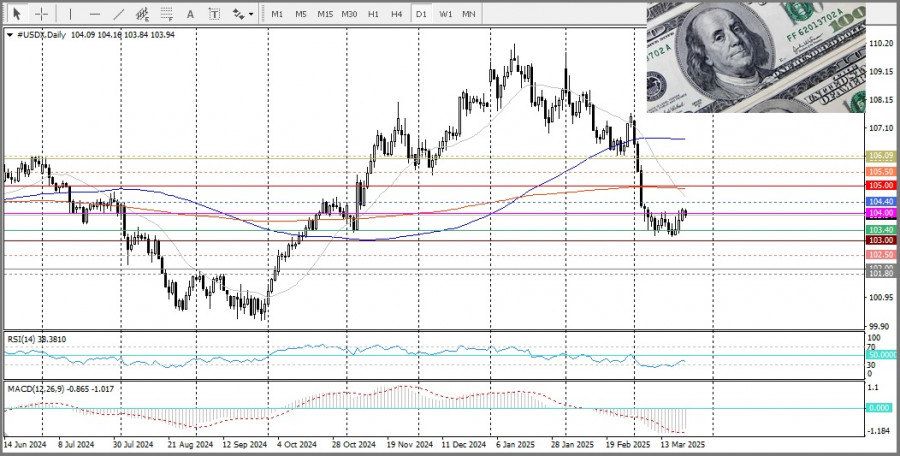

The U.S. dollar is hovering near a 1.5-week high reached last week.

However, expectations that economic slowdown caused by tariffs may force the Fed to resume rate cuts are also limiting the downside in gold prices. This creates uncertainty, and it would be prudent to wait for a more significant decline before opening new short positions.

Adding to the uncertainty is the tense situation in the Middle East: Israel continues its strikes on Gaza, while Iran-backed Houthis in Yemen launched a ballistic missile at Israel, though it was successfully intercepted. These developments increase the risk of further conflict escalation in the region.

Today, traders should pay close attention to the release of PMI data, which will provide fresh insight into the state of the U.S. economy and may impact commodities. Also in focus is the U.S. Core PCE Price Index, due to be published on Friday.

From a technical perspective, the $3000 level may attract buyers, but a break below it could trigger technical selling, pushing gold prices down toward the $2980–2978 area. If the correction continues, the next support lies at $2956–2954.

On the other hand, last week's all-time high near $3057–3058 could act as the nearest resistance. Given that the daily RSI has exited overbought territory, renewed buying may become the next trigger for bulls, opening the way for the continuation of the uptrend observed over the past three months.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.