See also

06.03.2024 11:28 AM

06.03.2024 11:28 AMOn Tuesday, traders got to know HCOB PMIs for the Eurozone. The actual data was stronger than flash estimates. The PMIs by the S&P Global and ISM for the US were also much better than estimated. The composite PMI by the S&P 500 Global went up, defying expectations for its decline.

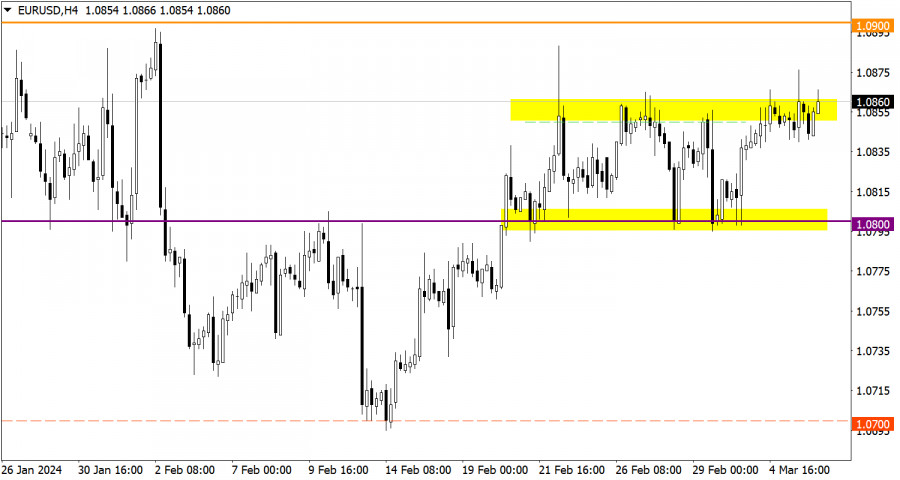

The EUR/USD pair is one step away from exiting the sideways channel of 1.0800/1.0850. However, analyzing the trading day on March 5, the instrument is currently accumulating trading forces, which is mirrored in the form of a Doji-type candle.

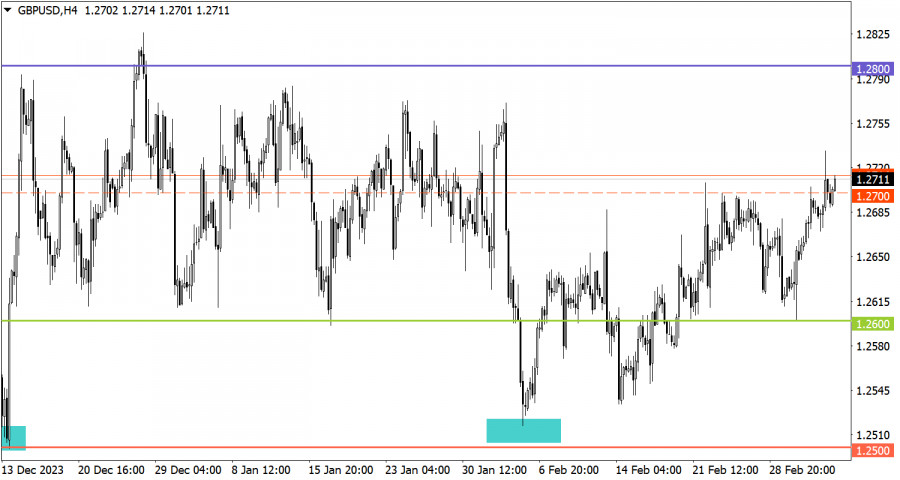

The GBP/USD pair overcame the level of 1.2700 during its rapid rally. This indicates a high excitement among traders about the upward cycle. As a result, traders increased long positions in the pound sterling.

Data on retail sales in the eurozone will be available today. Retail sales could have slowed the rate of decline from -0.8% to -0.3% in February. In addition, forecasts for the labor market in the US are rather negative, since employment may grow by only 90K, which is considered a low figure. Let me remind you that the deteriorating situation in the labor market is a convincing factor for the Federal Reserve as the regulator may decide on an early rate cut.

In case EUR/USD rises above 1.0850, the price may exit its trading range. Consequently, the euro will assert its strength, accompanied by increasing long positions toward 1.0900. As for the downward scenario, it will become relevant if the price does not stabilize above the upper border of the sideways channel. At the same time, EUR/USD could trade in the range of 50–60 pips.

In case of the price growth, GBP/USD is likely to swing around 1.2800. This level previously served as resistance. However, if the price again falls below 1.2700 at the end of the day, then the sideways scenario of 1.2600/1.2700 will remain relevant in the market.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time period: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for a possible future trajectory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.