See also

29.01.2025 04:54 AM

29.01.2025 04:54 AMOn the weekly chart, silver appears to be firmly positioned above the MACD indicator line, with the bodies of the weekly candlesticks entirely above this line. The only obstacle ahead is the balance line.

However, the price is likely to attempt a breakout, as the growth potential looks promising if it can overcome the resistance at 30.97, which is the high from the previous week.

On the daily chart, the Marlin oscillator is developing above the zero line within the growth zone. Before reaching the 30.97 level, the price will need to surpass the MACD line. A breakout above 30.97 would open the door to targets at 31.42 and then 32.28, which is the peak from December 12.

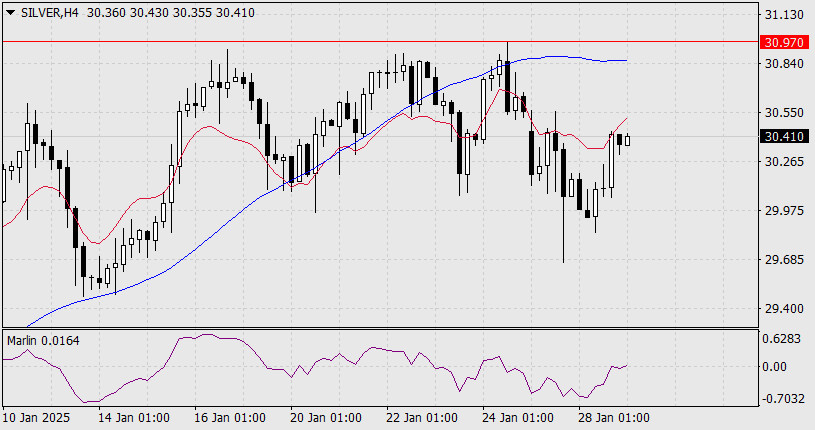

Similarly, on the four-hour chart, the 30.97 level is reinforced by the MACD line. Today's Federal Reserve meeting could potentially provide silver with the needed upward momentum. The Marlin oscillator is positioned for this move, having shifted into positive territory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.