See also

23.09.2024 10:20 AM

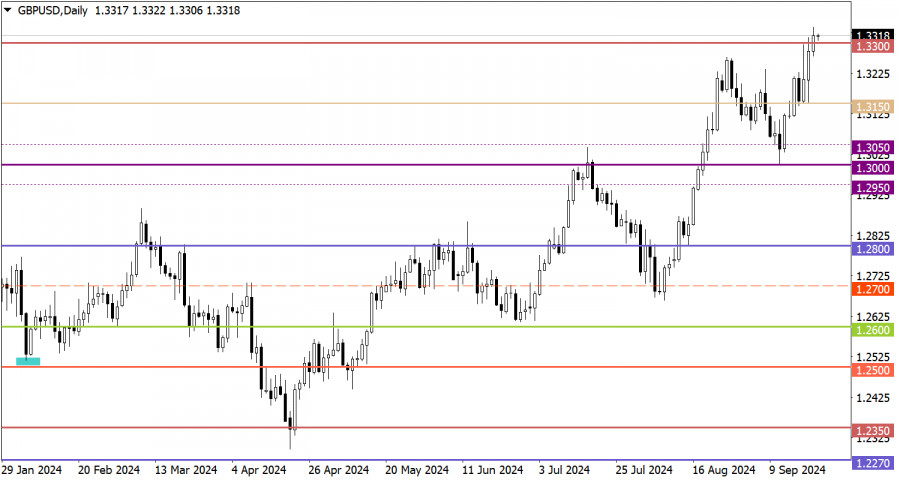

23.09.2024 10:20 AMOn Friday, the data on retail sales in the UK were published, showing a 1% increase in August. The actual figure significantly exceeded the forecasts of analytical agencies.

The movement around the local high of the mid-term trend indicates a prevailing bullish sentiment among market participants.

The close of the past trading week above the 1.3300 level indicates a prevailing bullish sentiment among market participants, which has already led to an update of the mid-term high.

The preliminary estimates of business activity indices are expected to be released today. In the Eurozone and the UK, no significant changes are anticipated for the main indicators, while in the United States, a noticeable decline is projected. Specifically, the composite business activity index in the US is expected to decrease from 54.6 points to 53.0 points.

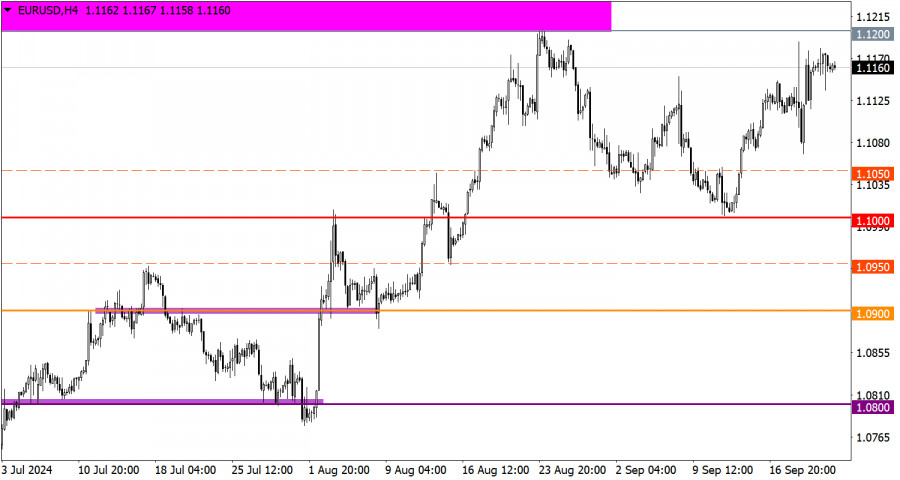

Considering the potential for further selling of dollar positions in financial markets, the euro's upward momentum could lead the price to reach at least the resistance level of 1.1200/1.1280. For more significant price changes, it will be necessary to stabilize above these levels, which would indicate an update of the mid-term high. Until then, the resistance area will continue to exert pressure on buyers.

The price has stabilized above the 1.3300 level, which indicates the potential for further growth of the British pound. A gradual movement toward the 1.3600 level is possible if the upward cycle remains uninterrupted. However, if the price drops below 1.3300, a temporary stagnation or pullback may occur.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.