See also

19.02.2025 10:36 AM

19.02.2025 10:36 AMThe Reserve Bank of Australia (RBA), like the Reserve Bank of New Zealand (RBNZ), continues its monetary policy easing to create conditions for stimulating economic growth. For now, the pair is holding above the 0.6340 support level, but the strength of the US dollar is likely to increase further as the situation around Donald Trump's trade tariffs becomes clearer. The divergence in monetary policies between the Federal Reserve and the RBA will ultimately drive the long-term decline of the pair.

There may be short-term rebounds due to profit-taking on previous positions, but the overall downward trend in the pair is expected to continue.

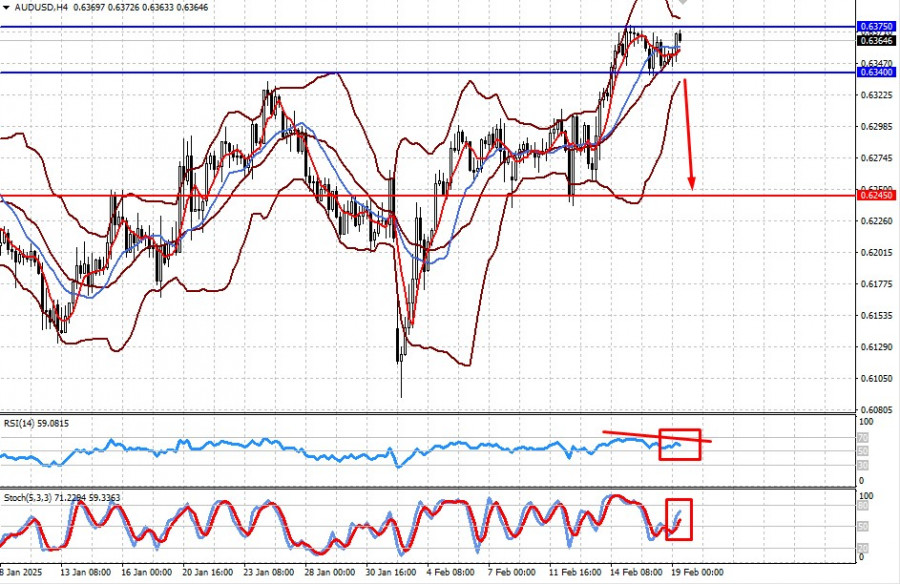

The price remains above the middle line of the Bollinger Bands, as well as above the SMA 5 and SMA 14. The RSI is below the overbought zone, indicating weakening bullish momentum. Meanwhile, the Stochastic indicator continues to rise actively.

If the pair fails to break above 0.6375 and hold above this level, a local reversal downward is likely, with the price falling toward 0.6245, once 0.6340 is breached.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.