See also

18.10.2022 03:20 PM

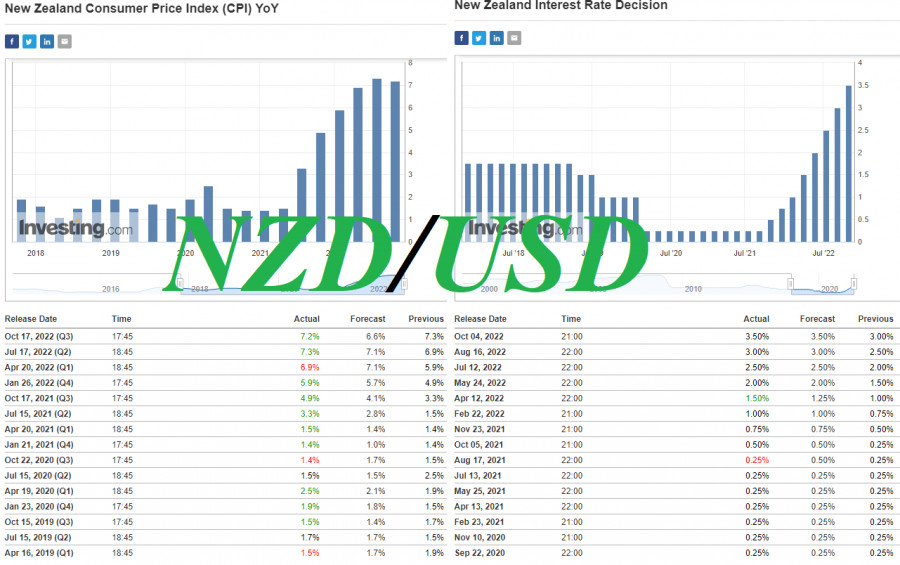

18.10.2022 03:20 PMThe New Zealand dollar has strengthened significantly during today's Asian trading session, including against the US dollar. As reported yesterday (at 21:45 GMT) by Statistics New Zealand, the consumer price index came out for the 3rd quarter with a value of +2.2% (forecast: +1.6%, previous value: +1.7%). The annual CPI came out with a value of +7.2% (forecast: +6.6%, previous value: +7.3%).

After the publication of these data, the NZD/USD pair rushed up, reaching an intraday high at around 0.5704, corresponding to levels almost two weeks ago.

Despite the renewed growth of the US dollar at the beginning of the European trading session, the NZD/USD pair half retains the bullish momentum received from the inflation data in New Zealand that exceeded the forecast, trying to stay in the zone above the short-term important support level of 0.5635 (200 EMA on the 1-hour chart): as of writing, the pair is trading near the 0.5662 mark. Characteristically, technical indicators paint a contradictory picture.

Today, after 14:00 (GMT), the latest data on prices for dairy products from the Global Dairy Trade will be published. The New Zealand economy still has signs of raw materials in many respects, with the bulk of New Zealand exports coming from dairy products and animal food products (27%, according to 2020 data). The increase in world prices for dairy products (expected by +0.6%) may have a positive impact on the quotes of the NZD and the NZD/USD pair, however, if the buyers of the US dollar allow it.

In October, the leaders of the Reserve Bank of New Zealand raised the rate by another 50 bps (to the level of 3.50%) and made it clear that they are set for further tightening of monetary policy.

Economists expect the RBNZ to raise its interest rate again to 4.00% at its November 23 meeting. However, in their opinion, now the role of the monetary policy of the central bank of New Zealand and its impact on the NZD rate remain secondary compared to the global dynamics of investor sentiment regarding risky assets.

As noted in one of our previous forecasts, we are witnessing an extraordinary situation in the financial markets. The central banks of the leading economically developed countries have embarked on the path of raising their interest rates. However, inflation in their national economies continues to rise, while the tightening of monetary conditions in itself has a negative impact on economic growth.

The RBNZ, like other major world central banks, is in the same difficult situation—high and continuing to grow inflation on the one hand, and a slowdown in the economy on the other.

Inflation in New Zealand will remain well above the RBNZ target range of 1%–3% until at least the end of 2023, economists say. The average inflation rate is expected to be 6.5% this year before falling to 3.5% in 2023. In July, this forecast assumed 6.0% and 2.8%, respectively.

Thus, despite the upward correction, NZD/USD remains in the zone of a long-term bear market. And this means that short positions are still preferable.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.