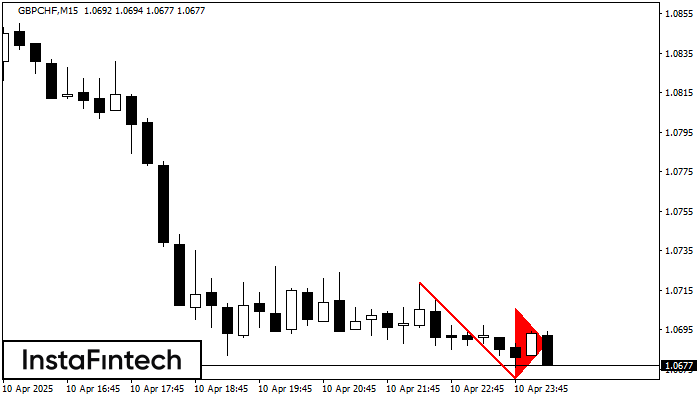

Bearish pennant

was formed on 10.04 at 23:20:38 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the GBPCHF M15 chart. It signals potential continuation of the existing trend. Specifications: the pattern’s bottom has the coordinate of 1.0670; the projection of the flagpole height is equal to 49 pips. In case the price breaks out the pattern’s bottom of 1.0670, the downtrend is expected to continue for further level 1.0647.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength