See also

24.01.2024 11:09 AM

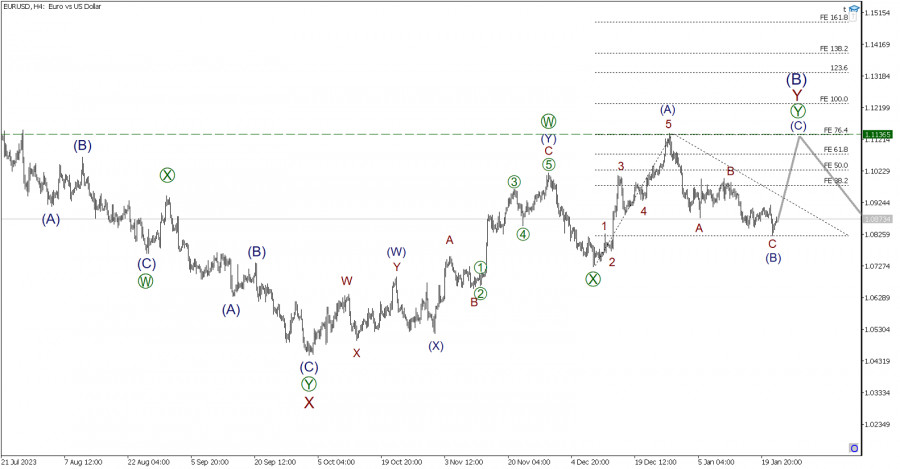

24.01.2024 11:09 AMIn the EUR/USD currency pair, the current wave [Y] is forming, which may complete a larger active wave Y. Wave [Y] consists of three parts—subwaves (A)-(B)-(C). As of writing, the first impulse wave (A) appears to be fully completed, consisting of five subwaves 1-2-3-4-5.

After the completion of the impulsive rise, the market began to move downward as part of the correction (B). This correction has the structure of a standard zigzag. In the last section of the chart, we can observe a rise in subwave (C).

The price increase in the indicated wave may rise to the previous high, where wave (A) was completed. Also, at the mentioned mark, the size of wave (C) will be 76.4% of (A).

Among the important news from Europe and the USA that can influence the EUR/USD exchange rate, it is worth highlighting changes in U.S. crude oil inventories.

Thus, the January 24 forecast for the euro-dollar pair suggests an attempt to develop the pair's impulse and test the area near the 1.1136 level.

In the current situation, it is recommended to consider opening long positions.

Trading recommendations: Buy at 1.0873, take profit at 1.1136.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.