See also

26.02.2025 06:55 AM

26.02.2025 06:55 AMSilver (XAG/USD)

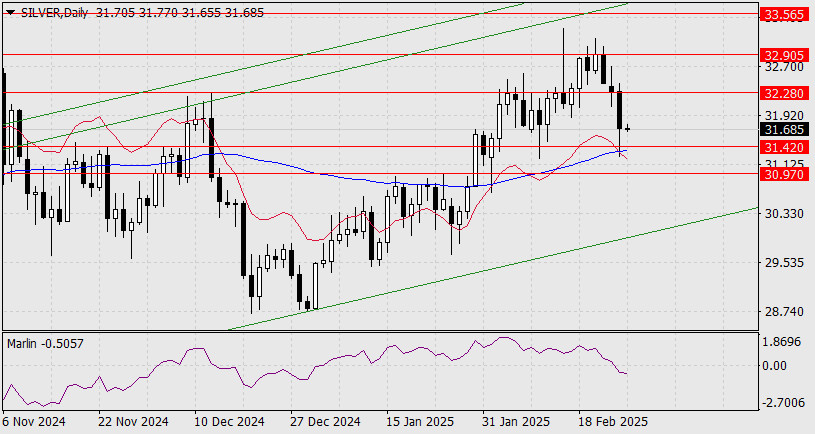

During yesterday's sharp downward move, silver tested the intersection point of two indicator lines (Balance Line and MACD Line), reaching the target support level at 31.420. This suggests that the entire correction from the uptrend that began on December 19 of last year may have now concluded.

However, one negative factor remains—the Marlin oscillator is still in negative territory and shows no signs of reversal yet. If a reversal occurs, it is more likely to begin tomorrow. For today, we expect a daily candlestick with a small body, regardless of its color.

On the H4 chart, there is also no clear reversal signal yet. This suggests that the market may continue to cool down before gradually turning towards new highs at 33.565.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.