See also

23.05.2025 09:04 AM

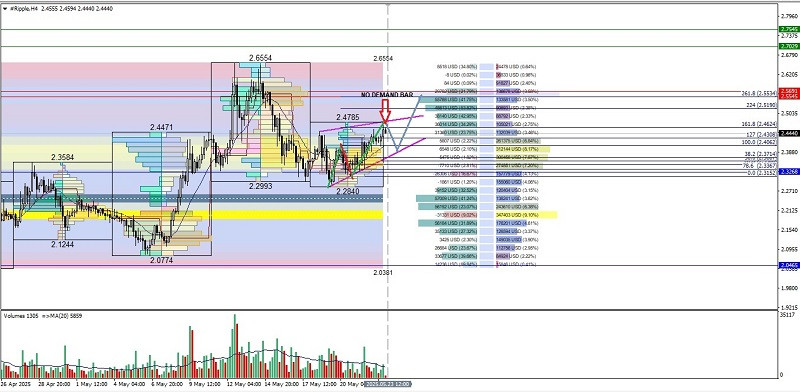

23.05.2025 09:04 AMIf we look at the 4-hour chart of the Ripple cryptocurrency, it appears to be moving above the WMA (21) which has a steep slope and has successfully broken out above the High Value Area level (yellow) and then continues to move above the blue area (average) and is in the BUYERS sentiment area which is quite significant, then in the near future Ripple has the potential to strengthen up to the level of 2.5190 as its first target and if the volatility and momentum of its strengthening support it, then 2.5534 will be the second target that Ripple will aim for, but it is also necessary to pay attention to the potential for a weakening correction indicated by the appearance of the Rising Wedge pattern and "No Demand Bar" where the distance of the last small Candle body is followed by the last volume bar which is lower than the previous 2 volume bars, thus giving a signal indicating a "Sign Of Weakness (SOS) but as long as the weakening correction does not break and close below the level of 2.2840, the strengthening scenario for Ripple that has been described previously will continue.

(Disclaimer)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.